Social Security's 2034 Funding Gap: Will Congress Act To Prevent Benefit Reductions?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security's 2034 Funding Gap: Will Congress Act to Prevent Benefit Reductions?

The clock is ticking. Social Security, a cornerstone of American retirement security, faces a looming crisis. By 2034, the Social Security Administration (SSA) projects the trust funds will be depleted, leading to potential benefit reductions unless Congress acts. This isn't a distant hypothetical; it's a pressing issue demanding immediate attention from lawmakers and proactive planning from current and future retirees.

The impending shortfall isn't due to a sudden collapse, but rather a confluence of factors: an aging population, increasing life expectancy, and a declining worker-to-beneficiary ratio. These demographic shifts, coupled with existing program structure, create a significant financial strain on the system. The projected 2034 depletion doesn't mean Social Security will disappear entirely. However, without legislative intervention, benefits could be slashed by as much as 20%, severely impacting millions of retirees and future beneficiaries.

Understanding the Scale of the Problem:

The Social Security Administration regularly publishes detailed reports outlining the financial health of the system. These reports clearly illustrate the projected shortfall and the potential consequences of inaction. Key factors contributing to the funding gap include:

- Increasing Life Expectancy: Americans are living longer, meaning they draw Social Security benefits for an extended period, increasing the overall payout.

- Declining Birth Rate: A lower birth rate translates to fewer workers contributing to the system to support a growing population of retirees.

- Baby Boomer Retirement: The massive Baby Boomer generation is now entering retirement, significantly increasing the number of beneficiaries.

Possible Solutions: A Political Tightrope Walk:

Addressing the funding gap requires a multifaceted approach, and finding a consensus in Congress proves challenging. Several potential solutions are being debated, including:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full Social Security benefits.

- Increasing the Social Security Tax Rate: Slightly raising the payroll tax rate to increase revenue.

- Adjusting the Benefit Formula: Modifying the formula used to calculate benefits to reduce payouts.

- Raising the Taxable Earnings Base: Increasing the maximum amount of earnings subject to Social Security taxes.

- Investing Social Security Funds: Allowing a portion of Social Security funds to be invested in the stock market (a controversial proposition).

Each of these options has its proponents and detractors, with significant political implications. Raising taxes, for instance, could be unpopular with voters, while altering benefit formulas could disproportionately impact lower-income retirees. Finding a solution that addresses the long-term solvency of the system while maintaining its crucial role in providing a safety net is a complex political challenge.

What You Can Do:

While the ultimate solution rests with Congress, individual action is also important. Stay informed about legislative developments concerning Social Security reform. Contact your representatives to voice your concerns and preferences regarding potential solutions. Plan for your retirement strategically, considering diverse income streams beyond Social Security. Exploring resources like the SSA website () can provide valuable insights into your personal benefits and retirement planning.

The Future of Social Security hangs in the balance. The 2034 deadline is fast approaching, emphasizing the urgent need for decisive action by Congress. The future financial security of millions depends on the choices made today. Staying informed and engaging in the political process are crucial steps in ensuring the long-term viability of this vital program.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's 2034 Funding Gap: Will Congress Act To Prevent Benefit Reductions?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Iran Policy At Center Tucker Carlsons Confrontation With Ted Cruz On Cnn

Jun 20, 2025

Iran Policy At Center Tucker Carlsons Confrontation With Ted Cruz On Cnn

Jun 20, 2025 -

Potential End Of Job Corps Program Leaves Thousands Of Young Americans Homeless

Jun 20, 2025

Potential End Of Job Corps Program Leaves Thousands Of Young Americans Homeless

Jun 20, 2025 -

Stephanie Whites Absence Indiana Fever Coach Misses Match For Personal Reasons

Jun 20, 2025

Stephanie Whites Absence Indiana Fever Coach Misses Match For Personal Reasons

Jun 20, 2025 -

Notting Hill Carnival A Fight For Survival Against Mounting Challenges

Jun 20, 2025

Notting Hill Carnival A Fight For Survival Against Mounting Challenges

Jun 20, 2025 -

Idaho Student Murders Police Video Shows Potential Witness Identifying Bryan Kohberger

