State Farm's California Rate Hike Approved: Understanding The Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's California Rate Hike Approved: Understanding the Implications

State Farm's proposed rate increases for California homeowners insurance have been approved, sparking concerns and prompting questions among policyholders. This significant development will impact millions of Californians and underscores the ongoing challenges facing the state's insurance market. Understanding the reasons behind this hike and its potential implications is crucial for homeowners across the Golden State.

Why the Increase?

State Farm, one of California's largest homeowners insurance providers, cites escalating costs as the primary reason for the rate increase. These costs stem from several factors:

- Increased Wildfire Risk: California's wildfire risk continues to grow, driven by climate change and expanding urban development in high-risk areas. The devastating wildfires of recent years have resulted in billions of dollars in damage, significantly impacting insurers' bottom lines. This increased risk directly translates into higher premiums.

- Construction Costs: The cost of rebuilding homes after a disaster has skyrocketed. The rising prices of lumber, labor, and other construction materials mean that insurers face significantly higher payouts for claims.

- Liability Claims: The cost of liability claims, including those related to property damage and injuries, has also risen substantially.

- Inflation: General inflation across the economy further contributes to increased operational costs for insurance providers.

How Much Will Premiums Increase?

The exact percentage increase varies depending on location and specific policy details. While State Farm has publicly announced the approval of their rate hike, the precise figures for individual policyholders are likely to be communicated directly through policy renewal notices. It's crucial to carefully review these notices and contact State Farm directly with any questions or concerns.

What Does This Mean for California Homeowners?

The rate hike presents significant challenges for many Californians. For some, the increased premiums may represent a substantial increase in household expenses. This could force homeowners to explore options like:

- Shopping Around: Comparing quotes from other insurance providers is crucial to ensure you're getting the best possible rate. Several online comparison tools can simplify this process.

- Increasing Deductibles: Raising your deductible can lower your premiums, but it also means you'll pay more out-of-pocket if you file a claim. Weigh the pros and cons carefully.

- Exploring Mitigation Measures: Implementing wildfire mitigation measures on your property, such as clearing brush and installing fire-resistant roofing, can potentially reduce your premiums. Check with your insurer about available discounts.

The Broader Context of California's Insurance Market

This rate increase highlights the broader challenges facing California's homeowners insurance market. The increasing frequency and severity of wildfires, coupled with rising construction costs and inflation, are creating an environment where insurance becomes increasingly expensive and, in some cases, unavailable. This situation underscores the need for comprehensive strategies to address wildfire risk mitigation and ensure the long-term stability of the state's insurance industry. The California Department of Insurance continues to monitor the situation and is working to ensure fair and accessible insurance for all Californians.

Looking Ahead:

Homeowners should proactively review their insurance policies, compare rates from different providers, and explore options to mitigate their risk. Staying informed about developments in the California insurance market is essential for protecting your property and your financial well-being. Contacting your insurance provider directly to understand the specifics of your rate increase is highly recommended. Further, exploring resources like the California Department of Insurance website can provide valuable information and guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm's California Rate Hike Approved: Understanding The Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rome Trip Under Scrutiny State Regulators And Industry Funding

May 18, 2025

Rome Trip Under Scrutiny State Regulators And Industry Funding

May 18, 2025 -

Friendship Box Office Triumph Detroit Premiere And Specialty Film Showcase

May 18, 2025

Friendship Box Office Triumph Detroit Premiere And Specialty Film Showcase

May 18, 2025 -

Los Angeles Angels Season Crumbles Injuries And Jansens Poor Performance Fuel Basement Dwellers

May 18, 2025

Los Angeles Angels Season Crumbles Injuries And Jansens Poor Performance Fuel Basement Dwellers

