Social Security Funding Crisis: 2034 Benefit Cuts Loom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Funding Crisis: 2034 Benefit Cuts Loom – What You Need to Know

The looming Social Security funding crisis is a topic that affects millions of Americans, and the projected 2034 benefit cuts are causing widespread concern. Understanding the intricacies of this issue is crucial for planning your financial future. This article will break down the current situation, explore potential solutions, and offer advice on how to prepare for potential changes.

The Ticking Clock: Social Security's Financial Shortfall

Social Security, a cornerstone of the American retirement system, faces a significant challenge. The system's trust funds, which pay out benefits, are projected to be depleted by 2034. This doesn't mean Social Security will vanish entirely, but it does mean significant changes are likely unless Congress acts. Without legislative intervention, benefits could be cut by approximately 20%, a drastic reduction that would severely impact retirees' financial security.

Understanding the Root Causes:

Several factors contribute to the Social Security funding crisis:

- Increasing Life Expectancy: Americans are living longer, leading to more years of benefit payouts.

- Declining Birth Rates: A smaller workforce is contributing to the system, meaning fewer individuals are paying into Social Security to support a growing number of retirees.

- Rising Healthcare Costs: Increased healthcare expenses strain individuals' financial resources, potentially impacting their ability to save independently for retirement.

Potential Solutions: A Political Tightrope Walk

Addressing the Social Security shortfall requires political will and compromise. Several solutions have been proposed, including:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Taxable Wage Base: Expanding the amount of earnings subject to Social Security taxes.

- Raising Payroll Taxes: Slightly increasing the Social Security tax rate for both employers and employees.

- Benefit Reductions (the dreaded 20% cut): This is the least desirable option, but a potential reality without congressional action.

These solutions each have proponents and detractors, and finding a compromise that satisfies all stakeholders presents a major political hurdle.

What You Can Do to Prepare:

While the future of Social Security remains uncertain, proactive planning can help mitigate the impact of potential benefit cuts:

- Maximize Your Savings: Contribute the maximum amount to your 401(k) or IRA to build a stronger financial foundation for retirement.

- Diversify Your Investments: Don't rely solely on Social Security. Explore other investment options to supplement your retirement income.

- Understand Your Benefits: Familiarize yourself with your projected Social Security benefits and how potential cuts might affect your retirement plan. Use the Social Security Administration's online calculator to estimate your benefits. ([Link to SSA calculator])

- Stay Informed: Keep abreast of legislative developments and proposed solutions regarding Social Security reform.

Conclusion: A Call to Action

The Social Security funding crisis is a complex issue demanding immediate attention. The potential for 2034 benefit cuts underscores the urgency of finding a viable solution. While the future remains uncertain, individuals can proactively protect their retirement security by maximizing savings, diversifying investments, and staying informed about the ongoing debate. Contact your elected officials and urge them to prioritize finding a long-term solution for the Social Security system. The future of millions of Americans depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Funding Crisis: 2034 Benefit Cuts Loom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sacramento Area Burn Permits Halted Due To Increased Fire Risk

Jun 20, 2025

Sacramento Area Burn Permits Halted Due To Increased Fire Risk

Jun 20, 2025 -

Nj Summer Heat Wave 60 Electric Bill Credit Program Explained

Jun 20, 2025

Nj Summer Heat Wave 60 Electric Bill Credit Program Explained

Jun 20, 2025 -

National Heatwave Uk Braces For 30 C Temperatures

Jun 20, 2025

National Heatwave Uk Braces For 30 C Temperatures

Jun 20, 2025 -

Tucker Carlson Challenges Ted Cruz On Iran Strategy During Cnn Interview

Jun 20, 2025

Tucker Carlson Challenges Ted Cruz On Iran Strategy During Cnn Interview

Jun 20, 2025 -

Urgent Safety Notice Ntsb Addresses Boeing 737 Max Engine Concerns

Jun 20, 2025

Urgent Safety Notice Ntsb Addresses Boeing 737 Max Engine Concerns

Jun 20, 2025

Latest Posts

-

Tucker Carlson Grills Ted Cruz On Iran Policy Cnn Debate Highlights

Jun 20, 2025

Tucker Carlson Grills Ted Cruz On Iran Policy Cnn Debate Highlights

Jun 20, 2025 -

Notting Hill Carnivals Survival At Stake Concerns Over Funding And Organization

Jun 20, 2025

Notting Hill Carnivals Survival At Stake Concerns Over Funding And Organization

Jun 20, 2025 -

60 Off Nj Electric Bills Summer Savings Program Explained

Jun 20, 2025

60 Off Nj Electric Bills Summer Savings Program Explained

Jun 20, 2025 -

Severe Weather Pummels Maryland Trees Down Power Lines Damaged

Jun 20, 2025

Severe Weather Pummels Maryland Trees Down Power Lines Damaged

Jun 20, 2025 -

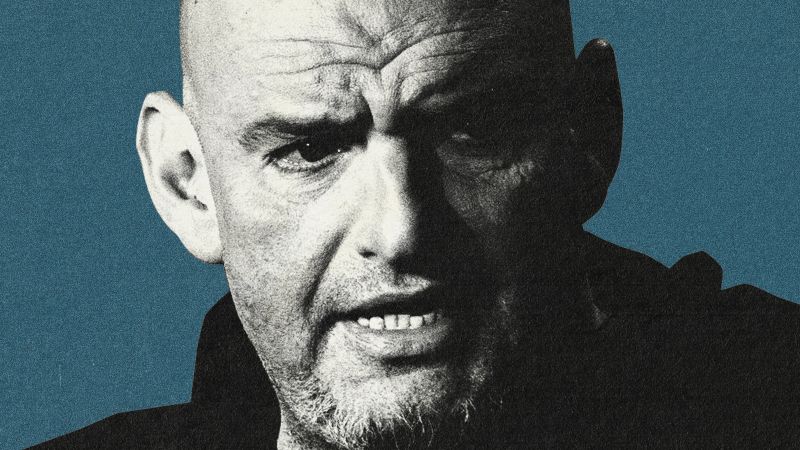

Tensions Rise Fettermans Public Criticism Increases Democratic Frustration

Jun 20, 2025

Tensions Rise Fettermans Public Criticism Increases Democratic Frustration

Jun 20, 2025