Jun 20, 2025

Idaho Student Murders Police Video Shows Potential Witness Identifying Bryan Kohberger

Jun 20, 2025

Latest Posts

-

Ice Custody Family Of Colorado Attack Suspect Faces Suffering

Jun 21, 2025

Ice Custody Family Of Colorado Attack Suspect Faces Suffering

Jun 21, 2025 -

Richard Fredianis Extended Leave Following Bullying Allegations At Bbc Breakfast

Jun 21, 2025

Richard Fredianis Extended Leave Following Bullying Allegations At Bbc Breakfast

Jun 21, 2025 -

Ahead Of International Duty Milliet Targets Strong Finish To Current Matches

Jun 21, 2025

Ahead Of International Duty Milliet Targets Strong Finish To Current Matches

Jun 21, 2025 -

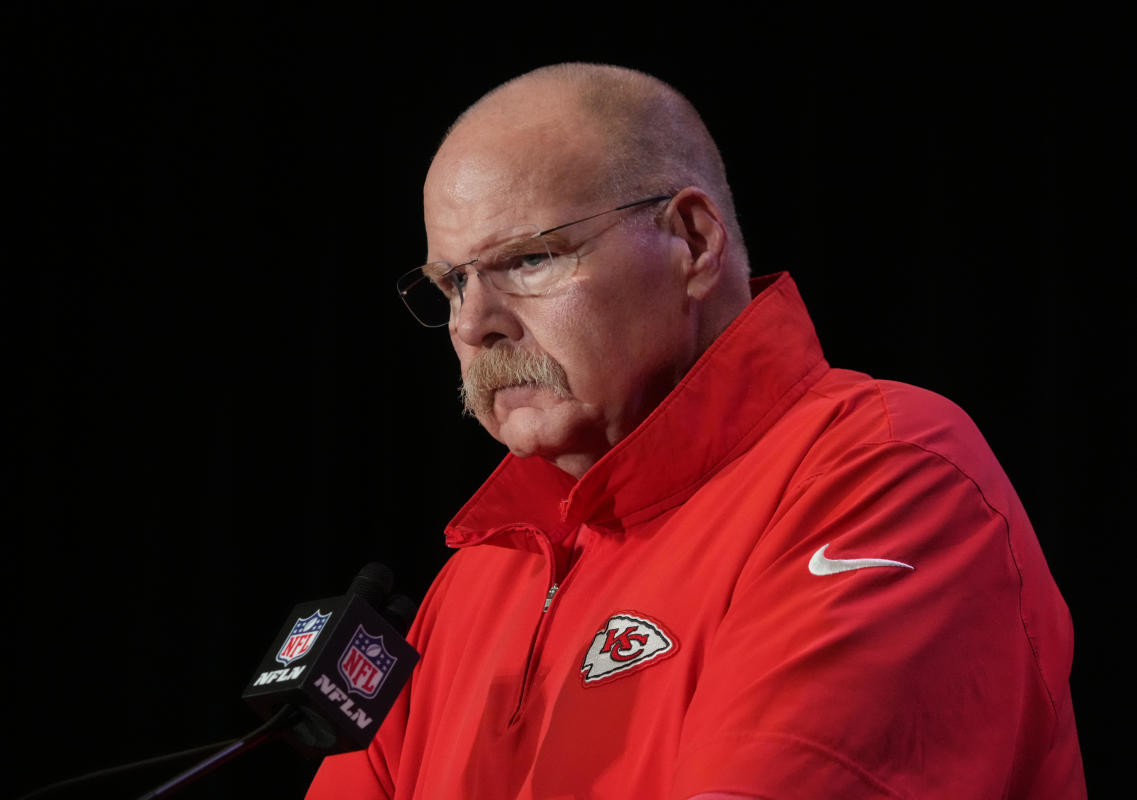

Andy Reids Offseason Strategy Patrick Mahomes Weighs In

Jun 21, 2025

Andy Reids Offseason Strategy Patrick Mahomes Weighs In

Jun 21, 2025 -

Irans Fearful Climate Stadium Showdown And Marijuanas Perils Todays Top News

Jun 21, 2025

Irans Fearful Climate Stadium Showdown And Marijuanas Perils Todays Top News

Jun 21, 2025