Slight Decrease In U.S. Treasury Yields Following Fed's Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decrease in U.S. Treasury Yields Following Fed's Rate Cut Projection

The U.S. Treasury market experienced a subtle shift this week, with yields on government bonds showing a slight decrease following the Federal Reserve's projected rate cut. This move, although modest, signals a potential change in investor sentiment and expectations regarding future monetary policy. Understanding the nuances of this shift is crucial for investors navigating the complexities of the current economic landscape.

The Fed's Influence: A Shift in Expectations

The Federal Open Market Committee (FOMC) hinted at a potential interest rate reduction in its recent statement, citing concerns about slowing economic growth and persistent inflationary pressures. This projection, while not a guaranteed rate cut, injected a degree of uncertainty into the market, influencing investor behavior and impacting Treasury yields. The possibility of lower interest rates generally leads to decreased yields on existing bonds, as investors seek higher returns on newly issued bonds with lower coupon rates.

Understanding Treasury Yields and their Volatility

U.S. Treasury yields represent the return an investor receives on a government bond. These yields are inversely related to bond prices; when bond prices rise, yields fall, and vice versa. Several factors contribute to the volatility of Treasury yields, including:

- Economic Growth: Strong economic growth typically leads to higher yields as investors anticipate higher inflation and increased demand for borrowing.

- Inflation: High inflation erodes the purchasing power of future interest payments, leading investors to demand higher yields to compensate for this risk.

- Federal Reserve Policy: The Fed's monetary policy actions, such as interest rate adjustments, significantly influence Treasury yields. Rate hikes typically increase yields, while rate cuts tend to decrease them.

- Global Economic Conditions: International economic events and geopolitical risks can also impact investor sentiment and Treasury yields.

The Impact on Investors

The recent slight decrease in Treasury yields presents both opportunities and challenges for investors. For bondholders, lower yields mean a reduced return on their investments. However, it also suggests a potential bottoming out of yields, potentially offering a good entry point for long-term investors. Conversely, for those seeking higher returns, the lower yields may encourage them to explore alternative investment options.

Looking Ahead: Uncertainty Remains

While the slight decrease in Treasury yields reflects a reaction to the Fed's projection, uncertainty remains. The actual implementation of a rate cut is not guaranteed, and other economic factors could influence future yield movements. Investors should carefully monitor economic indicators, Fed statements, and geopolitical developments to make informed investment decisions.

Call to Action: Stay informed about economic news and consult with a financial advisor to develop a robust investment strategy tailored to your individual risk tolerance and financial goals. Understanding the intricacies of the Treasury market is crucial for navigating the complexities of today's financial landscape. [Link to relevant financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decrease In U.S. Treasury Yields Following Fed's Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Last Of Us A Study In Deliberate Pacing And Powerful Storytelling

