State Farm Wins Approval For Significant California Insurance Rate Hike

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm Wins Approval for Significant California Insurance Rate Hike: What it Means for Homeowners

California homeowners are bracing for a significant increase in their insurance premiums following State Farm's successful application for a substantial rate hike. The approval, granted by the California Department of Insurance (CDI), will impact hundreds of thousands of policyholders across the state, sparking concerns about affordability and accessibility to home insurance.

A Substantial Increase: The Numbers Behind the Hike

State Farm, one of California's largest home insurers, has secured approval for an average rate increase of [Insert Percentage]%. While the exact percentage may vary depending on location and specific policy details, this represents a substantial jump in costs for many homeowners. The CDI justified the increase citing rising construction costs, increased reinsurance premiums, and a higher frequency and severity of catastrophic events like wildfires. This decision follows similar rate hike approvals for other major insurers in the state, highlighting a broader trend in the California insurance market.

Why the Increase? Understanding the Factors at Play

Several factors contributed to the CDI's decision to approve State Farm's rate increase request.

- Rising Construction Costs: The cost of building materials and labor has skyrocketed in recent years, making it significantly more expensive to rebuild homes after damage from fire, earthquake, or other disasters. This directly impacts insurance payouts and necessitates higher premiums.

- Increased Reinsurance Premiums: Reinsurance helps insurance companies manage their risk. As the frequency and severity of catastrophic events increase, the cost of reinsurance also rises, leading to higher premiums for homeowners.

- Wildfires and Natural Disasters: California's susceptibility to wildfires and other natural disasters is a major factor driving up insurance costs. The increased frequency and intensity of these events lead to higher claims payouts, forcing insurers to raise premiums to maintain financial stability.

Impact on Homeowners: Affordability and Accessibility Concerns

This significant rate increase raises serious concerns about affordability and accessibility of home insurance in California. Many homeowners, particularly those on fixed incomes, may struggle to afford the increased premiums. This could lead to an increase in the number of uninsured homes, leaving them vulnerable in the event of a disaster. The CDI acknowledged these concerns but emphasized the need for insurers to maintain financial solvency to continue providing coverage.

What Homeowners Can Do:

Facing a substantial increase in premiums, homeowners can take several steps:

- Shop Around: Compare quotes from multiple insurance providers to find the most competitive rates. Consider working with an independent insurance agent who can help you navigate the options.

- Review Your Coverage: Ensure you have adequate coverage without overspending. Consider increasing your deductible to lower your premium, but weigh this against the potential out-of-pocket costs in case of a claim.

- Mitigate Risk: Take steps to reduce the risk of damage to your home. This might include clearing brush around your property to reduce wildfire risk, installing fire-resistant roofing, or strengthening your home's structure against earthquakes.

Looking Ahead: The Future of California Home Insurance

The State Farm rate hike is a clear indication of the challenges facing the California home insurance market. Experts predict continued pressure on premiums as climate change exacerbates the risk of natural disasters and construction costs remain high. The ongoing debate about affordability and accessibility will likely dominate future discussions regarding home insurance regulation in the state. Further action from both insurers and regulators is necessary to ensure homeowners have access to affordable and adequate coverage. Stay informed by following updates from the California Department of Insurance and your individual insurance provider.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm Wins Approval For Significant California Insurance Rate Hike. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Key Moments From Day Number Of The Sean Combs Trial Ventura And Richard Testimony

May 18, 2025

Key Moments From Day Number Of The Sean Combs Trial Ventura And Richard Testimony

May 18, 2025 -

Business Park Blaze Claims Lives Of Several Firefighters Names Released

May 18, 2025

Business Park Blaze Claims Lives Of Several Firefighters Names Released

May 18, 2025 -

50 Cent Slams Jay Zs Friendship With Diddy A Bitter Public Feud

May 18, 2025

50 Cent Slams Jay Zs Friendship With Diddy A Bitter Public Feud

May 18, 2025 -

Istanbul Da Stres Seviyesi Alarm Verici Duezeyde Ibb Den Kritik Uyari

May 18, 2025

Istanbul Da Stres Seviyesi Alarm Verici Duezeyde Ibb Den Kritik Uyari

May 18, 2025 -

Death Toll Rises To Nine After Russian Strike On Ukrainian Passenger Bus

May 18, 2025

Death Toll Rises To Nine After Russian Strike On Ukrainian Passenger Bus

May 18, 2025

Latest Posts

-

Impact Of Weakening Ocean Currents On Us Coastal Sea Levels

May 18, 2025

Impact Of Weakening Ocean Currents On Us Coastal Sea Levels

May 18, 2025 -

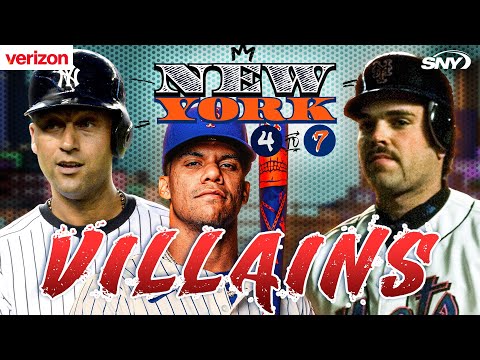

The Most Hated Mets And Yankees Players In Subway Series History

May 18, 2025

The Most Hated Mets And Yankees Players In Subway Series History

May 18, 2025 -

Unbeaten Streak Twins 13 Game Run Continues With Shutout Victory

May 18, 2025

Unbeaten Streak Twins 13 Game Run Continues With Shutout Victory

May 18, 2025 -

Trump And Springsteen Clash The Treason Controversy Explained

May 18, 2025

Trump And Springsteen Clash The Treason Controversy Explained

May 18, 2025 -

Diddy Jay Z And 50 Cent The Latest Chapter In A Long Running Rivalry

May 18, 2025

Diddy Jay Z And 50 Cent The Latest Chapter In A Long Running Rivalry

May 18, 2025