Slowdown Ahead? Fed's Rate Cut Projection Impacts U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slowdown Ahead? Fed's Rate Cut Projection Impacts U.S. Treasury Yields

The Federal Reserve's recent projection of potential interest rate cuts sent ripples through the financial markets, significantly impacting U.S. Treasury yields. This unexpected shift in monetary policy expectations has investors reassessing the economic outlook and its implications for bond prices. Is a significant economic slowdown on the horizon? Let's delve into the details.

The Fed's Pivot and its Market Impact

The Federal Open Market Committee (FOMC) surprised many analysts by hinting at the possibility of rate cuts later this year. This marked a significant departure from previous pronouncements emphasizing a commitment to fighting inflation, even at the cost of slower economic growth. The market reacted swiftly. The yield on the benchmark 10-year Treasury note, a key indicator of borrowing costs and investor sentiment, experienced a notable decline following the announcement.

This decrease in yields reflects several factors:

- Reduced Inflation Expectations: The Fed's projection suggests a belief that inflation is cooling more rapidly than previously anticipated. This lessened inflation pressure reduces the need for aggressive interest rate hikes, thereby lowering yields on government bonds.

- Growth Concerns: The shift in the Fed's stance also reflects growing concerns about the potential for a significant economic slowdown or even a recession. Investors are pricing in this risk by seeking the relative safety of U.S. Treasury bonds, driving up demand and pushing yields lower.

- Market Uncertainty: The unexpected nature of the Fed's announcement injected a significant degree of uncertainty into the market. Investors often react to uncertainty by seeking safer assets, further contributing to the decline in Treasury yields.

What Does This Mean for Investors?

The decline in Treasury yields presents both opportunities and challenges for investors:

- Bondholders: Existing bondholders benefit from increased prices as yields fall. However, future returns on new investments will be lower.

- Stock Market: Lower yields can be positive for the stock market, as lower borrowing costs can stimulate economic activity and corporate investment. However, the underlying economic slowdown concerns remain a significant risk.

- Mortgage Rates: While the direct impact is less immediate, lower yields on longer-term Treasuries can indirectly influence mortgage rates, potentially leading to more affordable borrowing for homebuyers.

Analyzing the Economic Outlook

The Fed's actions underscore the delicate balancing act central bankers face. While inflation remains a concern, the potential for a sharp economic contraction is a significant risk. Several key economic indicators will be closely watched in the coming months, including:

- GDP Growth: Sustained slower-than-expected GDP growth would lend credence to the Fed's concerns about a slowdown.

- Inflation Data: Further declines in inflation would support the Fed's decision to potentially cut rates. However, a resurgence of inflation could lead to a reversal in policy.

- Unemployment Figures: Rising unemployment rates would signal a weakening labor market and increase the likelihood of a recession.

Looking Ahead: Uncertainty Remains

The future path of U.S. Treasury yields remains uncertain. The Fed's projections are subject to revision depending on incoming economic data. Investors should carefully monitor key economic indicators and remain vigilant about potential shifts in the market. This dynamic situation highlights the importance of diversification and a well-defined investment strategy. Consult with a financial advisor for personalized guidance.

Keywords: US Treasury Yields, Federal Reserve, Interest Rate Cuts, Economic Slowdown, Bond Prices, Inflation, Recession, Monetary Policy, FOMC, 10-Year Treasury Note, Investment Strategy, Financial Markets

Related Articles: (Links to relevant articles on your website or other reputable financial news sources could be added here).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slowdown Ahead? Fed's Rate Cut Projection Impacts U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Two Killed Two Injured After Train Hits Family On Railroad Bridge

