Social Security Benefits At Risk: The 2034 Funding Challenge And Potential Solutions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Benefits at Risk: The 2034 Funding Challenge and Potential Solutions

The looming threat of Social Security insolvency in 2034 has sparked widespread concern among retirees, future retirees, and policymakers alike. The program, a vital safety net for millions of Americans, faces a significant funding shortfall unless decisive action is taken. This article delves into the challenges, explores potential solutions, and examines what this means for you.

The 2034 Deadline: A Looming Crisis

The Social Security Administration (SSA) projects that the Social Security Trust Fund will be depleted by 2034. This doesn't mean the program will immediately cease to exist, but it does mean that without legislative changes, benefits will likely be cut by approximately 20%. This reduction would severely impact the financial security of millions of seniors already struggling with rising healthcare costs and inflation. The shortfall stems from several factors, including:

- An aging population: The number of retirees receiving benefits is increasing, while the number of working-age individuals contributing to the system is relatively stagnant.

- Declining birth rates: Fewer workers entering the workforce means a smaller pool of contributors to support a growing retiree population.

- Increased life expectancy: People are living longer, requiring Social Security benefits for an extended period.

Potential Solutions: A Multifaceted Approach

Addressing the Social Security funding crisis requires a multifaceted approach. Several solutions are being debated, each with its own pros and cons:

1. Increasing the Full Retirement Age: Gradually raising the age at which individuals can receive full Social Security benefits could help alleviate the burden on the trust fund. However, this could disproportionately affect lower-income workers who may not be able to work longer.

2. Raising the Taxable Earnings Base: Currently, Social Security taxes only apply to earnings up to a certain limit. Increasing this limit would expand the pool of taxable income, generating more revenue for the system. This solution, while seemingly simple, could be viewed negatively by high-income earners.

3. Adjusting Benefit Formulas: Modifying the formula used to calculate Social Security benefits could reduce payouts, but this is a politically sensitive issue, as it directly impacts retirees' incomes.

4. Increasing Payroll Taxes: A small increase in the Social Security payroll tax rate could significantly boost the trust fund's solvency. However, this could impact the disposable income of workers.

5. Investing the Trust Fund: Some proposals suggest investing a portion of the Social Security Trust Fund in the stock market or other assets to generate higher returns. This approach is highly controversial, however, due to the inherent risks associated with investing.

What You Can Do:

While legislative action is crucial, individuals can take steps to prepare for potential benefit reductions:

- Plan for retirement early: Don't rely solely on Social Security. Develop a comprehensive retirement savings plan that includes 401(k)s, IRAs, and other investment vehicles. [Link to article about retirement planning]

- Understand your benefits: Familiarize yourself with your estimated Social Security benefits and plan accordingly. You can use the SSA's online retirement estimator. [Link to SSA Retirement Estimator]

- Stay informed: Keep abreast of legislative developments and potential changes to Social Security. Engage with your elected officials and voice your concerns.

Conclusion: A Call to Action

The Social Security funding crisis is a serious issue demanding immediate attention. The 2034 deadline is rapidly approaching, and inaction will have severe consequences for millions of Americans. By understanding the challenges and supporting viable solutions, we can collectively work to preserve this crucial safety net for generations to come. Contact your representatives and urge them to prioritize finding a solution to this critical issue. The future of Social Security depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Benefits At Risk: The 2034 Funding Challenge And Potential Solutions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Weather Alert Widespread Strong To Severe Thunderstorms Imminent

