State Farm, Allstate Under Scrutiny: Senator Hawley Chairs Key Hearing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm, Allstate Under Scrutiny: Senator Hawley Chairs Key Hearing on ESG Investing Impact on Auto Insurance

Introduction: The insurance industry giants, State Farm and Allstate, found themselves under the intense spotlight of a Senate hearing chaired by Senator Josh Hawley on [Date of Hearing]. The hearing focused on the impact of Environmental, Social, and Governance (ESG) investing on auto insurance rates and the availability of coverage in rural and underserved communities. Hawley's investigation alleges that these companies' prioritization of ESG factors over traditional risk assessment is leading to higher premiums and limited access to insurance for many Americans.

Senator Hawley's Concerns: Senator Hawley, a vocal critic of ESG investing, opened the hearing by expressing serious concerns about the potential for these investment strategies to negatively impact consumers. He argued that prioritizing factors like climate change mitigation over traditional risk factors, such as driving records and vehicle safety, distorts the insurance market and unfairly penalizes responsible drivers in certain regions. The Senator highlighted specific instances where, he claims, ESG considerations led to reduced availability of affordable insurance in areas deemed higher-risk due to factors unrelated to individual driver behavior.

The Insurance Companies' Responses: Representatives from State Farm and Allstate appeared before the committee to defend their investment strategies. While acknowledging the importance of ESG considerations in long-term planning, they maintained that these factors do not directly influence their underwriting decisions. They emphasized their commitment to providing affordable and accessible auto insurance to all Americans, arguing that their pricing models are primarily driven by actuarial data and risk assessment. However, they faced tough questioning from Senator Hawley and other committee members regarding the transparency of their investment portfolios and the potential influence of ESG factors on their overall business strategy.

<h3>Key Issues Raised During the Hearing:</h3>

- Transparency of ESG Investments: A central theme of the hearing was the lack of transparency surrounding how insurance companies incorporate ESG factors into their investment decisions. Critics argue that the lack of clear disclosure makes it difficult to assess the true impact of these strategies on insurance pricing and availability.

- Impact on Rural Communities: The hearing highlighted concerns that ESG-driven investment decisions disproportionately affect rural and underserved communities, where access to affordable insurance is already limited. These areas are often considered higher-risk due to factors such as climate change vulnerability, but the argument was made that individuals in these communities are penalized regardless of their individual driving records.

- The Definition of "Risk": A key point of contention was the definition of "risk" itself. While insurance companies emphasized their reliance on traditional risk assessment, the Senator pressed for clarification on how factors beyond individual driver behavior – such as broader societal risks related to climate change – are integrated into their pricing models.

<h3>Potential Consequences and Future Actions:</h3>

The hearing is likely to spur further investigation into the insurance industry's use of ESG investing. Senator Hawley has indicated his intention to pursue further legislative action to increase transparency and ensure that insurance pricing remains fair and equitable for all consumers. This could include stricter regulations regarding the disclosure of ESG investment strategies and their impact on insurance rates. The outcome could significantly impact the insurance industry's approach to ESG investing and its relationship with consumers and regulators.

Conclusion: The Senate hearing served as a crucial platform to examine the complex interplay between ESG investing, auto insurance pricing, and consumer access to coverage. The debate over the appropriate role of ESG factors in the insurance industry is far from over, and the hearing's implications will likely be felt for years to come. This ongoing debate underscores the need for greater transparency and a balanced approach that considers both long-term sustainability and the immediate needs of consumers. Further investigation and potential regulatory changes are expected in the coming months.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm, Allstate Under Scrutiny: Senator Hawley Chairs Key Hearing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Newark Airports Air Traffic Control Problems Inside The Systems Failures

May 17, 2025

Newark Airports Air Traffic Control Problems Inside The Systems Failures

May 17, 2025 -

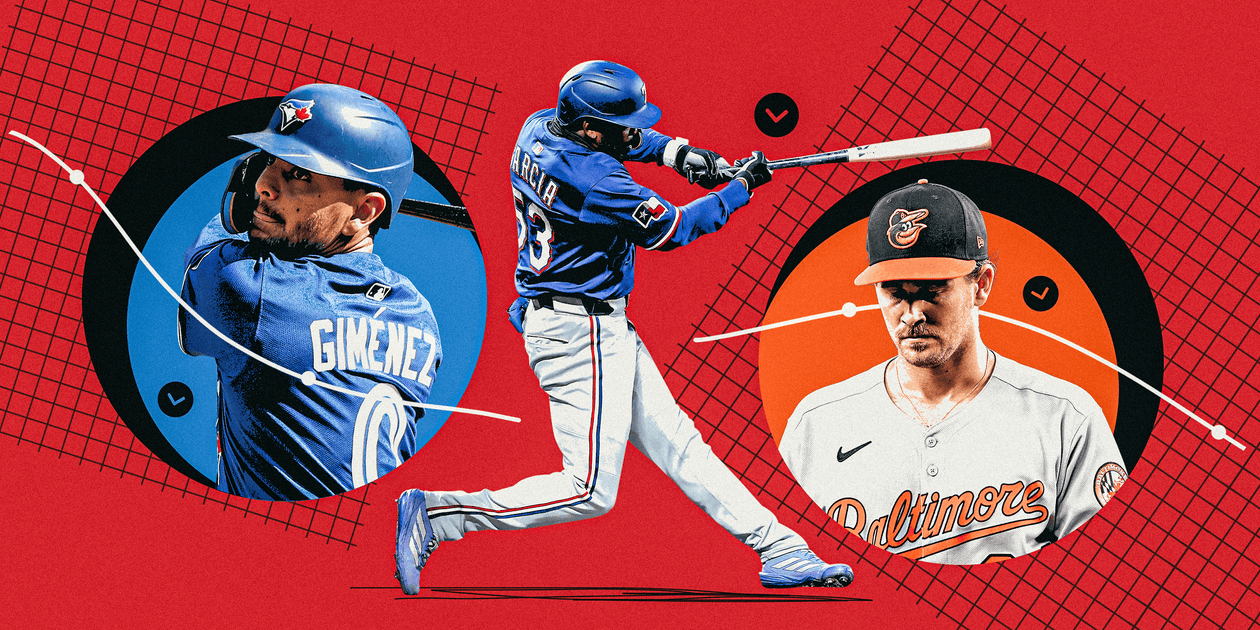

Mlb Red Flags 10 Early Season Numbers To Raise Concerns

May 17, 2025

Mlb Red Flags 10 Early Season Numbers To Raise Concerns

May 17, 2025 -

Financial Regulator Warns Significant Number Of Britons Have No Savings

May 17, 2025

Financial Regulator Warns Significant Number Of Britons Have No Savings

May 17, 2025 -

Early Season Mlb Performance 10 Stats Indicating Potential Problems

May 17, 2025

Early Season Mlb Performance 10 Stats Indicating Potential Problems

May 17, 2025 -

Proposed Farm Inheritance Tax Mps Call For 12 Month Postponement

May 17, 2025

Proposed Farm Inheritance Tax Mps Call For 12 Month Postponement

May 17, 2025