Social Security 2025: 15% Reduction Rumors And New Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security 2025: 15% Reduction Rumors and New Regulations – What You Need to Know

The year 2025 looms large for millions of Americans relying on Social Security benefits. Online chatter and anxieties are swirling around potential benefit cuts, fueled by rumors of a 15% reduction. While a drastic 15% reduction is currently unsubstantiated, significant changes and new regulations are indeed on the horizon. Understanding these changes is crucial for planning your financial future. This article will dissect the rumors, examine the real challenges facing Social Security, and outline the new regulations impacting beneficiaries in 2025 and beyond.

Debunking the 15% Reduction Myth:

The internet is rife with alarming headlines predicting a 15% cut to Social Security benefits in 2025. It's important to be critical of such claims. While the Social Security Administration (SSA) faces significant long-term funding challenges, there are currently no official plans for such a sweeping reduction. These rumors often stem from misunderstandings of the program's financial projections and the ongoing debate in Congress regarding long-term solvency. Reliable information should always come directly from the SSA website ().

The Real Challenges Facing Social Security:

The truth is, Social Security's trust funds are projected to be depleted within the next decade or two. This isn't a new problem; it's a long-term issue driven by several factors:

- Aging Population: The post-World War II baby boomer generation is entering retirement, leading to a significantly larger number of beneficiaries.

- Increased Life Expectancy: People are living longer, drawing benefits for a longer period.

- Declining Birth Rates: Fewer workers are contributing to the system to support a growing number of retirees.

New Regulations and Changes for 2025 and Beyond:

While a 15% cut isn't currently on the table, Congress is actively seeking solutions to address the long-term funding shortfall. This could result in several changes, including:

- Benefit Adjustments: While not a 15% cut, future annual cost-of-living adjustments (COLAs) might be modified, impacting the purchasing power of benefits. Understanding how COLAs are calculated is vital for accurate financial planning.

- Increased Retirement Age: The full retirement age could be gradually increased, meaning individuals might need to work longer to receive full benefits.

- Tax Increases: Congress may consider raising the Social Security tax rate or increasing the earnings subject to Social Security taxes.

What You Can Do Now:

The uncertainty surrounding Social Security's future necessitates proactive planning:

- Monitor Official Sources: Stay informed through the official SSA website and reputable financial news sources. Avoid sensationalist headlines and focus on factual reporting.

- Plan for Multiple Scenarios: Consider different possible outcomes – including smaller benefit adjustments or later retirement ages – when planning your retirement finances.

- Diversify Retirement Income: Don't rely solely on Social Security. Explore other retirement savings options, such as 401(k)s and IRAs.

- Consult a Financial Advisor: A financial advisor can help you create a personalized retirement plan that considers your individual circumstances and potential changes to Social Security.

Conclusion:

While the 15% reduction rumor is largely unfounded, the challenges facing Social Security are real. Staying informed about the evolving situation, understanding the potential changes, and proactively planning your retirement are crucial steps in securing your financial future. Don't rely on speculation; consult reliable sources and professional advice to navigate this complex landscape. Remember to check the official SSA website for the latest updates and information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security 2025: 15% Reduction Rumors And New Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Social Security Payment Changes In June 2025 What You Need To Know

May 27, 2025

Social Security Payment Changes In June 2025 What You Need To Know

May 27, 2025 -

Coffee Grounds Gardening 3 Simple Techniques For Lush Plants

May 27, 2025

Coffee Grounds Gardening 3 Simple Techniques For Lush Plants

May 27, 2025 -

Kuala Lumpur Hospital Brunei Sultans Stay For Fatigue Treatment

May 27, 2025

Kuala Lumpur Hospital Brunei Sultans Stay For Fatigue Treatment

May 27, 2025 -

Lineker Signs Off End Of An Era As He Leaves Match Of The Day

May 27, 2025

Lineker Signs Off End Of An Era As He Leaves Match Of The Day

May 27, 2025 -

Brunei Sultans Kuala Lumpur Hospital Stay Fatigue Reported

May 27, 2025

Brunei Sultans Kuala Lumpur Hospital Stay Fatigue Reported

May 27, 2025

Latest Posts

-

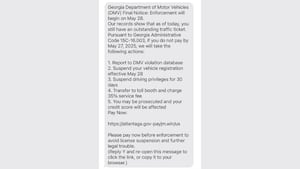

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025