Jun 20, 2025

Urgent Weather Alert Widespread Strong To Severe Thunderstorms Imminent

Jun 20, 2025 -

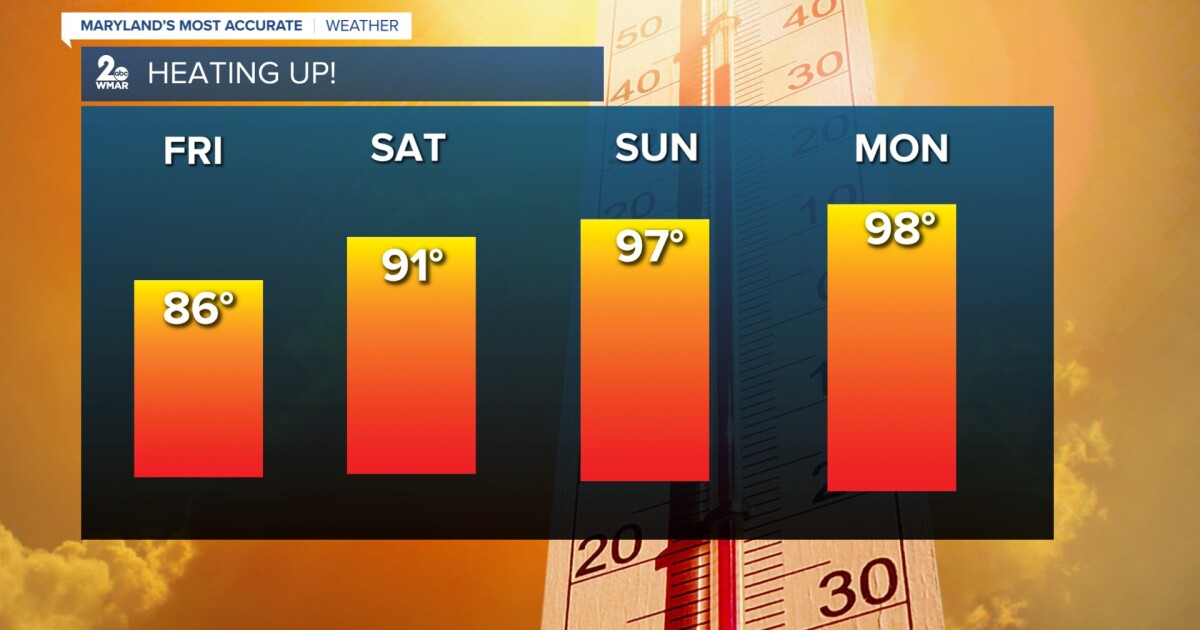

Beat The Nj Heat Wave Get Your 60 Electric Bill Discount Now

Jun 20, 2025

Beat The Nj Heat Wave Get Your 60 Electric Bill Discount Now

Jun 20, 2025 -

Urgent Pg And E Announces Power Shutdown In These Bay Area Locations

Jun 20, 2025

Urgent Pg And E Announces Power Shutdown In These Bay Area Locations

Jun 20, 2025 -

Serious Concerns Raised Nhs Trust Records Deceased Patient Eating Breakfast

Jun 20, 2025

Serious Concerns Raised Nhs Trust Records Deceased Patient Eating Breakfast

Jun 20, 2025 -

Former Federal Employee Wins Employee Of The Year A Controversial Choice

Jun 20, 2025

Former Federal Employee Wins Employee Of The Year A Controversial Choice

Jun 20, 2025

Latest Posts

-

Kyivs Night Of Terror Ongoing Search For Victims

Jun 20, 2025

Kyivs Night Of Terror Ongoing Search For Victims

Jun 20, 2025 -

How To Watch Caitlin Clark Play Indiana Fever Vs Golden State Valkyries Broadcast Information

Jun 20, 2025

How To Watch Caitlin Clark Play Indiana Fever Vs Golden State Valkyries Broadcast Information

Jun 20, 2025 -

Thousands Of At Risk Youths Face Homelessness As Job Corps Funding Uncertain

Jun 20, 2025

Thousands Of At Risk Youths Face Homelessness As Job Corps Funding Uncertain

Jun 20, 2025 -

Check If You Qualify The Warm Homes Discount And 150 Energy Bill Savings

Jun 20, 2025

Check If You Qualify The Warm Homes Discount And 150 Energy Bill Savings

Jun 20, 2025 -

Long Term Green Card Holders Deportation Fight After 58 Years In The Us

Jun 20, 2025

Long Term Green Card Holders Deportation Fight After 58 Years In The Us

Jun 20, 2025