Slowdown In Rate Cuts: U.S. Treasury Yields React To Fed's 2025 Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slowdown in Rate Cuts: US Treasury Yields React to Fed's 2025 Outlook

The Federal Reserve's more hawkish-than-expected projection for interest rates in 2025 sent ripples through the US Treasury market, leading to a noticeable increase in yields. This unexpected shift marks a potential turning point in the market's anticipation of future monetary policy, impacting everything from mortgage rates to corporate borrowing costs. The question on everyone's mind: what does this mean for the economy and your investments?

The Federal Open Market Committee (FOMC) concluded its September meeting with a hold on interest rate hikes, a decision largely anticipated by market analysts. However, the accompanying economic projections painted a different picture than many had predicted. The “dot plot,” which illustrates individual FOMC members' projections for the federal funds rate, showed a significantly higher terminal rate than previously forecast, suggesting rates may remain elevated well into 2025. This divergence from earlier expectations is driving the current market volatility.

Understanding the Impact on Treasury Yields

US Treasury yields are directly influenced by interest rate expectations. When the Fed signals a more hawkish stance, implying higher rates for longer, investors demand higher yields on Treasury bonds to compensate for the increased risk and opportunity cost. This is precisely what we're seeing now. The longer-term Treasury yields, particularly those maturing in 2025 and beyond, experienced the most significant upward pressure.

This increase in yields has several key implications:

-

Mortgage Rates: Higher Treasury yields typically translate into higher mortgage rates, potentially cooling down the already slowing housing market. This could impact both buyers and sellers, making homeownership less accessible for some.

-

Corporate Borrowing Costs: Companies relying on debt financing will face increased borrowing costs, potentially impacting investment and expansion plans. This could lead to slower economic growth if businesses become more hesitant to take on debt.

-

Investment Strategies: Investors will need to reassess their portfolio allocations in light of the changing interest rate environment. Bonds, previously seen as a safe haven, may offer lower returns than anticipated, prompting a shift towards other asset classes.

What's Behind the Fed's Shift?

The Fed's revised outlook reflects a persistent concern about inflation remaining stubbornly above its 2% target. While inflation has cooled somewhat, it remains higher than the central bank would like. The robust labor market, with low unemployment and strong wage growth, also contributes to the Fed's cautious approach. They are clearly prioritizing bringing inflation down, even at the risk of potentially slowing economic growth.

Looking Ahead: Uncertainty and Volatility

The market is currently digesting the implications of the Fed's revised projections. While the immediate reaction has been a rise in Treasury yields, the long-term impact remains uncertain. Several factors could influence future yield movements, including:

- Future inflation data: The release of upcoming inflation reports will be closely scrutinized by the market. Surprising inflation data could further influence the Fed's policy decisions.

- Economic growth: The pace of economic growth will play a critical role in determining the Fed's future actions. A significant slowdown could lead to a reassessment of its monetary policy.

- Geopolitical events: Global events can also significantly impact the financial markets and influence Treasury yields.

The current situation underscores the importance of staying informed about macroeconomic trends and the Federal Reserve's policy decisions. Investors should consult with a financial advisor to discuss how these developments might affect their investment strategies. Understanding the interplay between the Fed's actions and the Treasury market is crucial for navigating the complexities of today's economic landscape. Stay tuned for further updates as the market continues to react and evolve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slowdown In Rate Cuts: U.S. Treasury Yields React To Fed's 2025 Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

International Support Needed Balis Plea For Responsible Tourism

May 21, 2025

International Support Needed Balis Plea For Responsible Tourism

May 21, 2025 -

Assassins Creed Valhalla Shadows Of Ragnaroek Ubisoft Addresses The Absence Of Animal Killing

May 21, 2025

Assassins Creed Valhalla Shadows Of Ragnaroek Ubisoft Addresses The Absence Of Animal Killing

