Social Security Benefits In Jeopardy: The 2034 Funding Challenge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Benefits in Jeopardy: The 2034 Funding Challenge

The looming Social Security crisis: What you need to know about the 2034 funding shortfall and its potential impact on your benefits.

Millions of Americans rely on Social Security benefits for their retirement security. However, a looming financial crisis threatens the future of this vital program. The Social Security Administration (SSA) projects that the system's trust funds will be depleted by 2034, raising serious concerns about benefit cuts and the long-term solvency of the program. This article explores the challenges facing Social Security, the potential consequences of inaction, and what steps might be taken to address this critical issue.

The Heart of the Problem: Declining Ratios and Rising Costs

The core issue is a simple equation: fewer workers contributing to support a growing number of retirees. The ratio of workers to beneficiaries has been steadily declining for years, and this trend is projected to continue. Coupled with increasing life expectancies and rising healthcare costs, the strain on the system is significant. The SSA's projections indicate that without changes, benefits could be cut by approximately 20% in 2034.

Understanding the 2034 Deadline

The year 2034 represents the point at which the Social Security trust funds are projected to be exhausted. This doesn't mean the program will immediately shut down. Instead, incoming payroll taxes would only cover approximately 80% of scheduled benefits. This would necessitate significant benefit reductions unless Congress acts to shore up the system's finances.

Potential Consequences of Inaction:

- Benefit Reductions: The most immediate consequence of inaction is a substantial reduction in Social Security benefits for current and future retirees.

- Delayed Retirement: Individuals may be forced to delay their retirement to ensure they have sufficient income.

- Increased Financial Strain: Millions of retirees could face increased financial hardship, potentially leading to a rise in poverty among seniors.

Proposed Solutions and Ongoing Debates:

Several solutions have been proposed to address the looming crisis. These include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Payroll Tax: Raising the Social Security payroll tax rate to generate more revenue.

- Raising the Earnings Base: Increasing the amount of earnings subject to Social Security taxes.

- Benefit reductions: A gradual reduction in benefits across the board, though this remains a highly controversial option.

- Investing Social Security funds: Allowing a portion of the funds to be invested in the stock market to generate higher returns.

These proposals are highly debated, with various stakeholders holding differing opinions on their feasibility and impact. The political complexities involved in finding a bipartisan solution represent a significant hurdle.

What You Can Do:

While the future of Social Security remains uncertain, staying informed is crucial. Understanding the challenges and proposed solutions empowers you to participate in the ongoing dialogue and advocate for policies that protect your retirement security. Consider contacting your elected officials to express your concerns and support solutions that you believe are best for the future of the program. You can also explore resources like the Social Security Administration website () for detailed information on benefits and projections.

The Future of Social Security is Uncertain, but Action is Needed Now

The 2034 deadline is fast approaching. Addressing the funding challenges requires decisive action from Congress and ongoing engagement from the public. The future of Social Security – and the retirement security of millions – depends on it. Don't wait; learn more and get involved today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Benefits In Jeopardy: The 2034 Funding Challenge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

