Social Security Facing 2034 Payment Crisis: Congressional Action Needed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Facing 2034 Payment Crisis: Congressional Action Needed Now

The clock is ticking. America's Social Security system, a vital lifeline for millions of retirees and disabled Americans, is facing a potential crisis. Experts warn that unless Congress takes decisive action, the system's trust fund could be depleted by 2034, leading to significant benefit cuts. This looming shortfall demands immediate attention and comprehensive solutions.

This isn't just a distant threat; it's a rapidly approaching reality impacting the financial security of millions. Understanding the problem and the potential solutions is crucial for both current beneficiaries and future generations.

Understanding the Social Security Funding Crisis

The Social Security system's current funding model relies on a complex interplay of payroll taxes and investment income. However, demographic shifts – including an aging population and declining birth rates – are placing immense pressure on the system's ability to meet its obligations. Simply put, fewer workers are contributing to support a growing number of retirees.

This imbalance has resulted in a projected shortfall in the Social Security trust fund. While the system can still pay out 80% of promised benefits even after the trust fund is depleted in 2034, this represents a significant reduction in benefits for millions of Americans relying on Social Security for their retirement income. This potential 20% cut could leave many vulnerable to financial hardship.

Potential Solutions: A Multifaceted Approach

Addressing the Social Security crisis requires a multifaceted approach, involving several key strategies that need to be seriously considered by Congress:

-

Raising the Full Retirement Age: Gradually increasing the full retirement age – the age at which individuals receive their full Social Security benefits – could significantly reduce the long-term financial burden on the system. This is a complex issue, however, as it could disproportionately impact lower-income workers who may not be able to work longer.

-

Increasing the Taxable Earnings Base: Currently, Social Security taxes only apply to earnings below a certain threshold. Raising this cap would bring more high-income earners into the system, boosting overall revenue. This is a politically charged issue, however, with concerns about the impact on high-income individuals.

-

Modifying COLA Adjustments: The annual cost-of-living adjustments (COLA) ensure benefits keep pace with inflation. However, some argue that the current formula overestimates inflation, leading to higher benefit payouts than necessary. Examining and potentially modifying this formula could help maintain fiscal solvency.

-

Benefit Adjustments Based on Income: A progressive approach could modify benefit calculations to favor lower-income recipients, ensuring those who rely most heavily on Social Security receive adequate support. This could involve reducing benefits for higher earners while maintaining or increasing benefits for lower earners.

-

Investing in Economic Growth: A robust economy directly impacts Social Security's revenue streams. Investing in infrastructure, education, and other growth initiatives could boost the tax base and alleviate the long-term financial strain.

The Urgent Need for Congressional Action

The looming Social Security crisis is not a partisan issue; it's a national challenge that demands immediate bipartisan cooperation. Delaying action only exacerbates the problem, leaving future generations to grapple with even more drastic cuts and increased financial uncertainty. The longer Congress waits, the more difficult and painful the necessary reforms will become.

What can you do? Contact your representatives in Congress and urge them to prioritize Social Security reform. Your voice matters in shaping the future of this crucial social safety net. Learn more about the Social Security system and the proposed solutions by visiting the official Social Security Administration website: [Link to SSA website]. The future of Social Security depends on our collective engagement and informed action.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Facing 2034 Payment Crisis: Congressional Action Needed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Caitlin Clarks Next Wnba Game Indiana Fever Vs Golden State Valkyries How To Watch

Jun 20, 2025

Caitlin Clarks Next Wnba Game Indiana Fever Vs Golden State Valkyries How To Watch