May 21, 2025 -

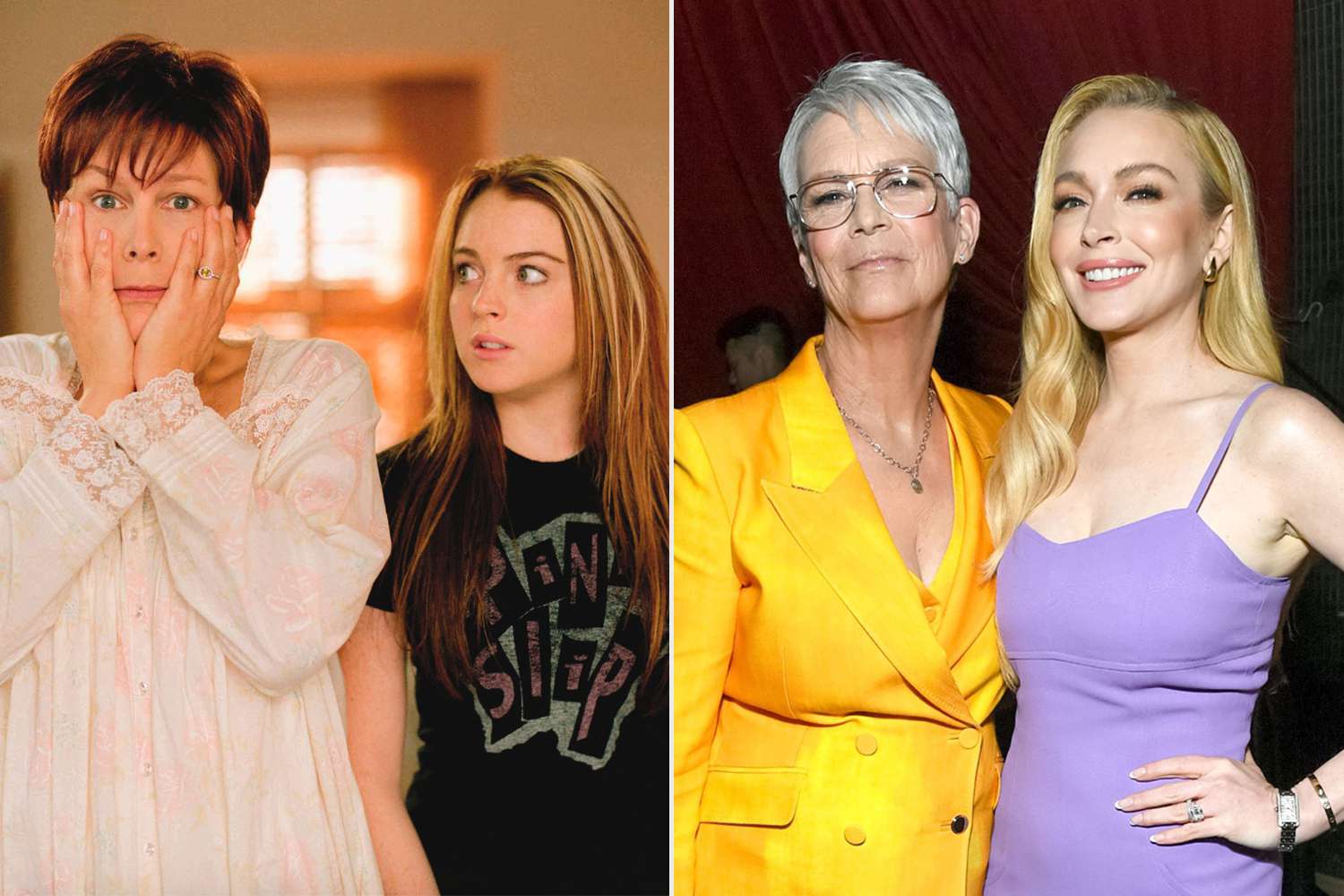

Jamie Lee Curtis Opens Up About Her Friendship With Lindsay Lohan An Exclusive Interview

May 21, 2025

Jamie Lee Curtis Opens Up About Her Friendship With Lindsay Lohan An Exclusive Interview

May 21, 2025 -

Alito And Roberts Supreme Court Legacy Entering Their Third Decade

May 21, 2025

Alito And Roberts Supreme Court Legacy Entering Their Third Decade

May 21, 2025 -

Brett Favres Fall A J Perez Discusses Threats And The Future Of Untold

May 21, 2025

Brett Favres Fall A J Perez Discusses Threats And The Future Of Untold

May 21, 2025

Latest Posts

-

Fourth Arrest Made In New Orleans Inmate Escape Manhunt Continues

May 21, 2025

Fourth Arrest Made In New Orleans Inmate Escape Manhunt Continues

May 21, 2025 -

Comedian Tim Dillon Slams Dork Politicians In Cnn Business Interview

May 21, 2025

Comedian Tim Dillon Slams Dork Politicians In Cnn Business Interview

May 21, 2025 -

Heartbreak To Hello Ellen De Generes Comeback After A Difficult Period

May 21, 2025

Heartbreak To Hello Ellen De Generes Comeback After A Difficult Period

May 21, 2025 -

Juvenile Delinquency Church Break In And Desecration Case

May 21, 2025

Juvenile Delinquency Church Break In And Desecration Case

May 21, 2025 -

Mercedes Benzs Electric G Wagon A Surprising Gift For League Of Legends Uzi

May 21, 2025

Mercedes Benzs Electric G Wagon A Surprising Gift For League Of Legends Uzi

May 21, 2025