State Farm Insurance Rate Increase: Understanding The California Emergency Approval

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm Insurance Rate Increase: Understanding the California Emergency Approval

State Farm's recent announcement of a significant rate increase for California homeowners has sent shockwaves through the state. The insurance giant received emergency approval from the California Department of Insurance (CDI) to implement these hikes, leaving many homeowners scrambling to understand the implications. This article breaks down the reasons behind the increase, its impact on California residents, and what you can do to navigate this challenging situation.

Why the Emergency Rate Increase?

State Farm, like other major insurance providers, cites escalating costs as the primary driver for the rate hike. These costs stem from several interconnected factors:

-

Increased Wildfire Risk: California's increasingly severe wildfire seasons are a major contributor. The cost of rebuilding homes destroyed by wildfires, along with the increased likelihood of such events, significantly impacts insurance payouts and risk assessments. This is particularly true in high-risk areas, leading to disproportionate increases for some homeowners.

-

Construction Costs: The cost of building materials and labor has skyrocketed in recent years, making rebuilding after a disaster significantly more expensive. This directly impacts the insurance companies' payout obligations.

-

Inflation and Supply Chain Issues: General inflation and ongoing global supply chain disruptions add further pressure on insurance companies' operational costs and claims payouts.

-

Litigation Costs: The frequency and cost of insurance-related litigation in California also plays a role, impacting the overall financial health of insurance providers.

The CDI granted State Farm emergency approval for these rate increases, acknowledging the urgency of the situation and the potential for a further tightening of the insurance market in California. This "emergency" designation bypasses the usual lengthy regulatory process, allowing State Farm to implement the increases more quickly.

What Does This Mean for California Homeowners?

The impact of these rate increases will vary depending on location, coverage, and other factors. However, many homeowners can expect to see a substantial jump in their monthly premiums. This comes at a time when many Californians are already struggling with the rising cost of living. For some, the increased premiums may be unaffordable, leading to potential policy cancellations and leaving them uninsured.

What Can You Do?

Facing a significant rate increase can be stressful. Here's what you can consider:

-

Shop Around: Don't assume State Farm offers the best rate. Compare quotes from multiple insurers to find more affordable options. Use online comparison tools to streamline the process.

-

Review Your Coverage: Carefully examine your current policy. Could you reduce your coverage while still maintaining adequate protection? Reducing coverage can sometimes lower premiums, but be sure to understand the implications.

-

Improve Your Home's Safety: Making your home more resistant to wildfires can potentially lower your insurance premiums. This might involve clearing brush around your property, installing fire-resistant roofing, or upgrading your home's overall fire safety features. Check with your insurer for specific recommendations.

-

Contact Your Insurance Agent: Discuss your options with your State Farm agent. They might be able to offer advice or explore alternative solutions.

-

Consider State Programs: Explore state-sponsored programs that may offer assistance with insurance costs or disaster preparedness.

Looking Ahead:

The State Farm rate increase highlights the complex challenges facing California's insurance market. The increasing frequency and severity of wildfires, coupled with rising costs, create a challenging environment for both insurers and homeowners. The situation underscores the need for comprehensive strategies to address wildfire risk and improve the affordability of home insurance in California. Stay informed about updates from the CDI and your insurance provider to navigate this evolving situation effectively. This is a developing story, so continue to check back for updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm Insurance Rate Increase: Understanding The California Emergency Approval. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Farm Inheritance Tax Changes Mps Seek One Year Extension

May 17, 2025

Farm Inheritance Tax Changes Mps Seek One Year Extension

May 17, 2025 -

Dodgers Recall Justin Wrobleski As Starting Rotation Remains Uncertain

May 17, 2025

Dodgers Recall Justin Wrobleski As Starting Rotation Remains Uncertain

May 17, 2025 -

Venezuelan Communitys Distress Video Of Detainees In El Salvador Fuels Concerns After Matt Gaetzs Allegations

May 17, 2025

Venezuelan Communitys Distress Video Of Detainees In El Salvador Fuels Concerns After Matt Gaetzs Allegations

May 17, 2025 -

Flying High To The Games La 2028 Explores Air Taxi Option For Spectators

May 17, 2025

Flying High To The Games La 2028 Explores Air Taxi Option For Spectators

May 17, 2025 -

Staffing Shortages And Tech Glitches Plague Newark Airport A Controllers Account

May 17, 2025

Staffing Shortages And Tech Glitches Plague Newark Airport A Controllers Account

May 17, 2025

Latest Posts

-

Three Shutouts In A Row Twins 13 Game Winning Streak Dominates The League

May 18, 2025

Three Shutouts In A Row Twins 13 Game Winning Streak Dominates The League

May 18, 2025 -

Urgent Manhunt 11 Inmates Including Murder Suspects Loose After New Orleans Jail Escape