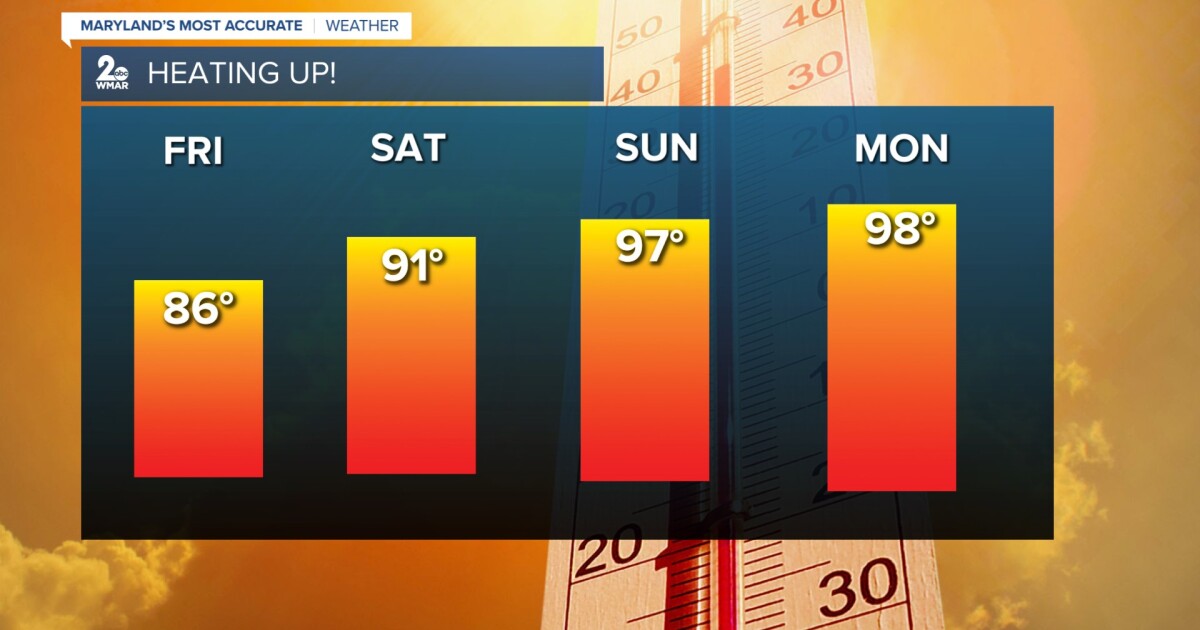

Scorching Temperatures Predicted Uk Braces For 30 C Heat

Jun 20, 2025

Scorching Temperatures Predicted Uk Braces For 30 C Heat

Jun 20, 2025 -

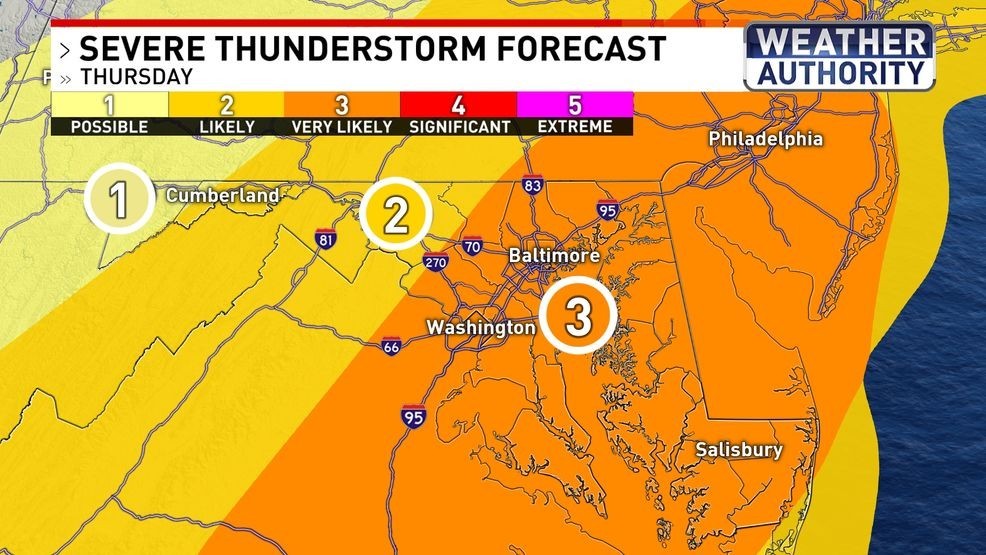

Urgent Weather Update Widespread Strong Severe Thunderstorms Today

Jun 20, 2025

Urgent Weather Update Widespread Strong Severe Thunderstorms Today

Jun 20, 2025 -

Thursday Afternoon Stay Alert For Strong To Severe Storms

Jun 20, 2025

Thursday Afternoon Stay Alert For Strong To Severe Storms

Jun 20, 2025 -

Funding Cuts Threaten The Future Of Notting Hill Carnival

Jun 20, 2025

Funding Cuts Threaten The Future Of Notting Hill Carnival

Jun 20, 2025 -

Democratic Party Faces Backlash From Senator Fettermans Ongoing Criticism

Jun 20, 2025

Democratic Party Faces Backlash From Senator Fettermans Ongoing Criticism

Jun 20, 2025

Latest Posts

-

Two Dead In Grimsby Area Car Crash During Test Drive

Jun 20, 2025

Two Dead In Grimsby Area Car Crash During Test Drive

Jun 20, 2025 -

June 19th 2025 Indiana Fever Vs Golden State Valkyries Prediction And Broadcast Details

Jun 20, 2025

June 19th 2025 Indiana Fever Vs Golden State Valkyries Prediction And Broadcast Details

Jun 20, 2025 -

Under Pressure Nhs Trust Faces Scrutiny Following Patient Death And Breakfast Anomoly

Jun 20, 2025

Under Pressure Nhs Trust Faces Scrutiny Following Patient Death And Breakfast Anomoly

Jun 20, 2025 -

Social Securitys 2034 Funding Gap What It Means For Retirees

Jun 20, 2025

Social Securitys 2034 Funding Gap What It Means For Retirees

Jun 20, 2025 -

Key Witness In Bryan Kohberger Case Police Bodycam Footage Shows Potential Connection

Jun 20, 2025

Key Witness In Bryan Kohberger Case Police Bodycam Footage Shows Potential Connection

Jun 20, 2025