Social Security Changes In 2025: Key Updates And Potential Payment Reductions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Changes in 2025: Key Updates and Potential Payment Reductions

Are you prepared for potential changes to your Social Security benefits in 2025? The future of Social Security is a topic of ongoing national conversation, and understanding the potential shifts is crucial for financial planning. This article explores the key updates and potential payment reductions expected in 2025, offering insights to help you navigate these important changes.

The Social Security Administration (SSA) is facing significant financial challenges. The trust funds supporting retirement benefits are projected to be depleted within the next decade, leading to potential benefit reductions unless Congress acts. While the exact details remain subject to ongoing debate and potential legislative action, several key areas are expected to impact beneficiaries in 2025.

COLA Adjustments and Inflation: A Double-Edged Sword

The annual Cost of Living Adjustment (COLA) is a crucial factor influencing Social Security payments. The COLA is designed to protect retirees from inflation, adjusting benefits to reflect the rising cost of living. However, high inflation rates in recent years have led to significant COLA increases, placing further strain on the trust funds. While the 2025 COLA is yet to be officially announced, understanding the impact of inflation on both benefit adjustments and the overall financial health of the system is vital. Predicting the precise COLA percentage requires careful consideration of economic forecasts and government announcements closer to the year's end.

Potential Benefit Reductions: What to Expect

The looming depletion of the Social Security trust funds raises serious concerns about potential benefit reductions. While no specific cuts have been legislated as of yet, various proposals are under discussion. These proposals range from gradually reducing benefits for future retirees to implementing a more comprehensive reform package. The likelihood and extent of benefit reductions depend heavily on the actions of Congress. It's crucial to stay informed about legislative developments and engage in civic discussions to influence policy decisions regarding Social Security's long-term viability.

- Understanding the different proposals: Various reform proposals aim to address the long-term solvency of Social Security. Some suggest raising the full retirement age, increasing payroll taxes, or adjusting benefit formulas. Understanding the nuances of each proposal is essential to understanding their potential impact on your future benefits.

- Impact on different beneficiary groups: The impact of potential benefit reductions may vary depending on factors like age, income, and the year you began receiving benefits. It is crucial to consider how proposed changes might specifically affect your situation.

Planning for the Future: Proactive Strategies

While uncertainty remains, proactive financial planning is crucial. Regardless of potential legislative changes, maintaining a healthy financial portfolio, exploring supplemental retirement income options, and understanding your Social Security benefits statement are key steps to ensure financial security in retirement.

- Diversify your retirement portfolio: Don't rely solely on Social Security. Invest wisely in other retirement accounts, like 401(k)s or IRAs, to supplement your income.

- Explore supplemental income sources: Consider part-time work, investments, or annuities to boost your retirement income.

- Review your Social Security benefits statement regularly: Understanding your projected benefits is essential for effective financial planning. The SSA's website provides valuable resources and tools to help you understand your statement.

Stay Informed: Resources and Further Information

The official Social Security Administration website () is your primary source for accurate and up-to-date information. Staying informed about legislative updates through reputable news sources and government websites is also vital. Engaging with your representatives in Congress can help you voice your concerns and influence policy decisions.

In conclusion, the future of Social Security in 2025 and beyond remains uncertain. However, by staying informed, actively engaging in the conversation, and planning proactively, you can better prepare for potential changes and secure your financial future. Remember to consult with a financial advisor for personalized guidance based on your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Changes In 2025: Key Updates And Potential Payment Reductions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Residents Battle Housing Development Over Sewage System Concerns

