Social Security Payment Cuts: June 2025 Changes Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Payment Cuts: What to Expect in June 2025

Are your Social Security benefits safe? The looming threat of Social Security payment cuts in June 2025 has many Americans worried. Understanding the potential changes and their impact is crucial for financial planning. This article breaks down the complexities of the situation, explaining what's at stake and what you can do to prepare.

The Social Security Administration (SSA) faces a significant funding shortfall, potentially triggering automatic benefit cuts unless Congress acts. This isn't a new problem; the trust funds supporting Social Security have been facing long-term solvency issues for years. However, the impending deadline of June 2025 brings the issue into sharp focus.

What are the potential cuts?

According to the SSA's latest projections, without legislative intervention, benefits could be cut by approximately 20% starting in June 2025. This means a substantial reduction in monthly payments for millions of retirees and disabled Americans who rely on Social Security for their livelihood. The exact percentage cut will depend on several factors, including economic growth and future legislative actions.

Why are these cuts happening?

The primary driver of the potential cuts is the increasing number of retirees and a shrinking workforce relative to the number of beneficiaries. Baby boomers are entering retirement in large numbers, placing significant strain on the system. Furthermore, life expectancy has increased, meaning beneficiaries are drawing payments for longer periods. These demographic shifts, coupled with fluctuating economic conditions, have created a significant funding imbalance.

What can Congress do?

Congress has several options to address the funding shortfall. These include:

- Raising the retirement age: Gradually increasing the age at which individuals can receive full Social Security benefits.

- Increasing the Social Security tax rate: Raising the percentage of earnings subject to Social Security taxes.

- Increasing the earnings base: Expanding the amount of earnings subject to Social Security taxes.

- Cutting benefits: Implementing the automatic benefit reductions as currently projected.

- A combination of the above: A multi-pronged approach addressing several factors contributing to the shortfall.

The debate in Congress is complex and highly politicized. Reaching a consensus on a long-term solution will be challenging.

How will these cuts affect me?

The impact of a 20% cut will vary depending on your individual benefits. For many retirees, this could mean a significant reduction in income, potentially impacting their ability to afford essential expenses like housing, healthcare, and food. For those relying heavily on Social Security, the consequences could be severe.

What should I do now?

While the situation is uncertain, proactive planning is crucial. Here are some steps you can take:

- Review your budget: Assess your current expenses and identify areas where you can cut back.

- Explore additional income sources: Consider part-time work, investment opportunities, or other ways to supplement your income.

- Consult a financial advisor: A financial advisor can help you develop a comprehensive retirement plan that accounts for potential Social Security benefit reductions.

- Stay informed: Keep abreast of developments in Congress and the SSA's official statements. Regularly check the SSA website for updates.

The future of Social Security remains uncertain. The potential for benefit cuts in June 2025 is a serious concern that requires immediate attention from both Congress and individual citizens. Taking proactive steps to prepare for potential reductions is crucial for ensuring financial security in retirement. By understanding the issues and planning accordingly, you can better navigate this challenging period. Stay tuned for further updates on this developing story.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Payment Cuts: June 2025 Changes Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Long Awaited Return Four Wwii Airmen Coming Home After Plane Crash

May 27, 2025

Long Awaited Return Four Wwii Airmen Coming Home After Plane Crash

May 27, 2025 -

Ancient Anglo Saxon Vessels Contents Discovered Archaeological Findings Explained

May 27, 2025

Ancient Anglo Saxon Vessels Contents Discovered Archaeological Findings Explained

May 27, 2025 -

Examining The Life And Career Of Michelle Mone A Case Study In Entrepreneurial Success And Failure

May 27, 2025

Examining The Life And Career Of Michelle Mone A Case Study In Entrepreneurial Success And Failure

May 27, 2025 -

Speed Climbing Everest Concerns Raised Over Anesthetic Gas Assistance

May 27, 2025

Speed Climbing Everest Concerns Raised Over Anesthetic Gas Assistance

May 27, 2025 -

Institutional Investor Activity Birmingham Capital Managements Sale Of Bank Of America Shares

May 27, 2025

Institutional Investor Activity Birmingham Capital Managements Sale Of Bank Of America Shares

