Social Security 2025: New Rules And Potential Payment Reductions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security 2025: Navigating New Rules and Potential Payment Reductions

Are you prepared for potential changes to your Social Security benefits in 2025? The future of Social Security is a topic of ongoing national discussion, with looming concerns about the trust fund's solvency and potential benefit reductions. Understanding the potential changes and how they might impact you is crucial for financial planning. This article breaks down the key issues and offers guidance for navigating this complex landscape.

The Social Security Administration (SSA) faces a projected shortfall in its trust funds within the next decade. This means that unless Congress acts, benefit reductions could become a reality for recipients starting in 2025. While the exact extent of these reductions remains uncertain, understanding the potential scenarios is vital for retirees and future beneficiaries.

Potential Payment Reductions: What We Know (and Don't Know)

The projected shortfall stems from several factors: an aging population, increasing life expectancy, and a relatively slower growth in the workforce contributing to the Social Security system. The current projections suggest potential benefit cuts ranging from a modest percentage to more significant reductions, depending on the legislative solutions (or lack thereof) implemented by Congress.

Several proposals are currently under consideration, ranging from gradual benefit reductions to increasing the retirement age or raising the Social Security tax cap. The ultimate outcome remains uncertain and depends heavily on political will and legislative action. For the latest updates and official announcements, it's crucial to consult the official .

New Rules and Regulations for 2025 (and Beyond)

While the focus is heavily on potential payment reductions, it's important to note that the SSA also implements routine updates and adjustments annually. These include:

- Cost of Living Adjustments (COLA): The annual COLA, adjusted for inflation, impacts benefit payments. While the COLA helps offset inflation, it doesn't address the underlying financial challenges facing the Social Security system.

- Benefit Calculations: The formulas used to calculate benefits are complex and regularly reviewed. Understanding how your benefits are calculated is crucial for accurate financial planning.

- Eligibility Requirements: While not drastically changing, the requirements for eligibility continue to evolve, so staying informed about the latest updates is vital.

These changes, while not as dramatic as potential benefit reductions, can still significantly affect your retirement income.

Protecting Your Social Security Benefits: Steps You Can Take

While you can't directly control legislative action, you can take proactive steps to prepare for potential changes:

- Diversify your retirement income: Don't rely solely on Social Security. Maximize your savings in 401(k)s, IRAs, and other retirement accounts.

- Monitor your benefits: Regularly check your Social Security statement online to understand your projected benefits and track any changes.

- Stay informed: Keep abreast of legislative developments regarding Social Security. Follow reputable news sources and government websites for updates.

- Consult a financial advisor: A financial professional can provide personalized advice tailored to your specific situation.

Conclusion: Planning for Uncertainty

The future of Social Security remains uncertain, especially concerning potential benefit reductions in 2025. By staying informed, planning ahead, and diversifying your income sources, you can mitigate the potential impact of these changes and secure a more stable retirement. The key is proactive planning and a commitment to understanding your options. Don't wait; start planning today to secure your financial future.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security 2025: New Rules And Potential Payment Reductions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