May 18, 2025

Urgent Manhunt 11 Inmates Including Murder Suspects Loose After New Orleans Jail Escape

May 18, 2025 -

Eurovision 2025 Getting To Know The Leading Five Artists

May 18, 2025

Eurovision 2025 Getting To Know The Leading Five Artists

May 18, 2025 -

Get To Know The Stars A Look At The Cast Of Netflixs Kakegurui

May 18, 2025

Get To Know The Stars A Look At The Cast Of Netflixs Kakegurui

May 18, 2025 -

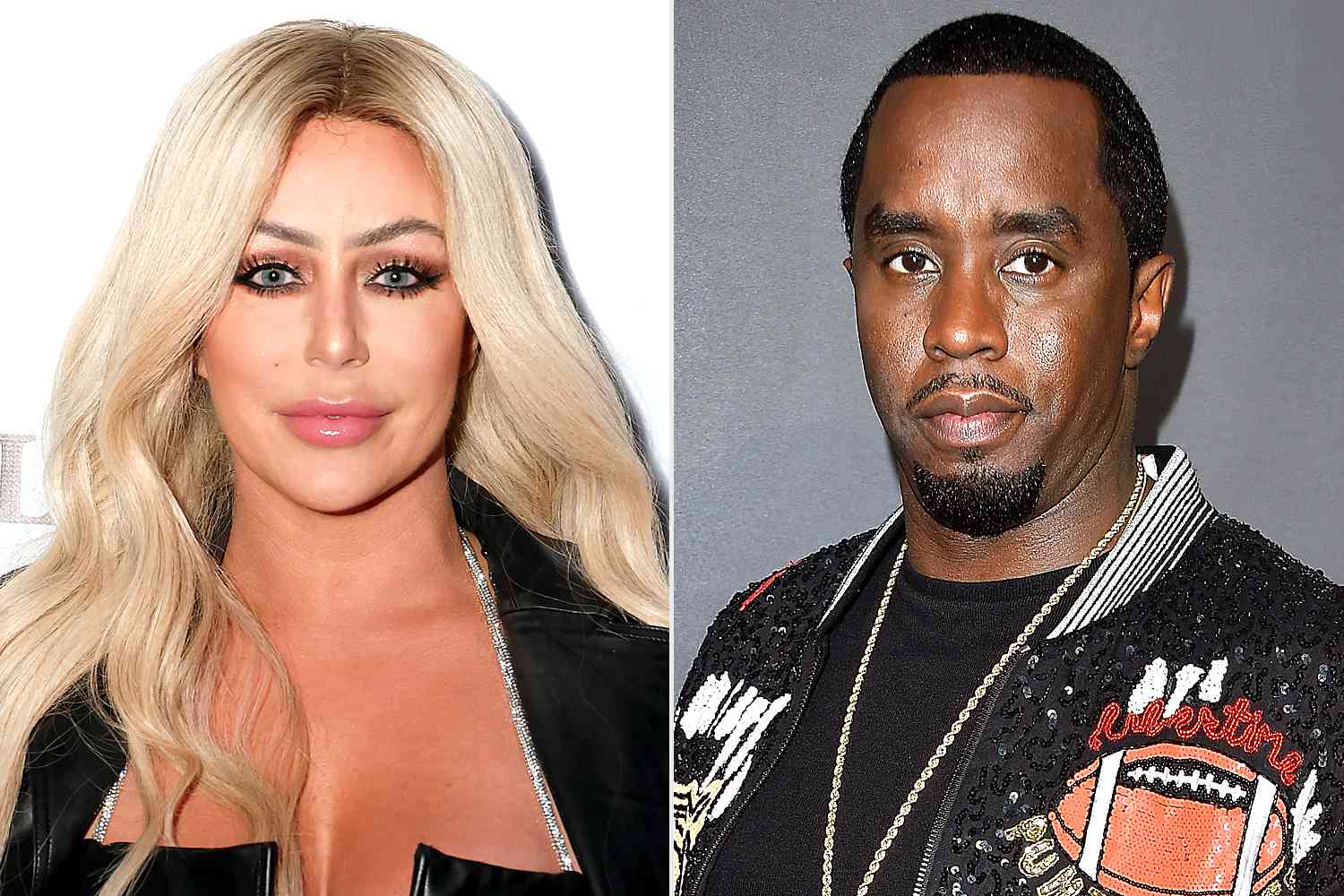

Exclusive Aubrey O Day Will Not Appear As Witness In Diddys Trial

May 18, 2025

Exclusive Aubrey O Day Will Not Appear As Witness In Diddys Trial

May 18, 2025