Slight Dip In US Treasury Yields Following Fed's Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Dip in US Treasury Yields Following Fed's Rate Cut Outlook

The Federal Reserve's hinted shift towards potential interest rate cuts sent ripples through the bond market, causing a minor decrease in US Treasury yields. This move, while subtle, signifies a potential change in the economic landscape and has investors closely watching for further developments. The implications extend beyond the bond market, affecting everything from mortgages to corporate borrowing costs.

The recent market reaction follows comments from Federal Reserve officials suggesting a pause, or even a potential reduction, in interest rate hikes. This cautious approach reflects growing concerns about the US economy's resilience in the face of persistent inflation and potential recessionary pressures. For weeks, analysts have been debating the Fed's next move, with predictions ranging from continued tightening to a complete pivot. This uncertainty has created volatility in financial markets.

Understanding the Connection: Interest Rates and Treasury Yields

US Treasury yields move inversely to bond prices. When demand for US Treasuries increases (often seen as a safe haven during economic uncertainty), their prices rise, leading to lower yields. Conversely, decreased demand results in lower prices and higher yields. The Fed's signaling of potential rate cuts sparked increased demand for Treasuries, leading to the observed dip in yields.

This relationship is crucial to understanding the broader economic picture. Lower yields generally translate to lower borrowing costs for businesses and consumers. This can stimulate economic activity but also potentially fuel inflation if borrowing becomes too readily accessible. The delicate balance the Fed is attempting to strike is a key factor driving market sentiment.

What This Means for Investors

The slight dip in US Treasury yields presents a complex scenario for investors. While lower yields might seem less attractive on the surface for income-seeking investors, they could signal opportunities in other sectors. For example, the potential for reduced interest rates could boost equity markets, making stocks a more attractive investment.

Key considerations for investors include:

- Diversification: A well-diversified portfolio is crucial in navigating uncertain market conditions.

- Risk Tolerance: Investors should assess their risk tolerance before making significant investment decisions.

- Long-Term Perspective: Maintaining a long-term perspective is essential in weathering short-term market fluctuations.

Looking Ahead: Uncertainty Remains

While the recent dip in yields offers a glimpse into potential future monetary policy, significant uncertainty remains. The actual timing and magnitude of any future rate cuts remain unclear, heavily dependent on incoming economic data and the Fed's assessment of inflation and economic growth. Factors such as the ongoing war in Ukraine, global supply chain disruptions, and the strength of the US labor market will continue to influence the Fed's decisions.

Investors and analysts will be closely monitoring key economic indicators like inflation data (CPI and PCE), employment figures (nonfarm payrolls), and consumer confidence indices in the coming weeks and months. These indicators will provide crucial insights into the health of the US economy and guide future market movements.

In conclusion, the slight decrease in US Treasury yields reflects the market's reaction to the Fed's hinted shift towards potential rate cuts. While this signifies a potential change in economic direction, significant uncertainty remains. Investors should carefully consider the implications of this development and adjust their strategies accordingly. Staying informed about economic news and consulting with financial advisors is crucial in navigating this complex market environment. [Link to relevant financial news website] could provide further insights and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Dip In US Treasury Yields Following Fed's Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cannes Film Festival Kevin Spacey Receives Award Amidst Comeback Bid

May 20, 2025

Cannes Film Festival Kevin Spacey Receives Award Amidst Comeback Bid

May 20, 2025 -

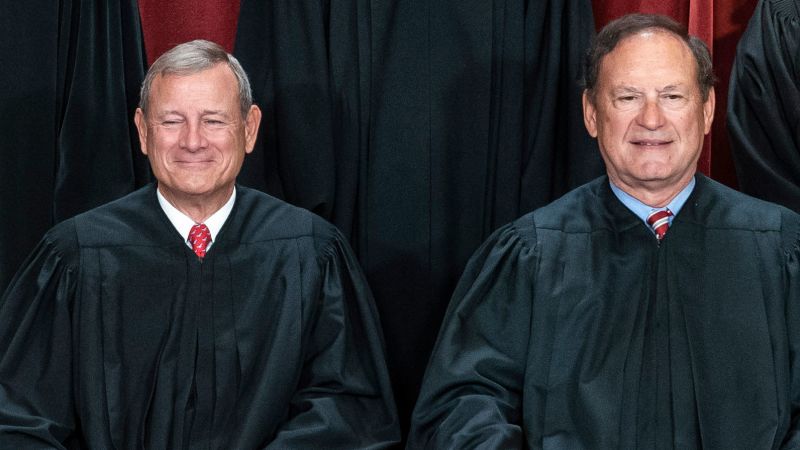

Three Decades Of Influence A Look At Justices Alito And Roberts

May 20, 2025

Three Decades Of Influence A Look At Justices Alito And Roberts

May 20, 2025 -

The Putin Trump Dynamic A Shift In The Balance Of Power

May 20, 2025

The Putin Trump Dynamic A Shift In The Balance Of Power

May 20, 2025 -

Brexit Endgame Negotiations Reach Critical Point With Betrayal Allegations

May 20, 2025

Brexit Endgame Negotiations Reach Critical Point With Betrayal Allegations

May 20, 2025 -

I M Done Jon Jones Hints At Ufc Retirement Amidst Aspinall Fight Delay

May 20, 2025

I M Done Jon Jones Hints At Ufc Retirement Amidst Aspinall Fight Delay

May 20, 2025

Latest Posts

-

Heartbreaking And Brilliant Why The Last Of Uss Pacing Works

May 20, 2025

Heartbreaking And Brilliant Why The Last Of Uss Pacing Works

May 20, 2025 -

Brexit Betrayal Eu And Uk Leaders Face Tense Final Negotiations

May 20, 2025

Brexit Betrayal Eu And Uk Leaders Face Tense Final Negotiations

May 20, 2025 -

Jon Joness Explosive Accusation Ufc Covered Up Aspinalls Injury

May 20, 2025

Jon Joness Explosive Accusation Ufc Covered Up Aspinalls Injury

May 20, 2025 -

Assessing The Damage St Louis Grapples With Aftermath Of Rare Tornado

May 20, 2025

Assessing The Damage St Louis Grapples With Aftermath Of Rare Tornado

May 20, 2025 -

Childs Pacifier And Thumb Age Appropriate Weaning Strategies For Parents

May 20, 2025

Childs Pacifier And Thumb Age Appropriate Weaning Strategies For Parents

May 20, 2025