Smart Savings For College: How A 529 Account Can Help

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Smart Savings for College: How a 529 Account Can Help

The soaring cost of higher education is a major concern for families across the nation. Tuition fees, room and board, books, and other expenses can quickly add up to a daunting figure. But there's a powerful tool that can significantly alleviate this financial burden: the 529 college savings plan. This article explores the benefits of a 529 account and how it can pave the way for a brighter financial future for your child's education.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically to help families save for future education expenses. These plans are sponsored by states, state agencies, or educational institutions, and offer several key advantages:

- Tax-Deferred Growth: The earnings on your investments grow tax-free, as long as the money is used for qualified education expenses. This means your savings compound faster than in a taxable account.

- Tax-Free Withdrawals: When you withdraw money for qualified expenses (tuition, fees, room and board, books, etc.), you won't pay federal taxes on the earnings. Many states also offer state tax deductions or exemptions for contributions and withdrawals. Check your state's specific rules, as they vary.

- Flexibility: Most 529 plans offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and time horizon. You can typically change your investment choices as your child gets closer to college.

- Beneficiary Changes: While typically used for a child, you can change the beneficiary to another family member, offering flexibility in case your child's plans change.

Types of 529 Plans:

There are two main types of 529 plans:

- State-sponsored plans: Each state (and some territories) offers its own 529 plan, often with different investment options and fee structures. Some states offer tax deductions or credits for contributions made to their own plan.

- Private plans: These plans are offered by financial institutions and may have broader investment choices but might not offer the same state tax benefits.

Choosing the Right 529 Plan:

Selecting the best 529 plan depends on several factors:

- Investment Options: Look for plans with a diverse range of investment choices to match your risk profile and time horizon.

- Fees: Compare expense ratios and other fees charged by different plans. Lower fees mean more money goes towards your child's education.

- State Tax Benefits: Consider whether your state offers any tax advantages for contributing to its own 529 plan.

- Investment Management: Decide whether you prefer to manage your investments yourself or use a professionally managed plan.

Beyond Tuition: Qualified Education Expenses

It's important to understand that 529 funds can be used for a wider range of education expenses than just tuition. Qualified expenses also include:

- Tuition and fees: At both undergraduate and graduate levels.

- Room and board: While attending college at least half-time.

- Books, supplies, and equipment: Required for courses.

- Computers and other technology: Required for coursework.

- K-12 Tuition: Many states allow limited use of 529 funds for K-12 tuition expenses.

Getting Started with a 529 Plan:

Opening a 529 account is relatively straightforward. You can typically do so online through the plan's website. Start by researching different plans and comparing their features and fees. Even small, regular contributions can make a significant difference over time thanks to the power of compounding.

Conclusion:

A 529 college savings plan is a powerful tool that can significantly reduce the financial burden of higher education. By understanding the benefits, choosing the right plan, and making regular contributions, you can help secure your child's future and make college more attainable. Don't delay – start saving today!

Disclaimer: This article provides general information about 529 plans and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Smart Savings For College: How A 529 Account Can Help. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

John Brenkus Creator Of Sports Science Dies At 54

Jun 04, 2025

John Brenkus Creator Of Sports Science Dies At 54

Jun 04, 2025 -

Tom Daleys Movie Choice Why Tom Holland Is The Perfect Fit

Jun 04, 2025

Tom Daleys Movie Choice Why Tom Holland Is The Perfect Fit

Jun 04, 2025 -

Jonathan Andersons Appointment Shakes Up The Dior Fashion House

Jun 04, 2025

Jonathan Andersons Appointment Shakes Up The Dior Fashion House

Jun 04, 2025 -

Analysis Proposed Republican Retirement Changes And Their Effect On Millennials

Jun 04, 2025

Analysis Proposed Republican Retirement Changes And Their Effect On Millennials

Jun 04, 2025 -

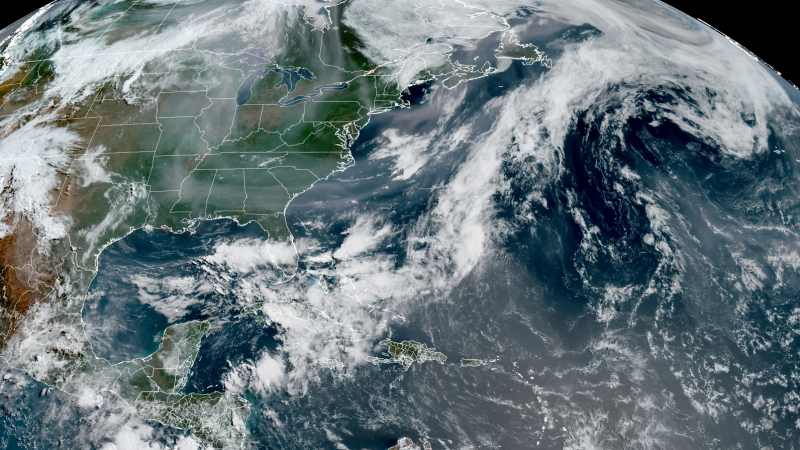

African Dust And Canadian Wildfire Smoke To Converge Over The Southern United States

Jun 04, 2025

African Dust And Canadian Wildfire Smoke To Converge Over The Southern United States

Jun 04, 2025

Latest Posts

-

Preventing Hospital Stays Understanding The Influence Of Initial Microbiome Composition

Jun 06, 2025

Preventing Hospital Stays Understanding The Influence Of Initial Microbiome Composition

Jun 06, 2025 -

The Realization Maintaining Two Separate Homes

Jun 06, 2025

The Realization Maintaining Two Separate Homes

Jun 06, 2025 -

Steve Guttenberg Lifetime Movie Casts Actor As Serial Killer

Jun 06, 2025

Steve Guttenberg Lifetime Movie Casts Actor As Serial Killer

Jun 06, 2025 -

New Video Meghan Duchess Of Sussex Celebrates Pregnancy With Dance

Jun 06, 2025

New Video Meghan Duchess Of Sussex Celebrates Pregnancy With Dance

Jun 06, 2025 -

Analysis The Rationale Behind Trumps Travel Ban On 12 Countries

Jun 06, 2025

Analysis The Rationale Behind Trumps Travel Ban On 12 Countries

Jun 06, 2025