Social Security Payments 2025: Potential 15% Cuts And New Rules Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Payments 2025: Potential 15% Cuts and New Rules Explained

The looming crisis facing Social Security benefits in 2025 has many Americans worried. Potential 15% cuts and proposed rule changes are sparking intense debate and uncertainty about the future of this vital safety net. This article breaks down the situation, explaining the potential impact and what you need to know.

The Social Security Administration (SSA) faces a significant funding shortfall. The Social Security trust fund, which pays out benefits, is projected to be depleted by 2024. This doesn't mean Social Security will immediately cease to exist, but it does mean benefits could be drastically reduced without Congressional intervention. Current projections indicate a potential benefit cut of around 15%, a devastating blow to millions of retirees and disabled Americans who rely on these payments.

What Could Cause a 15% Cut to Social Security Benefits?

The looming crisis stems from a combination of factors:

- Aging Population: The United States is experiencing an aging population, meaning more people are drawing benefits while fewer are contributing through payroll taxes.

- Declining Birth Rates: Lower birth rates further exacerbate the imbalance between contributors and beneficiaries.

- Increased Life Expectancy: People are living longer, requiring Social Security to pay out benefits for an extended period.

These demographic shifts, coupled with economic fluctuations, have created a significant strain on the system. Without legislative action, automatic benefit reductions will likely occur in 2025 to ensure the system can continue paying out benefits, albeit at a significantly reduced rate. This 15% figure is a projection based on current trends and could vary depending on future economic conditions and legislative changes.

Potential New Rules and Reforms

Several proposals are being debated to address the Social Security shortfall. These include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Taxable Wage Base: Expanding the amount of earnings subject to Social Security taxes.

- Adjusting Benefit Formulas: Modifying the calculation of benefits to better reflect current economic realities.

- Cutting Benefits (as described above): This is considered the last resort, as it directly impacts the income of millions of retirees.

These potential reforms are highly controversial, with various groups advocating for different approaches. Understanding these proposals is crucial for everyone concerned about their future Social Security benefits.

What You Can Do Now

While the future of Social Security remains uncertain, there are steps you can take to prepare:

- Stay Informed: Keep up-to-date on the latest developments regarding Social Security reform by following reputable news sources and government websites like the SSA's official website.

- Plan for Retirement: Regardless of the outcome of these discussions, it’s essential to have a comprehensive retirement plan that includes diverse income streams. Consider diversifying your investments and exploring additional retirement savings options.

- Contact Your Representatives: Reach out to your elected officials to express your concerns and opinions on potential Social Security reforms. Your voice matters in this crucial debate.

The situation surrounding Social Security benefits in 2025 is complex and evolving. Understanding the potential cuts and proposed changes empowers you to make informed decisions about your financial future. The coming months will be crucial in shaping the fate of Social Security, and staying engaged is paramount. Regularly checking the SSA website for updates and engaging in constructive dialogue are key to navigating this uncertain landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Payments 2025: Potential 15% Cuts And New Rules Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unraveling The New Orleans Jailbreak The 7 People Accused Of Assisting Escaped Inmates

May 27, 2025

Unraveling The New Orleans Jailbreak The 7 People Accused Of Assisting Escaped Inmates