May 27, 2025

Latest Posts

-

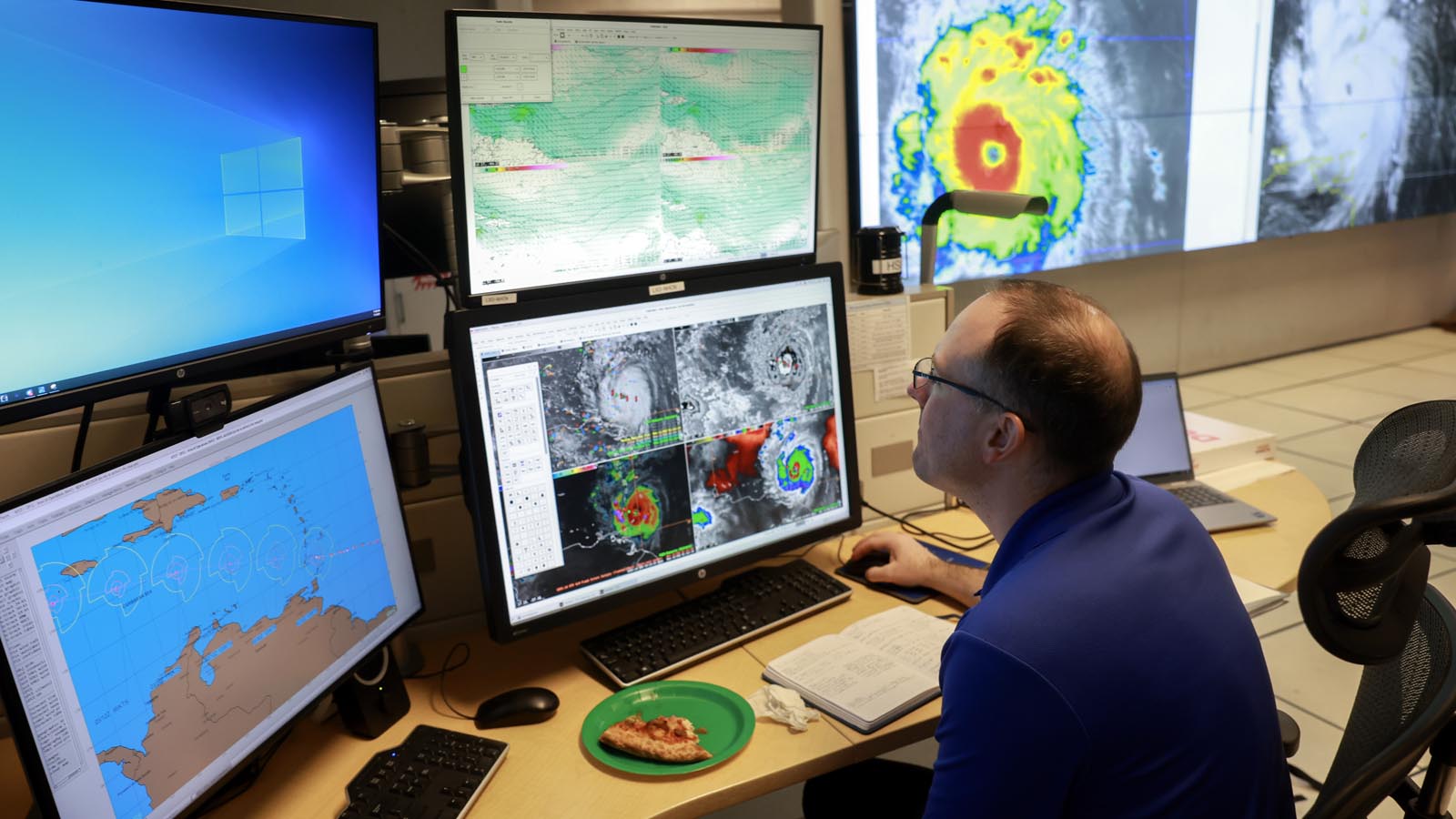

Understanding Hurricane Track Forecasts A 2025 Perspective

May 28, 2025

Understanding Hurricane Track Forecasts A 2025 Perspective

May 28, 2025 -

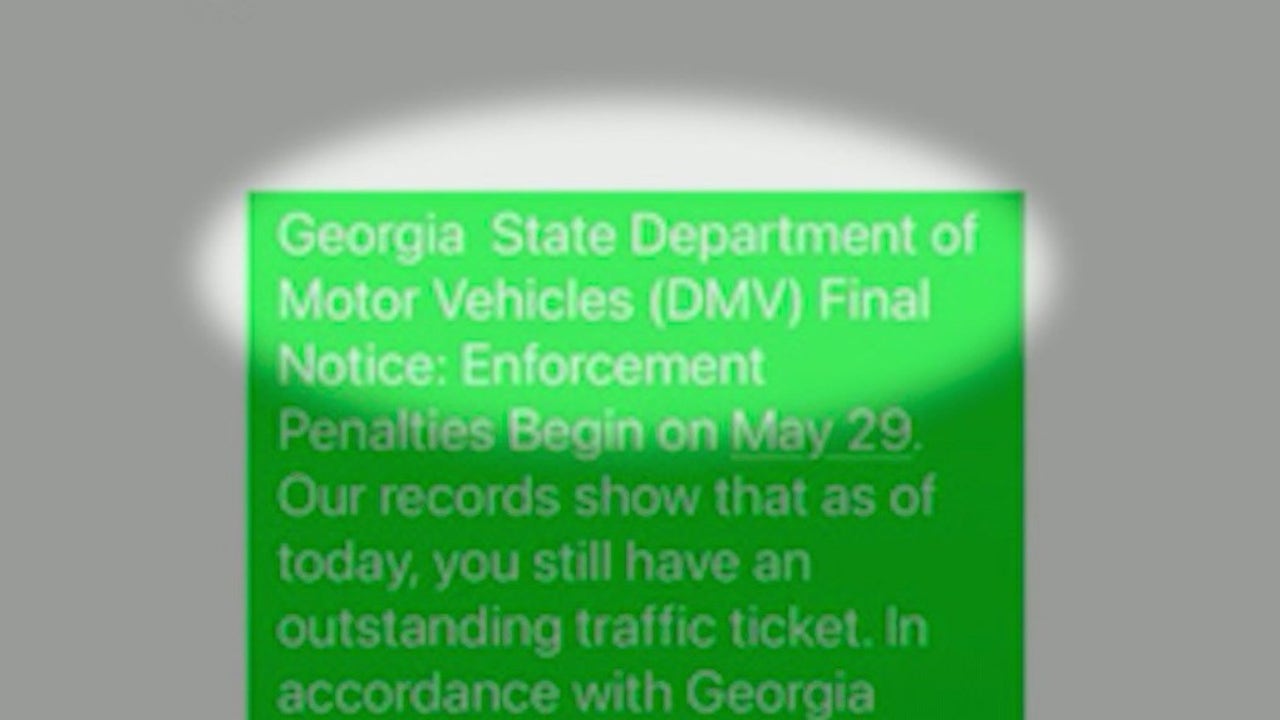

Fake Text Message Traffic Tickets A Warning For Georgia Drivers

May 28, 2025

Fake Text Message Traffic Tickets A Warning For Georgia Drivers

May 28, 2025 -

Alexandra Daddarios See Through Lace Dress Stuns

May 28, 2025