May 20, 2025

The Last Of Us A Study In Deliberate Pacing And Powerful Storytelling

May 20, 2025 -

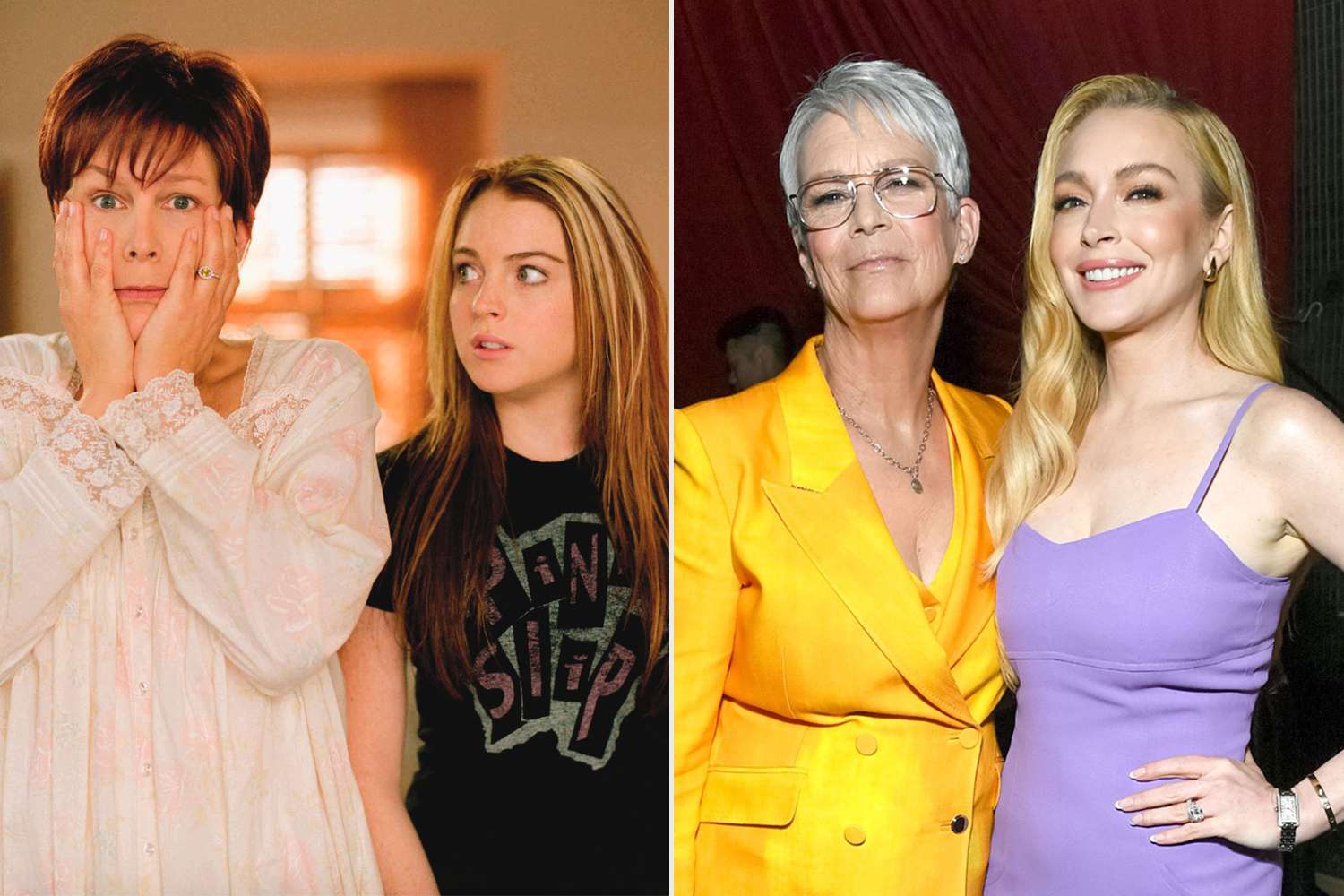

Jamie Lee Curtis Reveals The Status Of Her Relationship With Lindsay Lohan Following Freaky Friday

May 20, 2025

Jamie Lee Curtis Reveals The Status Of Her Relationship With Lindsay Lohan Following Freaky Friday

May 20, 2025 -

Lineker Exit Imminent The Future Of Match Of The Day Uncertain

May 20, 2025

Lineker Exit Imminent The Future Of Match Of The Day Uncertain

May 20, 2025 -

Peaky Blinders Future Creator Announces New Series With Unexpected Turn

May 20, 2025

Peaky Blinders Future Creator Announces New Series With Unexpected Turn

May 20, 2025 -

Putin Demonstrates Independence From Trump Implications For Global Politics

May 20, 2025

Putin Demonstrates Independence From Trump Implications For Global Politics

May 20, 2025

Latest Posts

-

Breaking Trump Initiates Immediate Peace Talks Between Russia And Ukraine

May 20, 2025

Breaking Trump Initiates Immediate Peace Talks Between Russia And Ukraine

May 20, 2025 -

The Putin Trump Dynamic A Shift In Power

May 20, 2025

The Putin Trump Dynamic A Shift In Power

May 20, 2025 -

Jamie Lee Curtis Opens Up About Staying Connected With Lindsay Lohan

May 20, 2025

Jamie Lee Curtis Opens Up About Staying Connected With Lindsay Lohan

May 20, 2025 -

Jon Jones Ufc Future Uncertain Fan Reactions To Cryptic Hint And Aspinall Talks Stall

May 20, 2025

Jon Jones Ufc Future Uncertain Fan Reactions To Cryptic Hint And Aspinall Talks Stall

May 20, 2025 -

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Market Trend

May 20, 2025

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Market Trend

May 20, 2025