Social Security Payment Adjustments: Analyzing The 2025 Budget And Its Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Payment Adjustments: Analyzing the 2025 Budget and its Impact

Millions of Americans rely on Social Security benefits. The annual adjustment to these payments, based on the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W), is a crucial factor influencing the financial well-being of retirees and disabled individuals. The 2025 budget and its projected impact on Social Security payments are generating significant discussion and concern. This article delves into the key aspects of the planned adjustments, exploring potential implications for beneficiaries.

Understanding the COLA Adjustment:

The cost of living adjustment (COLA) is an annual increase applied to Social Security benefits to help maintain their purchasing power in the face of inflation. The COLA is calculated using the CPI-W, measuring changes in the prices of goods and services purchased by urban wage earners and clerical workers. A higher CPI-W translates to a larger COLA, while a lower CPI-W results in a smaller increase, or even a potential freeze in benefit amounts.

2025 Projections and Their Implications:

While the precise COLA for 2025 won't be finalized until October, current economic indicators suggest a potential scenario. [Insert specific projected COLA percentage here, citing a reputable source like the Social Security Administration or a major financial news outlet]. This projection, while subject to revision, presents both opportunities and challenges for beneficiaries.

Potential Positive Impacts:

- Increased purchasing power: A substantial COLA can help offset the rising costs of essential goods and services like groceries, healthcare, and housing, improving the quality of life for recipients.

- Reduced financial strain: For many retirees, Social Security benefits represent a significant portion of their income. A COLA adjustment offers a degree of protection against inflation's eroding effects.

Potential Challenges and Concerns:

- Inflation's persistent impact: Even with a COLA, the persistent effects of inflation may still outpace the increase, potentially leaving many beneficiaries struggling to make ends meet.

- Long-term sustainability: The ongoing debate surrounding the long-term solvency of the Social Security system raises concerns about the future of these benefits and the sustainability of future COLA adjustments. The [link to relevant SSA report on long-term solvency] provides a comprehensive overview.

- Uneven distribution of benefits: The impact of a COLA is not uniformly distributed across all beneficiaries. Lower-income retirees often experience a more significant strain due to a higher proportion of their income being allocated to essentials.

Analyzing the 2025 Budget's Influence:

The 2025 federal budget plays a crucial role in determining the resources available for Social Security. [Mention specific budgetary allocations or proposed changes related to Social Security, citing official government sources]. Any reductions in funding or changes to benefit calculations could significantly impact the COLA and its effectiveness in protecting beneficiaries from inflation.

Looking Ahead: Strategies for Social Security Beneficiaries:

Navigating the complexities of Social Security benefits requires careful planning and proactive measures. Here are some key strategies to consider:

- Budgeting and financial planning: Develop a detailed budget to carefully manage expenses and allocate resources efficiently.

- Diversification of income: Explore supplemental income streams, such as part-time work or investments, to augment Social Security benefits.

- Staying informed: Keep abreast of changes in Social Security policies and regulations by regularly consulting the Social Security Administration website and reputable financial news sources.

Conclusion:

The 2025 Social Security payment adjustments represent a crucial factor influencing the financial well-being of millions. Understanding the projected COLA, its potential impacts, and the long-term challenges facing the Social Security system is essential for both beneficiaries and policymakers. Proactive financial planning and staying informed are key to navigating this complex landscape. Regularly checking the official Social Security Administration website for updates is crucial for ensuring you have the most accurate and up-to-date information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Payment Adjustments: Analyzing The 2025 Budget And Its Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Macron Denies Claims In Viral Video Showing Interaction With Brigitte Macron

May 28, 2025

Macron Denies Claims In Viral Video Showing Interaction With Brigitte Macron

May 28, 2025 -

Financial Avengers Inc S Top Holdings Bank Of America A Major Player

May 28, 2025

Financial Avengers Inc S Top Holdings Bank Of America A Major Player

May 28, 2025 -

The Rise And Fall Of Michelle Mone An Entrepreneurial Journey

May 28, 2025

The Rise And Fall Of Michelle Mone An Entrepreneurial Journey

May 28, 2025 -

Social Security Payment Changes June 2025 Update

May 28, 2025

Social Security Payment Changes June 2025 Update

May 28, 2025 -

Milwaukee Bucks Future Uncertain Doc Rivers Role In Keeping Giannis

May 28, 2025

Milwaukee Bucks Future Uncertain Doc Rivers Role In Keeping Giannis

May 28, 2025

Latest Posts

-

I Miss Him So Much George Straits Raw Eulogy For Deceased Persons Name

May 29, 2025

I Miss Him So Much George Straits Raw Eulogy For Deceased Persons Name

May 29, 2025 -

Will Zverev Advance French Open Mens Day 5 Match Analysis

May 29, 2025

Will Zverev Advance French Open Mens Day 5 Match Analysis

May 29, 2025 -

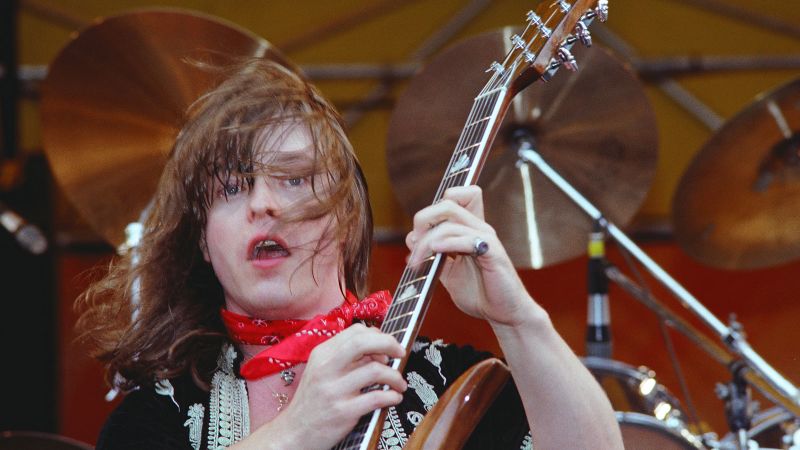

Rock Guitarist Rick Derringer Passes Away At Age 77

May 29, 2025

Rock Guitarist Rick Derringer Passes Away At Age 77

May 29, 2025 -

England Announces Smith To Open In Odi Series Against West Indies

May 29, 2025

England Announces Smith To Open In Odi Series Against West Indies

May 29, 2025 -

Giants Causeway Authority Condemns Rock Coin Jamming

May 29, 2025

Giants Causeway Authority Condemns Rock Coin Jamming

May 29, 2025