Social Security's 2034 Funding Gap: A Looming Crisis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security's 2034 Funding Gap: A Looming Crisis

The looming shortfall in Social Security funding is a critical issue facing the United States, with potentially devastating consequences for millions of retirees. By 2034, the Social Security Administration (SSA) projects that its trust funds will be depleted, leading to a significant reduction in benefits unless Congress acts. This isn't just a problem for future generations; current retirees and those nearing retirement will feel the impact. Understanding this crisis and the potential solutions is crucial for every American.

What's Causing the Social Security Funding Gap?

The impending crisis stems from a confluence of factors, primarily driven by demographics:

- Aging Population: The baby boomer generation is entering retirement, leading to a surge in the number of beneficiaries receiving benefits. This increase in payouts strains the system.

- Declining Birth Rates: Lower birth rates mean fewer workers are contributing to the system to support a growing number of retirees. This imbalance creates a significant funding pressure.

- Increased Life Expectancy: People are living longer, which is positive, but it also means they're drawing Social Security benefits for an extended period, further increasing the financial burden.

These demographic shifts, combined with factors like slower wage growth and economic fluctuations, have created a substantial gap between incoming payroll taxes and outgoing benefit payments. The SSA projects that, without reform, benefits could be cut by approximately 20% in 2034.

Potential Solutions: A Balancing Act

Addressing the Social Security funding gap requires a multifaceted approach, and several solutions are currently being debated:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could alleviate some of the pressure on the system.

- Increasing the Social Security Tax Rate: A small increase in the payroll tax rate could significantly bolster the Social Security trust funds. However, this would likely require bipartisan support and careful consideration of its impact on workers.

- Increasing the Social Security Taxable Wage Base: Currently, Social Security taxes only apply to earnings up to a certain level. Expanding this base would bring more high earners into the system, increasing revenue.

- Benefit Reductions (Targeted or Across-the-Board): This is a politically sensitive option, but it remains a potential solution to bridge the funding gap. Targeted reductions focusing on higher earners are often proposed as a more palatable alternative.

- Investing Social Security Funds: Diversifying the Social Security Trust Fund's investments beyond government bonds could potentially generate higher returns, mitigating the shortfall. However, this approach carries inherent risks.

What Can You Do?

While the ultimate solution rests with Congress, individual action is also important:

- Stay Informed: Keep abreast of legislative developments and proposals regarding Social Security reform. Understanding the issues is the first step towards advocating for change.

- Contact Your Representatives: Reach out to your senators and representatives to voice your concerns and opinions on Social Security reform. Let them know how important this issue is to you.

- Plan for Retirement: Regardless of legislative changes, it's crucial to plan for your retirement proactively. Diversify your savings and explore additional retirement income streams beyond Social Security.

Conclusion: A Call to Action

The 2034 Social Security funding gap represents a significant challenge to the nation's social safety net. Ignoring this issue will have profound consequences for current and future generations. It demands immediate attention from policymakers and informed engagement from every citizen. The time to act is now. Learn more about the details of the Social Security shortfall on the official . Your voice matters.

(Note: This article provides general information and should not be considered financial or legal advice. Consult with qualified professionals for personalized guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's 2034 Funding Gap: A Looming Crisis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

