Slowdown In US Economy: Private Sector Job Growth At Two-Year Low

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slowdown in US Economy: Private Sector Job Growth Hits Two-Year Low

The US economy is showing signs of cooling, with private sector job growth plummeting to a two-year low in August, according to the latest ADP National Employment Report. This significant slowdown raises concerns about the overall health of the economy and the potential for a broader recession. The report, released on [Date of Report Release], paints a concerning picture for American workers and businesses alike.

August's Disappointing Numbers: A Deeper Dive

ADP reported that private sector employment increased by just 132,000 jobs in August, significantly lower than the expected 195,000 and a sharp decline from the revised 371,000 jobs added in July. This marks the weakest monthly gain since January 2021 and fuels ongoing debates about the Federal Reserve's aggressive interest rate hikes aimed at curbing inflation. The slowdown was felt across various sectors, highlighting a broader economic trend rather than a localized issue.

Which Sectors Were Most Affected?

While the slowdown impacted multiple sectors, some felt the pinch more severely than others. The report showed a particularly weak performance in the goods-producing sector, suggesting potential manufacturing slowdowns and reduced consumer demand. The services sector, while still adding jobs, saw a marked decrease in growth compared to previous months. This points towards a potential dampening effect across various aspects of the economy. Specific breakdowns by industry will be crucial for understanding the nuances of this economic contraction.

The Inflationary Pressure Remains:

The Federal Reserve's ongoing battle with inflation continues to play a significant role in this economic slowdown. The aggressive interest rate hikes, while aimed at cooling down the economy and reducing inflationary pressures, are also having the unintended consequence of slowing job growth and potentially tipping the economy into a recession. The ongoing debate centers around finding the delicate balance between curbing inflation and avoiding a severe economic downturn. [Link to relevant Federal Reserve article/data].

What Does This Mean for the Future?

The ADP report serves as a significant indicator, but it's crucial to consider other economic indicators alongside it. The upcoming jobs report from the Bureau of Labor Statistics (BLS) will offer a more comprehensive picture of the employment situation. [Link to BLS website]. Economists will be closely scrutinizing the data to gauge the extent of the slowdown and predict future economic trajectory.

Several factors will influence the coming months, including consumer spending, inflation rates, and the effectiveness of the Federal Reserve's monetary policy. The possibility of a recession remains a concern for many experts, and this latest data only reinforces those anxieties.

Looking Ahead:

This slowdown underscores the volatile nature of the current economic climate. Businesses need to adapt to these changing conditions, while policymakers face the challenging task of navigating a path towards sustainable growth without triggering a deeper economic crisis. Further analysis and upcoming economic reports will be critical in providing a clearer understanding of the future direction of the US economy. Stay tuned for further updates and analysis as the situation unfolds.

Keywords: US Economy, Job Growth, Private Sector Jobs, ADP Report, Economic Slowdown, Recession, Inflation, Federal Reserve, BLS, Employment Report, Economic Indicators, Monetary Policy, Consumer Spending

Call to Action (subtle): Stay informed about crucial economic developments by regularly checking back for updates on our website.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slowdown In US Economy: Private Sector Job Growth At Two-Year Low. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Joint Military Operation In Gaza Recovery Of Israeli American Hostage Remains Confirmed

Jun 06, 2025

Joint Military Operation In Gaza Recovery Of Israeli American Hostage Remains Confirmed

Jun 06, 2025 -

Singer Jessie J Announces Early Breast Cancer Diagnosis Inspiring Fans

Jun 06, 2025

Singer Jessie J Announces Early Breast Cancer Diagnosis Inspiring Fans

Jun 06, 2025 -

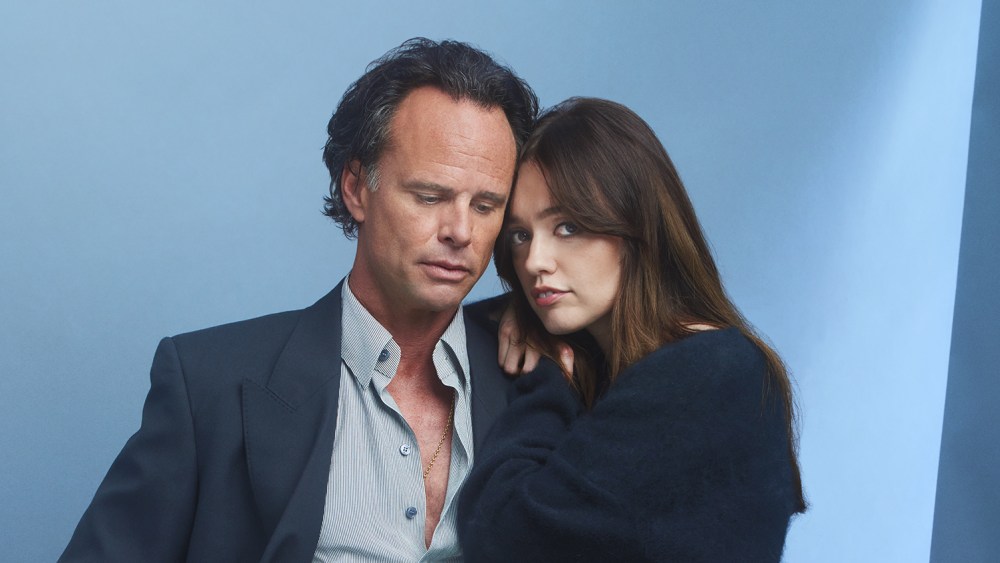

White Lotus Stars Address Fan Speculation Goggins And Wood On Instagram Unfollow And Cut Scene

Jun 06, 2025

White Lotus Stars Address Fan Speculation Goggins And Wood On Instagram Unfollow And Cut Scene

Jun 06, 2025 -

Cnn Analyst Harry Enten Examines The My Pillow Ceos Rise And Fall

Jun 06, 2025

Cnn Analyst Harry Enten Examines The My Pillow Ceos Rise And Fall

Jun 06, 2025 -

Workplace Discrimination Case Supreme Court Upholds Ohio Womans Claim

Jun 06, 2025

Workplace Discrimination Case Supreme Court Upholds Ohio Womans Claim

Jun 06, 2025

Latest Posts

-

Bidens Autopen Use And Actions Trump Orders Investigation Citing Cognitive Decline Concerns

Jun 06, 2025

Bidens Autopen Use And Actions Trump Orders Investigation Citing Cognitive Decline Concerns

Jun 06, 2025 -

Coaching Change In Dallas Stars Dismiss De Boer Post Playoff Loss

Jun 06, 2025

Coaching Change In Dallas Stars Dismiss De Boer Post Playoff Loss

Jun 06, 2025 -

Cassie Venturas Close Friends Testimony Continues In Sean Combs Trial

Jun 06, 2025

Cassie Venturas Close Friends Testimony Continues In Sean Combs Trial

Jun 06, 2025 -

Ukraines Airfield Attacks Strategic Success Or Tactical Shift

Jun 06, 2025

Ukraines Airfield Attacks Strategic Success Or Tactical Shift

Jun 06, 2025 -

Has Ibm Regained Its Cool Factor Analyzing The Evidence

Jun 06, 2025

Has Ibm Regained Its Cool Factor Analyzing The Evidence

Jun 06, 2025