Social Security Funding Crisis: 2034 Benefit Cuts Looming

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Funding Crisis: 2034 Benefit Cuts Looming – What You Need To Know

The looming Social Security funding crisis is a topic dominating headlines and causing significant anxiety for millions of Americans. With the Social Security Administration (SSA) projecting a depletion of trust fund reserves by 2034, the potential for benefit cuts is a stark reality. This isn't just a distant threat; it's a critical issue demanding immediate attention and understanding. This article will delve into the current state of Social Security, the projected shortfall, potential solutions, and what you can do to prepare.

Understanding the Social Security Trust Fund Deficit

The Social Security system faces a significant financial challenge. The number of retirees and beneficiaries is steadily increasing, while the worker-to-beneficiary ratio is declining. This demographic shift, combined with longer lifespans, is putting immense pressure on the system's ability to meet its obligations. Simply put, there aren't enough workers contributing to support the growing number of retirees.

The SSA's projections indicate that by 2034, the Social Security trust funds will be unable to pay 100% of scheduled benefits without changes. This doesn't mean benefits will disappear entirely, but a substantial reduction – potentially around 20% – is a very real possibility. This would have a devastating impact on millions of seniors who rely on Social Security for their primary source of income.

Potential Solutions: A Complex Equation

Addressing the Social Security funding crisis requires a multifaceted approach. Several solutions are being debated, each with its own set of pros and cons:

-

Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could help alleviate the burden on the system. However, this would disproportionately affect lower-income workers who often have shorter lifespans and less opportunity to save.

-

Increasing the Social Security Tax Rate: Raising the current Social Security tax rate could generate more revenue. But this could burden workers, especially those with lower incomes.

-

Increasing the Taxable Earnings Base: Currently, Social Security taxes only apply to earnings up to a certain level. Expanding the taxable base would include higher earners, generating more revenue. However, this measure could face political resistance from higher-income individuals.

-

Benefit Reductions: As previously mentioned, reducing benefits is a drastic but possible outcome if no other solutions are implemented. This would severely impact retirees' financial security.

-

Investing the Trust Fund: Some propose investing a portion of the Social Security trust funds in the stock market to generate higher returns. This approach, however, carries significant risk and could lead to further instability if investments underperform.

What Can You Do? Planning for the Future

While the future of Social Security remains uncertain, proactive planning is crucial. Consider these steps:

-

Maximize your savings: Diversify your retirement savings beyond Social Security by contributing to 401(k)s, IRAs, and other retirement accounts.

-

Delaying your retirement: If possible, delaying your retirement even by a few years can significantly increase your Social Security benefits.

-

Stay informed: Keep abreast of developments regarding Social Security reform and the ongoing debate surrounding potential solutions.

The Social Security funding crisis is a significant challenge with far-reaching implications. Understanding the issues, exploring potential solutions, and engaging in informed discussions are critical for ensuring the long-term viability of this vital program for future generations. The time to act is now. Don't wait for 2034; start planning your financial future today. Learn more by visiting the official Social Security Administration website: .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Funding Crisis: 2034 Benefit Cuts Looming. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

White Steps Down Kelly Takes The Reins At Fever

Jun 20, 2025

White Steps Down Kelly Takes The Reins At Fever

Jun 20, 2025 -

Coaching Absence Stephanie White Will Not Coach Indiana Fever Vs Valkyries

Jun 20, 2025

Coaching Absence Stephanie White Will Not Coach Indiana Fever Vs Valkyries

Jun 20, 2025 -

June 19th 2025 Indiana Fever Vs Golden State Valkyries Prediction Tv And Live Stream

Jun 20, 2025

June 19th 2025 Indiana Fever Vs Golden State Valkyries Prediction Tv And Live Stream

Jun 20, 2025 -

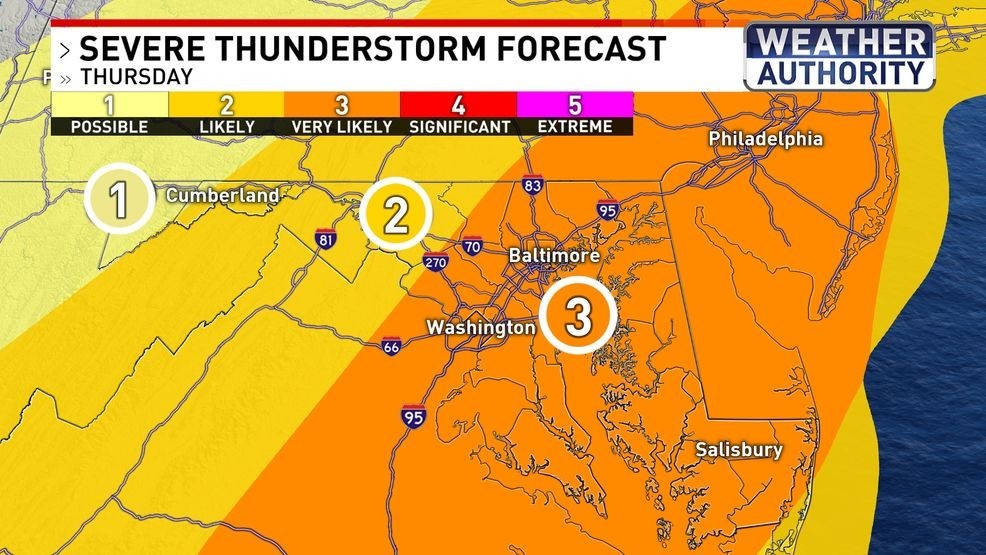

Severe Weather Alert Strong Storms Predicted Thursday Afternoon

Jun 20, 2025

Severe Weather Alert Strong Storms Predicted Thursday Afternoon

Jun 20, 2025 -

Key Witness Testimony Police Video May Link Bryan Kohberger To Idaho Murders

Jun 20, 2025

Key Witness Testimony Police Video May Link Bryan Kohberger To Idaho Murders

Jun 20, 2025

Latest Posts

-

Serious Concerns Raised Nhs Trust Records Deceased Patient Eating Breakfast

Jun 20, 2025

Serious Concerns Raised Nhs Trust Records Deceased Patient Eating Breakfast

Jun 20, 2025 -

Cnn Tucker Carlson Confronts Ted Cruz On Us Iran Relations

Jun 20, 2025

Cnn Tucker Carlson Confronts Ted Cruz On Us Iran Relations

Jun 20, 2025 -

Morocco Rabies Warning Uk Citizen Dies After Stray Dog Contact

Jun 20, 2025

Morocco Rabies Warning Uk Citizen Dies After Stray Dog Contact

Jun 20, 2025 -

2025 Wnba Season Where To Watch Caitlin Clark Play For The Indiana Fever

Jun 20, 2025

2025 Wnba Season Where To Watch Caitlin Clark Play For The Indiana Fever

Jun 20, 2025 -

Summer Heat Wave Brings 60 Electric Bill Savings To New Jersey Residents

Jun 20, 2025

Summer Heat Wave Brings 60 Electric Bill Savings To New Jersey Residents

Jun 20, 2025