Solar And Wind Industries Face Existential Threat From GOP Tax Proposal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Solar and Wind Industries Face Existential Threat from GOP Tax Proposal

The renewable energy sector is bracing for a potential knockout blow. A newly proposed tax plan from the Republican Party threatens to drastically curtail the tax credits that have fueled the growth of the solar and wind industries for years. This move, critics argue, could cripple the sector and severely hinder the nation's progress towards clean energy goals. The implications are far-reaching, impacting not only energy production but also jobs and the overall fight against climate change.

A Deep Dive into the Proposed Tax Changes

The Republican tax proposal, details of which are still emerging, reportedly aims to significantly reduce or eliminate the Investment Tax Credit (ITC) and the Production Tax Credit (PTC), two cornerstone incentives that have underpinned the expansion of solar and wind power in the United States. The ITC provides a tax credit for investing in solar energy projects, while the PTC offers a credit based on the amount of electricity generated by wind turbines. These credits have been crucial in making renewable energy projects financially viable, especially in comparison to fossil fuel alternatives.

The Potential Devastation: Jobs and the Economy

The proposed changes aren't just a threat to environmental progress; they represent a significant economic risk. The solar and wind industries are booming sectors, employing hundreds of thousands of Americans. A sudden reduction or elimination of tax credits would likely lead to:

- Massive job losses: Construction workers, engineers, technicians, and manufacturing employees would be among the hardest hit. The ripple effect would extend throughout the supply chain.

- Project cancellations: Many renewable energy projects are currently in development, relying on the continuation of these tax credits. Cancellation of these projects would represent billions of dollars in lost investment.

- Slowed innovation: The reduced financial viability of renewable energy projects could stifle innovation and hinder the development of more efficient and cost-effective technologies.

- Increased reliance on fossil fuels: Without the competitive edge provided by tax credits, renewable energy sources become less attractive, potentially leading to a resurgence of fossil fuel dependence.

Industry Reaction: Outrage and Calls for Action

The proposed tax changes have been met with fierce opposition from the renewable energy industry and environmental groups. Major solar and wind companies have issued statements expressing deep concern, emphasizing the potential for devastating consequences. Lobbying efforts are already underway to persuade lawmakers to reconsider the proposal. Industry leaders are highlighting the long-term economic benefits of investing in renewable energy, arguing that the proposed tax cuts would ultimately be counterproductive.

The Broader Context: Climate Change and National Security

The debate extends beyond economic concerns. The transition to renewable energy is crucial in addressing climate change and improving national energy security. Reducing reliance on foreign oil and mitigating the effects of climate change are national priorities, and the proposed tax changes directly undermine these objectives.

What Happens Next?

The fate of the proposed tax plan remains uncertain. The coming weeks and months will see intense lobbying and political maneuvering. The renewable energy industry and its allies will be fighting hard to prevent the passage of legislation that could fundamentally reshape the American energy landscape. This is a crucial moment for the future of clean energy in the United States. Stay informed and contact your elected officials to voice your opinion. What are your thoughts on this proposed tax plan? Share your comments below.

(Note: This article is for informational purposes only and does not constitute financial or political advice. Always consult with relevant experts for specific guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Solar And Wind Industries Face Existential Threat From GOP Tax Proposal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Royal Mail Nearly 2 200 Dog Attacks On Postal Workers In Past Year

Jul 02, 2025

Royal Mail Nearly 2 200 Dog Attacks On Postal Workers In Past Year

Jul 02, 2025 -

When And How To Buy Figma Stock Your Guide To The Figma Ipo

Jul 02, 2025

When And How To Buy Figma Stock Your Guide To The Figma Ipo

Jul 02, 2025 -

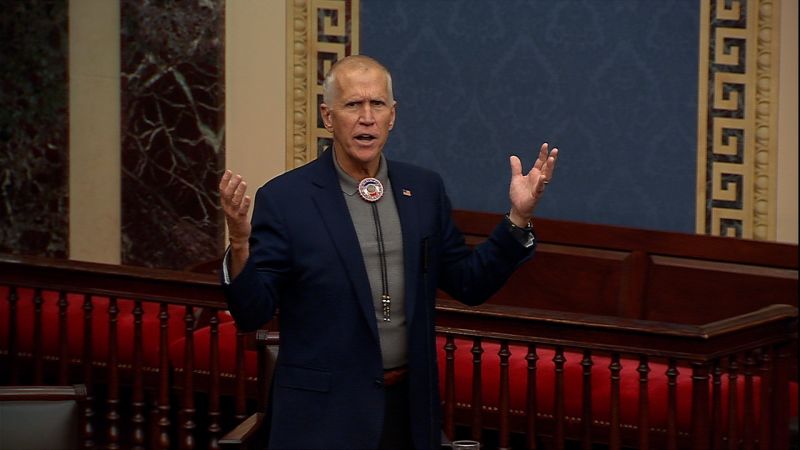

Political Showdown Looms Gop Senator Challenges Trumps Big Beautiful Bill

Jul 02, 2025

Political Showdown Looms Gop Senator Challenges Trumps Big Beautiful Bill

Jul 02, 2025 -

Medicaid Cuts The Crushing Blow To Families In Republican States

Jul 02, 2025

Medicaid Cuts The Crushing Blow To Families In Republican States

Jul 02, 2025 -

Detroit Red Wings Offseason Moves John Leonard Agrees To One Year Contract

Jul 02, 2025

Detroit Red Wings Offseason Moves John Leonard Agrees To One Year Contract

Jul 02, 2025

Latest Posts

-

Game Changing Ai Bot Blocker Now Protects Millions Of Websites

Jul 03, 2025

Game Changing Ai Bot Blocker Now Protects Millions Of Websites

Jul 03, 2025 -

Maha A Gen Z Attempt To Make Healthy Eating Hip

Jul 03, 2025

Maha A Gen Z Attempt To Make Healthy Eating Hip

Jul 03, 2025 -

More Arrests In Lucy Letby Case Focus Remains On Hospital Manslaughter Allegations

Jul 03, 2025

More Arrests In Lucy Letby Case Focus Remains On Hospital Manslaughter Allegations

Jul 03, 2025 -

Saddlebrooke Missing Boys Silver Alert Canceled Safe Return Confirmed

Jul 03, 2025

Saddlebrooke Missing Boys Silver Alert Canceled Safe Return Confirmed

Jul 03, 2025 -

Major Government Concessions Secure Welfare Bill Passage

Jul 03, 2025

Major Government Concessions Secure Welfare Bill Passage

Jul 03, 2025