May 20, 2025

Two Killed Two Injured After Train Hits Family On Railroad Bridge

May 20, 2025 -

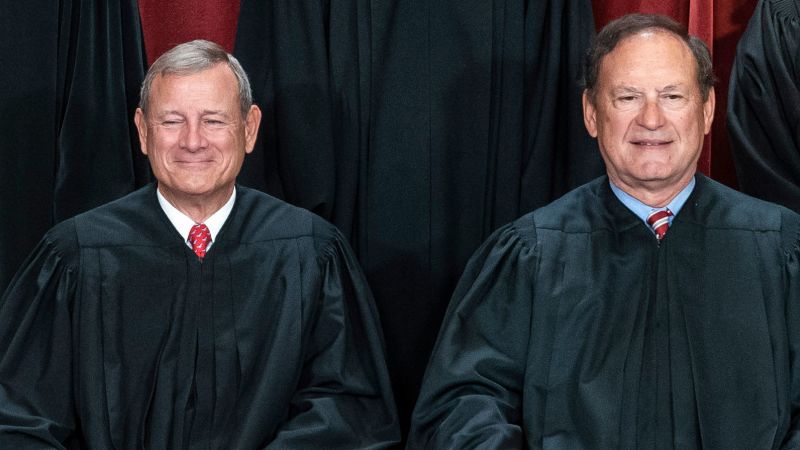

Supreme Court Justices Alito And Roberts A Legacy In The Making

May 20, 2025

Supreme Court Justices Alito And Roberts A Legacy In The Making

May 20, 2025 -

Prisoners To Repair Roads And Clean Streets Under New Government Initiative

May 20, 2025

Prisoners To Repair Roads And Clean Streets Under New Government Initiative

May 20, 2025 -

Griffith Park Vs The Competition A Ranking Of Americas Best City Parks

May 20, 2025

Griffith Park Vs The Competition A Ranking Of Americas Best City Parks

May 20, 2025 -

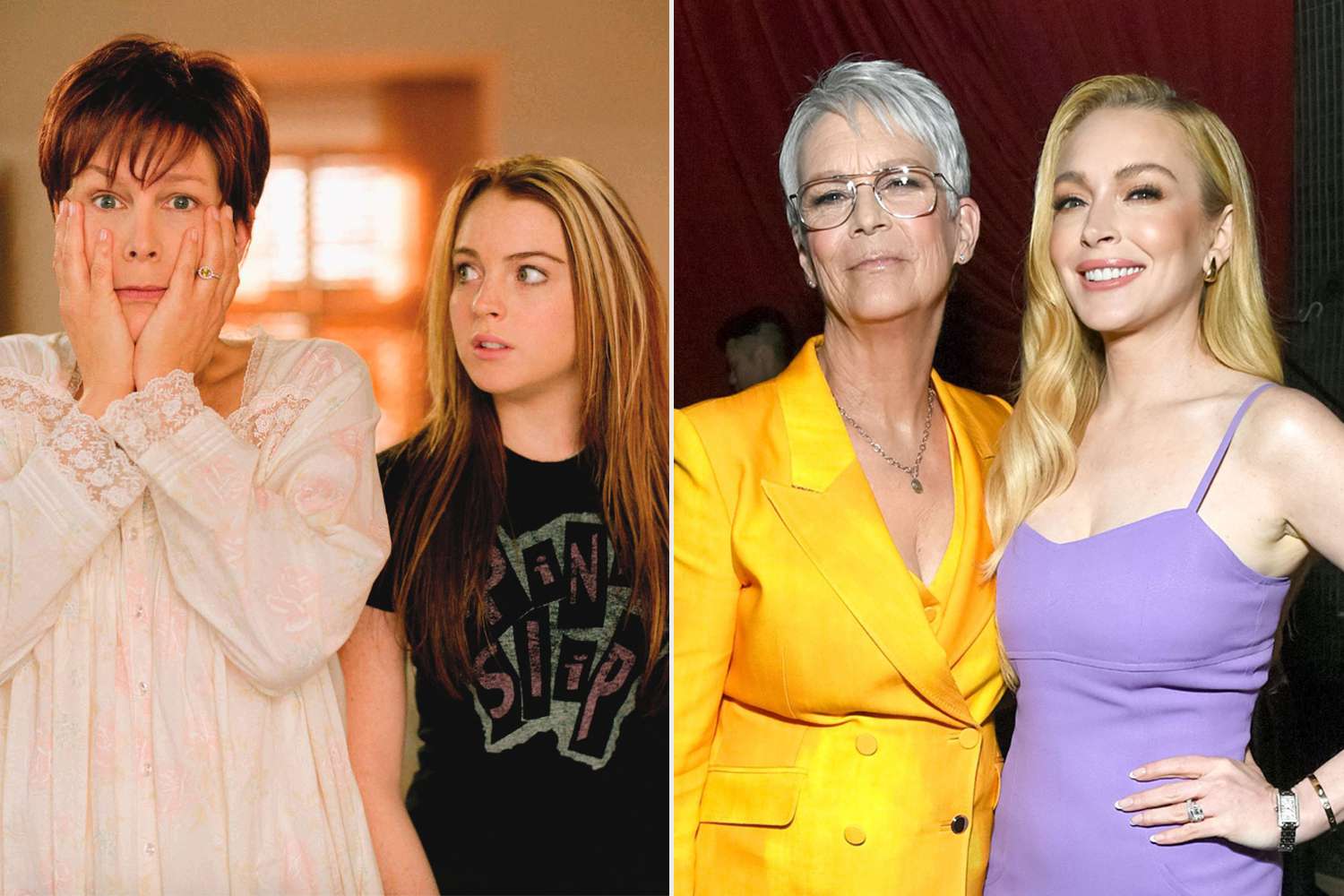

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday

May 20, 2025

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday

May 20, 2025

Latest Posts

-

Legal Aid System Hit By Cyberattack Clients Private Data Including Criminal Records Stolen

May 21, 2025

Legal Aid System Hit By Cyberattack Clients Private Data Including Criminal Records Stolen

May 21, 2025 -

Investor Confidence Soars 200 M Rush Into Ethereum Funds After Pectra

May 21, 2025

Investor Confidence Soars 200 M Rush Into Ethereum Funds After Pectra

May 21, 2025 -

Balis Plea International Collaboration For Responsible Tourism

May 21, 2025

Balis Plea International Collaboration For Responsible Tourism

May 21, 2025 -

Market Rally Continues S And P 500s Six Day Winning Streak And Positive Outlook

May 21, 2025

Market Rally Continues S And P 500s Six Day Winning Streak And Positive Outlook

May 21, 2025 -

Family Killed And Injured In Train Collision On Bridge A Community Mourns

May 21, 2025

Family Killed And Injured In Train Collision On Bridge A Community Mourns

May 21, 2025