Jun 20, 2025 -

Summer Relief Three South Jersey Electric Companies Lowering Rates

Jun 20, 2025

Summer Relief Three South Jersey Electric Companies Lowering Rates

Jun 20, 2025 -

Tense Exchange Carlson Questions Cruzs Iran Stance On Cnn

Jun 20, 2025

Tense Exchange Carlson Questions Cruzs Iran Stance On Cnn

Jun 20, 2025 -

Injured List Updates Giants Activate Justin Verlander And Anthony De Sclafani

Jun 20, 2025

Injured List Updates Giants Activate Justin Verlander And Anthony De Sclafani

Jun 20, 2025 -

Urgent Weather Alert Widespread Strong Severe Thunderstorms Impacting Region

Jun 20, 2025

Urgent Weather Alert Widespread Strong Severe Thunderstorms Impacting Region

Jun 20, 2025

Latest Posts

-

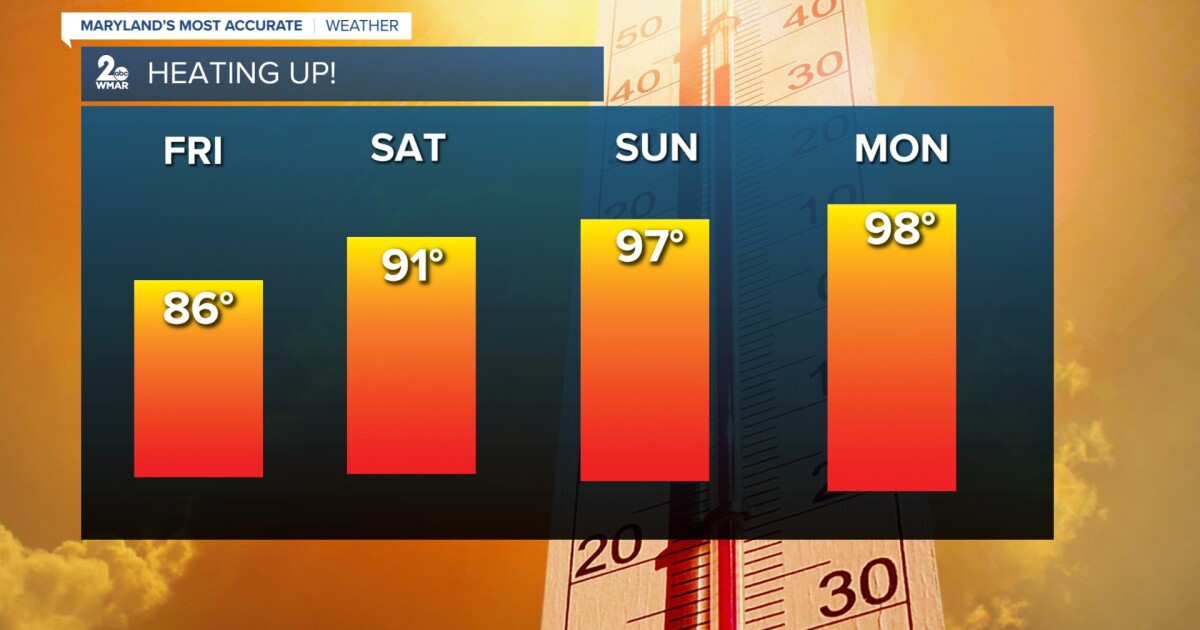

30 C Heat Sweeps Across The Uk

Jun 20, 2025

30 C Heat Sweeps Across The Uk

Jun 20, 2025 -

Verlanders 2025 Season An Inconsistent Start Still Seeking First Win

Jun 20, 2025

Verlanders 2025 Season An Inconsistent Start Still Seeking First Win

Jun 20, 2025 -

Facing A 2034 Deadline The Urgent Need For Social Security Reform

Jun 20, 2025

Facing A 2034 Deadline The Urgent Need For Social Security Reform

Jun 20, 2025 -

Mlb Baseballs Unpredictable Behavior Scientists Baffled

Jun 20, 2025

Mlb Baseballs Unpredictable Behavior Scientists Baffled

Jun 20, 2025 -

Powerful Storms Slam Maryland Leaving Thousands Without Power

Jun 20, 2025

Powerful Storms Slam Maryland Leaving Thousands Without Power

Jun 20, 2025