SiriusXM: Weighing The Pros And Cons Before Investing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM: Weighing the Pros and Cons Before Investing

SiriusXM Holdings Inc. (SIRI) has captivated investors for years with its seemingly recession-proof satellite radio business model. But is it truly a worthwhile investment? Before diving in, potential investors need to carefully consider the pros and cons. This in-depth analysis will help you decide if SiriusXM is the right addition to your portfolio.

The Allure of SiriusXM: Pros to Consider

SiriusXM boasts several compelling advantages, making it an attractive proposition for some investors:

-

Subscription-Based Revenue Model: This is arguably SiriusXM's biggest strength. Subscribers pay recurring fees, generating predictable revenue streams less susceptible to economic downturns than other media models. This stability provides a crucial buffer during periods of economic uncertainty. Think of it as a more predictable version of Netflix's streaming model.

-

Content Exclusivity and Differentiation: The platform offers ad-free music, exclusive talk shows, and sports programming unavailable elsewhere. This curated content provides a significant competitive advantage, fostering subscriber loyalty. This differentiation is key to their market position.

-

Growing Podcast Landscape: SiriusXM's strategic investments in podcast acquisitions and original programming continue to expand its content library and attract a younger demographic. This diversification is vital for long-term growth and relevance.

-

Potential for Synergies and Expansion: The company's potential for mergers and acquisitions, along with expansion into new markets and technologies, presents significant opportunities for growth and increased shareholder value.

Navigating the Challenges: Cons to Evaluate

While the prospects are promising, SiriusXM also faces several headwinds:

-

Competition from Streaming Services: The rise of Spotify, Apple Music, and other streaming services presents stiff competition for music listeners. SiriusXM must constantly innovate to retain its subscriber base.

-

High Debt Levels: SiriusXM carries a substantial debt load, which could pose risks during periods of economic stress or increased interest rates. This is a critical factor to monitor for potential investors.

-

Dependence on the Automotive Industry: A significant portion of SiriusXM's subscribers are through car manufacturers. Slowdowns in the auto industry could negatively impact subscriber acquisition.

-

Churn Rate: While subscriber acquisition is important, the rate at which subscribers cancel their subscriptions (churn) is a key metric to watch. High churn can offset new subscriber growth.

Making an Informed Decision: Key Questions to Ask Yourself

Before investing in SiriusXM, ask yourself these crucial questions:

- What is your risk tolerance? Investing in SiriusXM carries inherent risks, especially considering the debt load and competitive landscape.

- What are your investment goals and timeframe? Are you a long-term investor seeking steady income, or are you looking for quick gains?

- Have you thoroughly researched the company's financials? Understanding the company's balance sheet, income statement, and cash flow is essential.

- Have you considered alternative investments? Compare SiriusXM's potential returns and risks against other investment options in the media and entertainment sector.

Conclusion:

SiriusXM presents a compelling investment case with its recurring revenue model and exclusive content. However, potential investors must carefully weigh the risks associated with high debt levels, competition, and industry dependence. Conduct thorough due diligence, analyze the company's financials, and assess your personal risk tolerance before making any investment decisions. Consider consulting a financial advisor for personalized guidance. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM: Weighing The Pros And Cons Before Investing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sramkova Vs Swiatek Tennis Free Online Streaming Links And Guide

May 27, 2025

Sramkova Vs Swiatek Tennis Free Online Streaming Links And Guide

May 27, 2025 -

Bates Claims Post Office Compensation Offer Is Half The Requested Amount

May 27, 2025

Bates Claims Post Office Compensation Offer Is Half The Requested Amount

May 27, 2025 -

E Commerce Giant Pdd Holdings To Report Q1 2025 Financial Results

May 27, 2025

E Commerce Giant Pdd Holdings To Report Q1 2025 Financial Results

May 27, 2025 -

Remembering George Floyd A Celebration Of His Life And Values

May 27, 2025

Remembering George Floyd A Celebration Of His Life And Values

May 27, 2025 -

Weakened Black Lung Protections The Impact Of Federal Budget Cuts On Coal Miners Health

May 27, 2025

Weakened Black Lung Protections The Impact Of Federal Budget Cuts On Coal Miners Health

May 27, 2025

Latest Posts

-

Streamlined Planning Simplifying Home Heat Pump Installations

May 31, 2025

Streamlined Planning Simplifying Home Heat Pump Installations

May 31, 2025 -

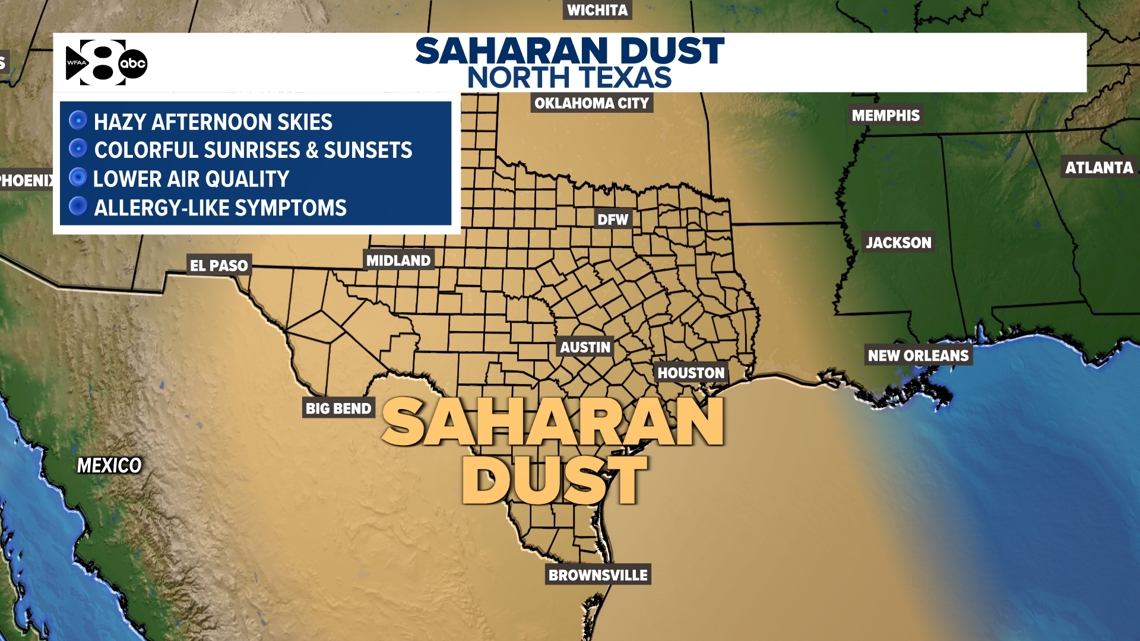

North Texas Dust Understanding The 5 000 Mile Saharan Trek

May 31, 2025

North Texas Dust Understanding The 5 000 Mile Saharan Trek

May 31, 2025 -

French Open 2024 Runes Dominant Performance Secures Third Round Spot

May 31, 2025

French Open 2024 Runes Dominant Performance Secures Third Round Spot

May 31, 2025 -

Relief In Sight Transportation Secretary Addresses Newark Airport Delays

May 31, 2025

Relief In Sight Transportation Secretary Addresses Newark Airport Delays

May 31, 2025 -

After Criticism Elon Musk Exits Trump White House Role

May 31, 2025

After Criticism Elon Musk Exits Trump White House Role

May 31, 2025