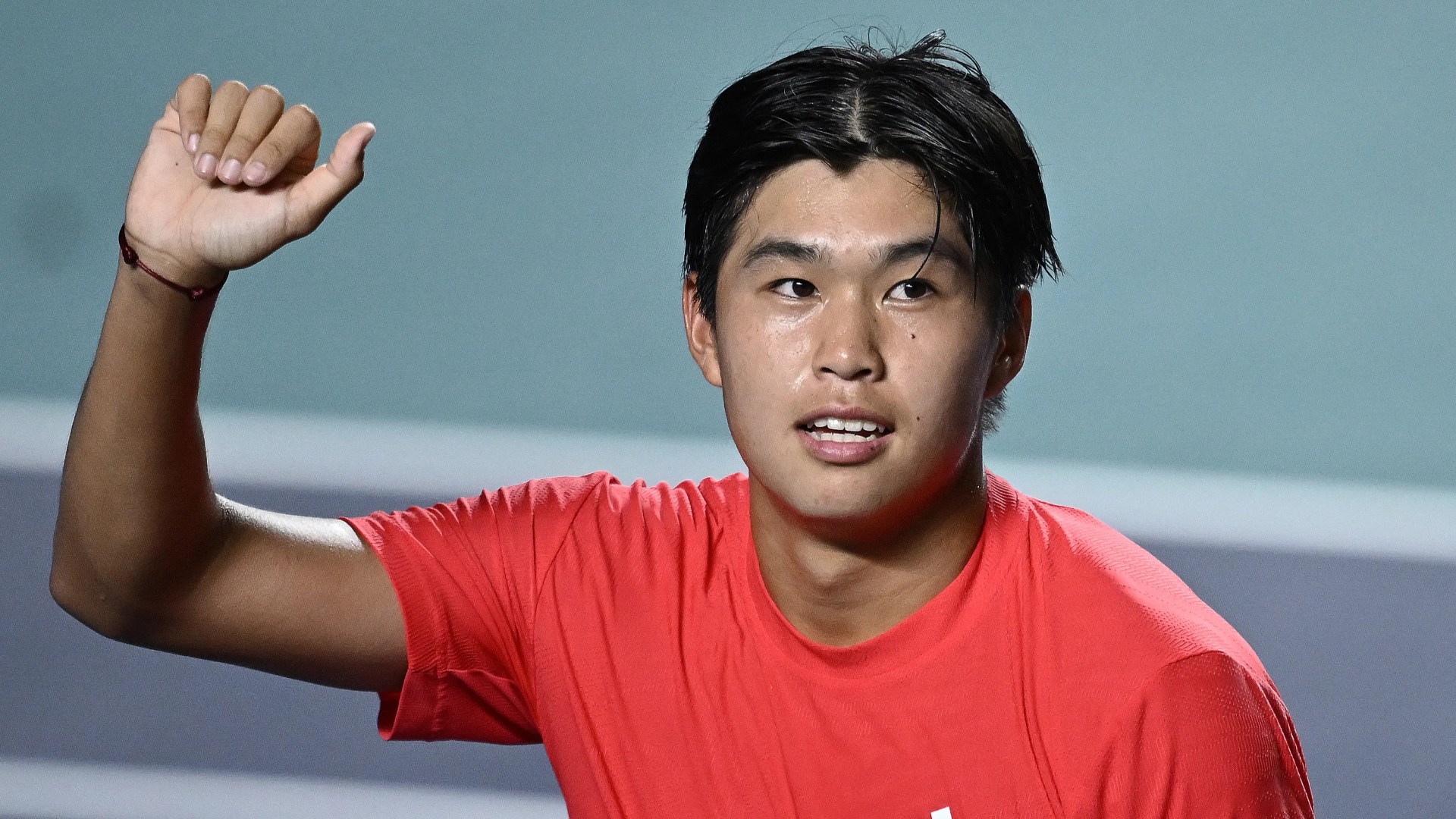

Facing The World No 3 The Story Of A Us Tennis Prodigy Named After Moms Work

May 27, 2025

Facing The World No 3 The Story Of A Us Tennis Prodigy Named After Moms Work

May 27, 2025 -

Financial Strain On Learner Drivers The Cost Of Driving Tests

May 27, 2025

Financial Strain On Learner Drivers The Cost Of Driving Tests

May 27, 2025 -

Social Security News 5 108 Payments Scheduled For This Week

May 27, 2025

Social Security News 5 108 Payments Scheduled For This Week

May 27, 2025 -

Revitalize Your Lawn The Benefits Of Using Coffee Grounds

May 27, 2025

Revitalize Your Lawn The Benefits Of Using Coffee Grounds

May 27, 2025 -

Multiple Stabbings And Fights On Seaside Heights Boardwalk Crowd Control Issues Amid Curfew

May 27, 2025

Multiple Stabbings And Fights On Seaside Heights Boardwalk Crowd Control Issues Amid Curfew

May 27, 2025

Latest Posts

-

Food Inflation Hits Year High Peak The Impact Of Beef Prices

May 29, 2025

Food Inflation Hits Year High Peak The Impact Of Beef Prices

May 29, 2025 -

The Truth Behind Trumps Outburst At Harvard A Maga Fundraising Scheme

May 29, 2025

The Truth Behind Trumps Outburst At Harvard A Maga Fundraising Scheme

May 29, 2025 -

Stellantis Appoints Antonio Filosa As Its Ceo What To Expect

May 29, 2025

Stellantis Appoints Antonio Filosa As Its Ceo What To Expect

May 29, 2025 -

The Changing Face Of Philanthropy Hundreds Of Billionaires Pledge 600 Billion But Is It Enough

May 29, 2025

The Changing Face Of Philanthropy Hundreds Of Billionaires Pledge 600 Billion But Is It Enough

May 29, 2025 -

Harvard And Trump Unraveling The Fury And The Alleged Maga Scam

May 29, 2025

Harvard And Trump Unraveling The Fury And The Alleged Maga Scam

May 29, 2025