May 28, 2025

Residents Battle Housing Development Over Sewage System Concerns

May 28, 2025 -

Is Amazon Amzn A Buy Examining Its Momentum And Future Growth

May 28, 2025

Is Amazon Amzn A Buy Examining Its Momentum And Future Growth

May 28, 2025 -

Alexandra Daddario Stuns In Sheer Lace At Diors Cruise Collection

May 28, 2025

Alexandra Daddario Stuns In Sheer Lace At Diors Cruise Collection

May 28, 2025 -

Bank Of America Bac Significant In Financial Avengers Portfolio

May 28, 2025

Bank Of America Bac Significant In Financial Avengers Portfolio

May 28, 2025 -

Food Inflation Hits Year High Peak The Impact Of Rising Beef Prices

May 28, 2025

Food Inflation Hits Year High Peak The Impact Of Rising Beef Prices

May 28, 2025

Latest Posts

-

Alexander Zverevs French Open Day 5 Challenge A De Jong Showdown

May 29, 2025

Alexander Zverevs French Open Day 5 Challenge A De Jong Showdown

May 29, 2025 -

Tearful Tribute George Strait Delivers Heartfelt Eulogy At 73

May 29, 2025

Tearful Tribute George Strait Delivers Heartfelt Eulogy At 73

May 29, 2025 -

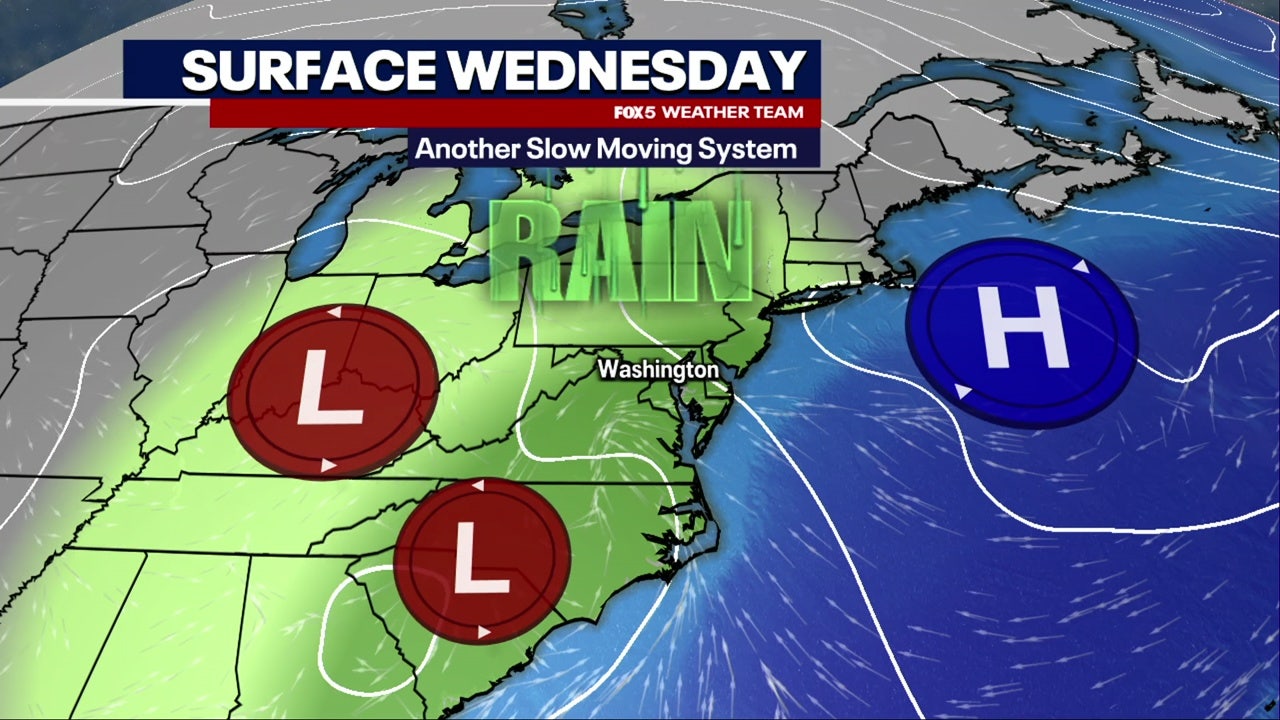

Thunderstorms And Heavy Rain To Pummel The Dmv Region Wednesday

May 29, 2025

Thunderstorms And Heavy Rain To Pummel The Dmv Region Wednesday

May 29, 2025 -

French Open Day 5 2025 Expert Betting Picks And Odds For Munar Fils And Draper Monfils Matches

May 29, 2025

French Open Day 5 2025 Expert Betting Picks And Odds For Munar Fils And Draper Monfils Matches

May 29, 2025 -

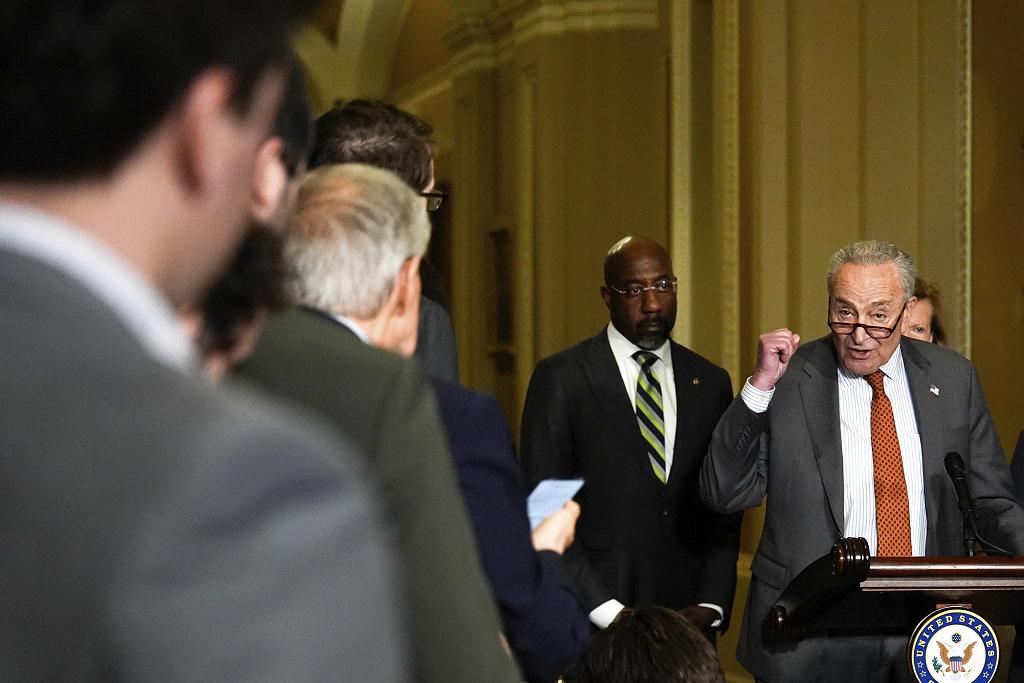

Senate Democrats Fight Against The Big Beautiful Bill A New Tool In Play

May 29, 2025

Senate Democrats Fight Against The Big Beautiful Bill A New Tool In Play

May 29, 2025