Alexandra Daddarios See Through Lace Dress Stuns

May 28, 2025 -

How A Lumber Yard Became A Social Media Sensation The Shepmates Phenomenon

May 28, 2025

How A Lumber Yard Became A Social Media Sensation The Shepmates Phenomenon

May 28, 2025 -

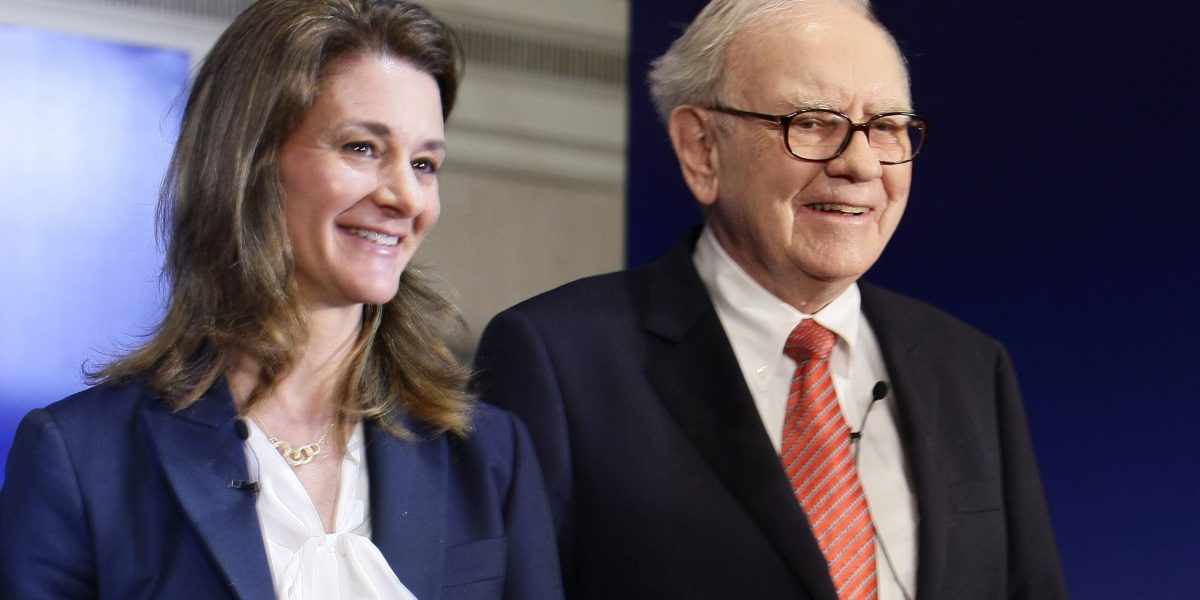

Beyond Gates And Buffett Analyzing The 600 Billion Commitment From Global Billionaires

May 28, 2025

Beyond Gates And Buffett Analyzing The 600 Billion Commitment From Global Billionaires

May 28, 2025