Social Security's 2034 Deadline: Will Congress Avert Benefit Reductions?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security's 2034 Deadline: Will Congress Avert Benefit Reductions?

The looming deadline of 2034 for Social Security's trust fund is causing significant anxiety among retirees and future beneficiaries. The program faces a projected shortfall, potentially leading to drastic benefit cuts unless Congress acts. But with political gridlock a persistent challenge, the question remains: will lawmakers find a solution before the crisis hits?

This article delves into the intricacies of the Social Security funding crisis, exploring the potential consequences of inaction and examining the various proposals circulating in Washington to address this critical issue.

Understanding the 2034 Cliff:

The Social Security Administration (SSA) projects that by 2034, the trust funds supporting retirement, disability, and survivor benefits will be depleted. This doesn't mean the program will immediately shut down. However, without legislative intervention, benefits could be slashed by approximately 20%. This reduction would significantly impact the financial security of millions of Americans relying on Social Security for their retirement income. The impact would be particularly harsh on lower-income beneficiaries who rely most heavily on these benefits.

Why is Social Security Facing a Funding Crisis?

Several factors contribute to the looming shortfall:

- Aging Population: The US population is aging, meaning a larger percentage of people are drawing benefits while a smaller percentage is contributing through payroll taxes.

- Increased Life Expectancy: People are living longer, drawing benefits for a more extended period.

- Declining Birth Rates: Fewer workers are entering the workforce to support the growing number of retirees.

- Economic Shifts: Changes in the workforce participation rate and wage growth have also affected the program's solvency.

Potential Solutions and Political Hurdles:

Several proposals aim to address the Social Security funding crisis. These include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Payroll Tax: Raising the Social Security tax rate for both employers and employees.

- Increasing the Earnings Base: Expanding the amount of earnings subject to Social Security taxes to include higher earners.

- Benefit Reductions (the dreaded "cut"): While this is a last resort, reducing benefits remains a possibility without legislative action.

- Cutting Benefits for Wealthier Beneficiaries: This proposal targets higher-income beneficiaries, aiming to preserve benefits for those most in need.

The political landscape presents a significant obstacle to enacting any of these solutions. Partisan divides and disagreements on the best approach have hampered progress for years. Finding a bipartisan solution that satisfies both Democrats and Republicans remains a monumental challenge.

What Can You Do?

While the future of Social Security hangs in the balance, there are steps you can take:

- Stay Informed: Keep abreast of the latest developments regarding Social Security reform by following reputable news sources and the SSA website.

- Contact Your Representatives: Urge your elected officials to prioritize finding a solution to the Social Security funding crisis.

- Plan for Retirement: Regardless of the outcome, it's crucial to plan for your retirement, considering potential benefit reductions or delays. Diversify your retirement savings beyond Social Security.

The Road Ahead:

The 2034 deadline is fast approaching. The coming years will be critical in determining the fate of Social Security. Whether Congress can overcome political gridlock and implement a sustainable solution remains to be seen. The consequences of inaction will be felt by millions, highlighting the urgent need for decisive action to secure the future of this vital social safety net. The debate continues, and the future of Social Security benefits hangs precariously in the balance. Stay informed, stay engaged, and advocate for a solution that ensures the long-term viability of this crucial program.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's 2034 Deadline: Will Congress Avert Benefit Reductions?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mc Cutchens Baseball Concerns Validated Data Reveals Significant Changes

Jun 20, 2025

Mc Cutchens Baseball Concerns Validated Data Reveals Significant Changes

Jun 20, 2025 -

Cnn Debate Tucker Carlson Challenges Ted Cruz On Iran Strategy

Jun 20, 2025

Cnn Debate Tucker Carlson Challenges Ted Cruz On Iran Strategy

Jun 20, 2025 -

Royal Family News Princess Of Wales Skips Royal Ascot

Jun 20, 2025

Royal Family News Princess Of Wales Skips Royal Ascot

Jun 20, 2025 -

The Curious Case Of The Changing Mlb Baseball

Jun 20, 2025

The Curious Case Of The Changing Mlb Baseball

Jun 20, 2025 -

Gaza Emergency Israeli Fire Kills 11 Aid Workers Rescuers Report

Jun 20, 2025

Gaza Emergency Israeli Fire Kills 11 Aid Workers Rescuers Report

Jun 20, 2025

Latest Posts

-

Bryan Kohberger Case Witness Claims To Have Seen Him At The Crime Scene

Jun 20, 2025

Bryan Kohberger Case Witness Claims To Have Seen Him At The Crime Scene

Jun 20, 2025 -

Search For Bodies Continues After Devastating Night In Kyiv

Jun 20, 2025

Search For Bodies Continues After Devastating Night In Kyiv

Jun 20, 2025 -

New Evidence In Kohberger Case Witness Testimony Supported By Police Video Footage

Jun 20, 2025

New Evidence In Kohberger Case Witness Testimony Supported By Police Video Footage

Jun 20, 2025 -

Summer Relief South Jersey Utility Companies Offer Bill Reductions

Jun 20, 2025

Summer Relief South Jersey Utility Companies Offer Bill Reductions

Jun 20, 2025 -

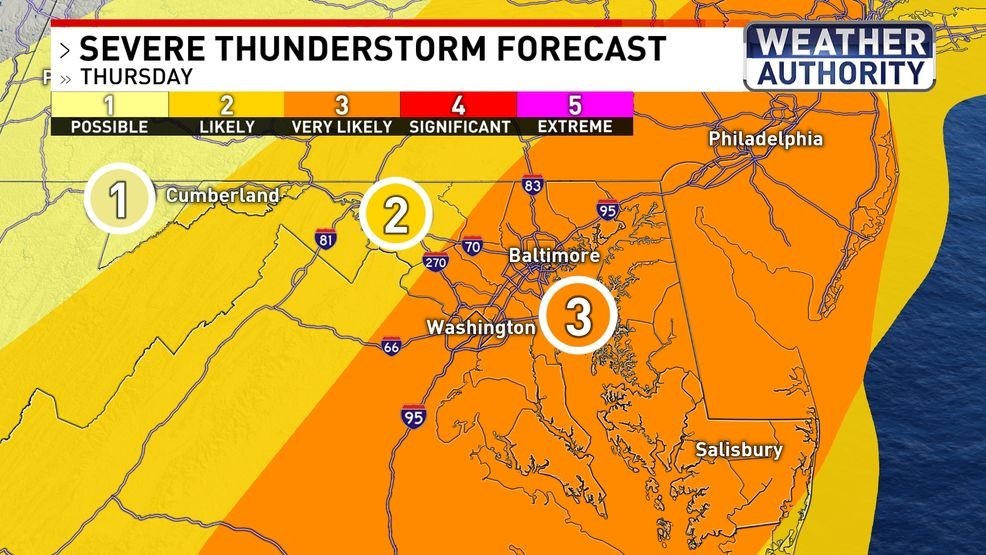

Urgent Weather Alert Strong To Severe Storms Expected Thursday

Jun 20, 2025

Urgent Weather Alert Strong To Severe Storms Expected Thursday

Jun 20, 2025