May 27, 2025 -

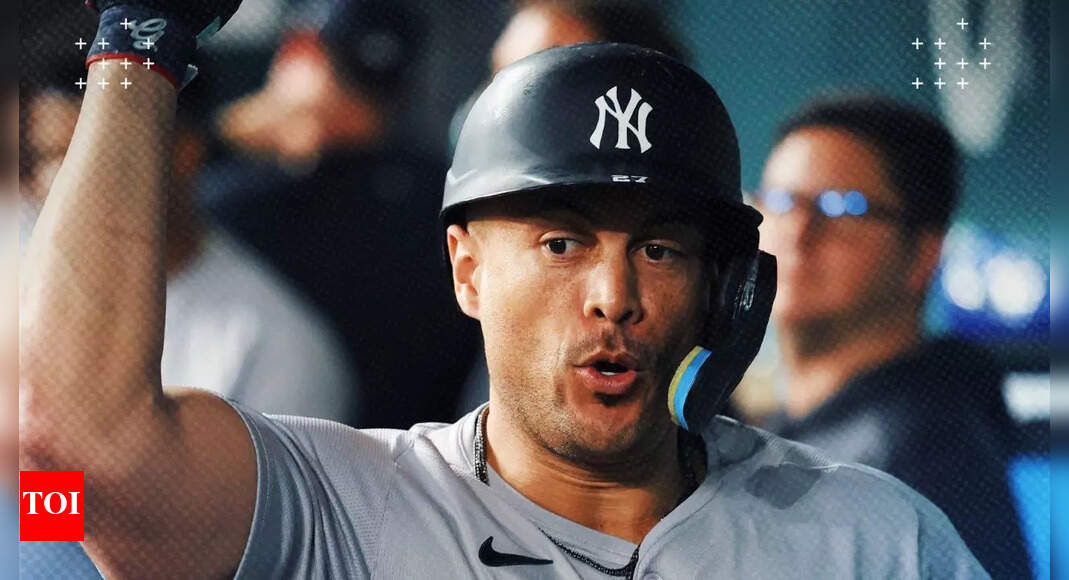

Report Giancarlo Stanton In Talks With Seattle Mariners

May 27, 2025

Report Giancarlo Stanton In Talks With Seattle Mariners

May 27, 2025 -

Twelve Injured In Mexican Hot Air Balloon Incident Cnn Reports

May 27, 2025

Twelve Injured In Mexican Hot Air Balloon Incident Cnn Reports

May 27, 2025 -

Iga Swiatek Roland Garros Obrone Tytulu Rozpoczyna Dzis

May 27, 2025

Iga Swiatek Roland Garros Obrone Tytulu Rozpoczyna Dzis

May 27, 2025 -

Black Lung Cases Rise As Federal Enforcement Staff And Regulations Diminish

May 27, 2025

Black Lung Cases Rise As Federal Enforcement Staff And Regulations Diminish

May 27, 2025

Latest Posts

-

High Profile Jailbreaks Why America Remains Captivated By Manhunts

May 30, 2025

High Profile Jailbreaks Why America Remains Captivated By Manhunts

May 30, 2025 -

Henrique Rocha Estoria De Sucesso Na Estreia Em Roland Garros

May 30, 2025

Henrique Rocha Estoria De Sucesso Na Estreia Em Roland Garros

May 30, 2025 -

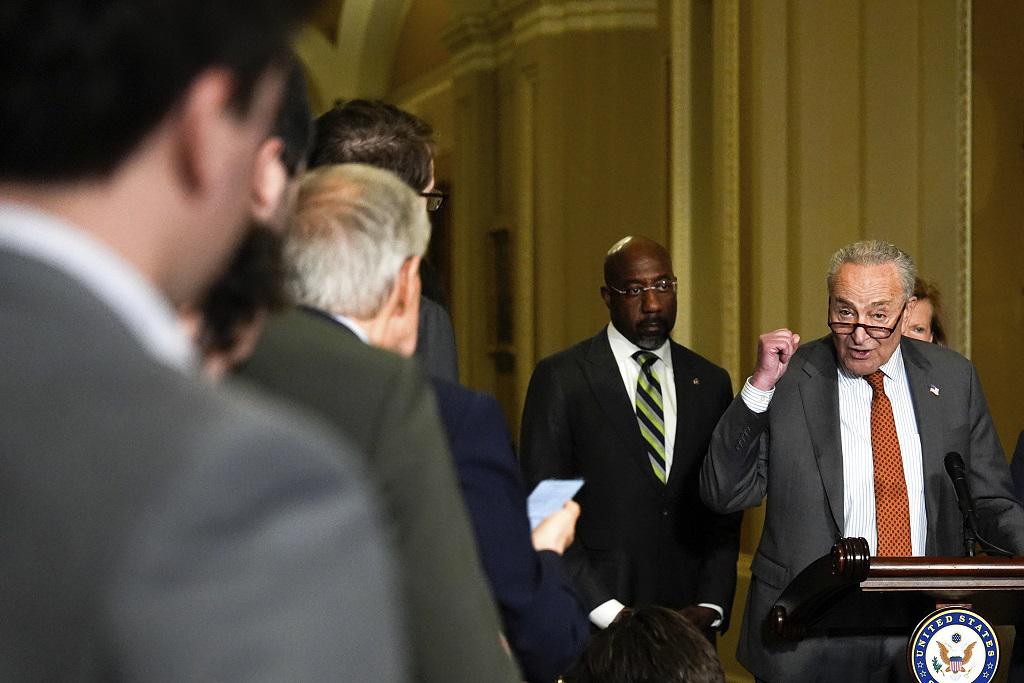

Democrats Gain Leverage Blocking The Big Beautiful Bill

May 30, 2025

Democrats Gain Leverage Blocking The Big Beautiful Bill

May 30, 2025 -

Americas Manhunt Obsession Examining The Latest Jailbreak Cases

May 30, 2025

Americas Manhunt Obsession Examining The Latest Jailbreak Cases

May 30, 2025 -

2025 French Open Second Round Expert Prediction For Munar Vs Fils

May 30, 2025

2025 French Open Second Round Expert Prediction For Munar Vs Fils

May 30, 2025