South Bay Family Battles Ice Deportation Order For Green Card Holder

Jun 20, 2025

South Bay Family Battles Ice Deportation Order For Green Card Holder

Jun 20, 2025 -

Cameron And David Walsh Victims Of Tragic Grimsby Car Crash

Jun 20, 2025

Cameron And David Walsh Victims Of Tragic Grimsby Car Crash

Jun 20, 2025 -

Morocco Rabies Warning Uk Citizen Dies Following Stray Dog Encounter

Jun 20, 2025

Morocco Rabies Warning Uk Citizen Dies Following Stray Dog Encounter

Jun 20, 2025 -

Mlb 2025 Verlanders Inconsistent Performances Hamper Win Column

Jun 20, 2025

Mlb 2025 Verlanders Inconsistent Performances Hamper Win Column

Jun 20, 2025 -

Wnba Fever New Coach Kelly Replaces White

Jun 20, 2025

Wnba Fever New Coach Kelly Replaces White

Jun 20, 2025

Latest Posts

-

Analysis Verlanders Return And The Struggle For Consistency In 2025

Jun 20, 2025

Analysis Verlanders Return And The Struggle For Consistency In 2025

Jun 20, 2025 -

San Francisco Giants Reinforce Rotation Verlander And Bailey Return

Jun 20, 2025

San Francisco Giants Reinforce Rotation Verlander And Bailey Return

Jun 20, 2025 -

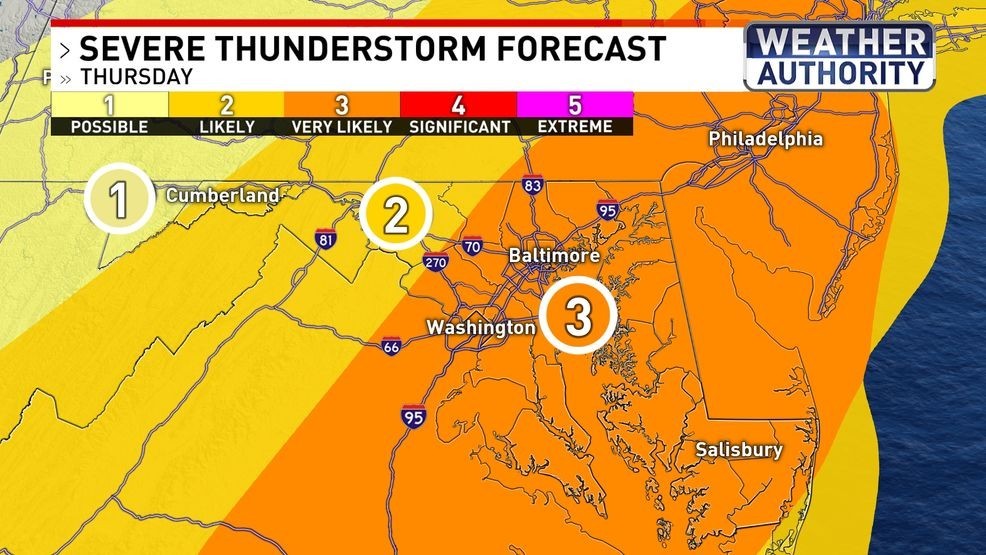

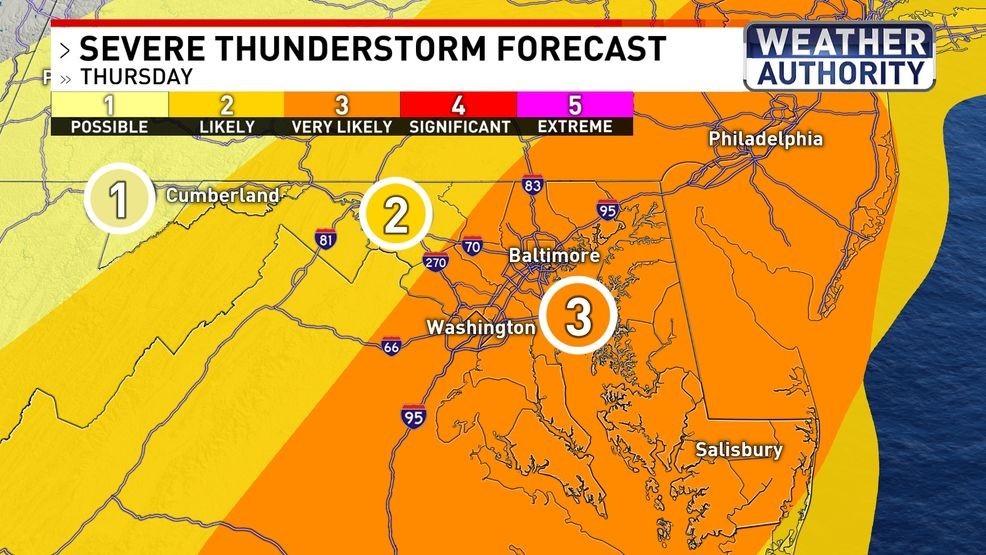

Thursday Afternoon Prepare For Strong To Severe Storms

Jun 20, 2025

Thursday Afternoon Prepare For Strong To Severe Storms

Jun 20, 2025 -

Weather Alert Damaging Storms Expected Thursday

Jun 20, 2025

Weather Alert Damaging Storms Expected Thursday

Jun 20, 2025 -

New Evidence Witness Testimony Links Kohberger To Idaho Murders

Jun 20, 2025

New Evidence Witness Testimony Links Kohberger To Idaho Murders

Jun 20, 2025