May 18, 2025 -

Trumps Peace Plan A Week Of Intense Negotiations And Hidden Agendas

May 18, 2025

Trumps Peace Plan A Week Of Intense Negotiations And Hidden Agendas

May 18, 2025 -

Dodgers Make Roster Changes Pepiot Called Up Bruihl Optioned

May 18, 2025

Dodgers Make Roster Changes Pepiot Called Up Bruihl Optioned

May 18, 2025

Latest Posts

-

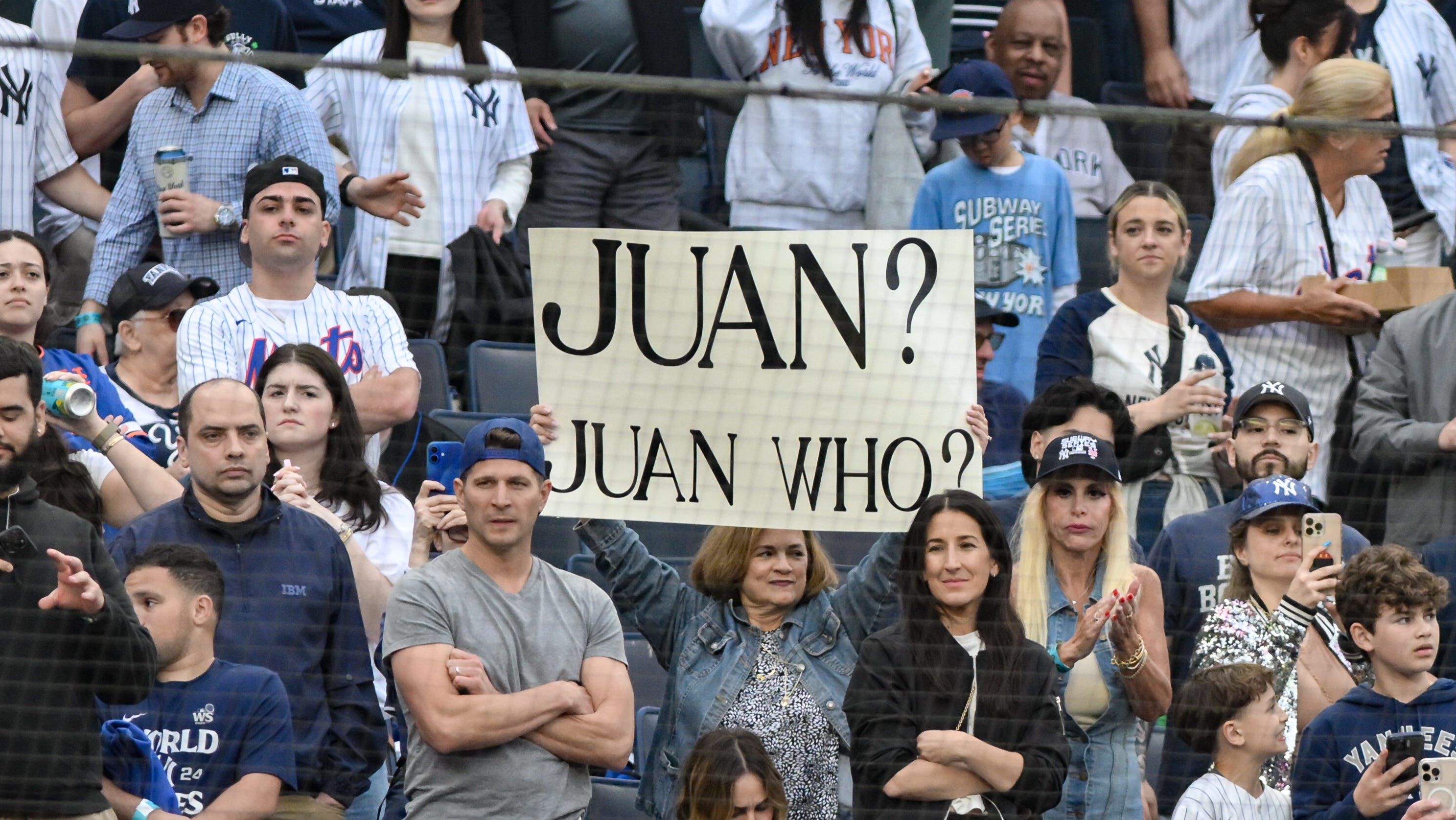

Unforgettable Moments Best Photos From The 2025 Yankees Mets Subway Series

May 18, 2025

Unforgettable Moments Best Photos From The 2025 Yankees Mets Subway Series

May 18, 2025 -

Joe Ryans Dominance Fuels Twins 12 Game Winning Streak

May 18, 2025

Joe Ryans Dominance Fuels Twins 12 Game Winning Streak

May 18, 2025 -

Netflixs Manga Series Bet Fails To Deliver A Thorough Tv Review

May 18, 2025

Netflixs Manga Series Bet Fails To Deliver A Thorough Tv Review

May 18, 2025 -

Jon Chus New Film Potential Cast And Project Details

May 18, 2025

Jon Chus New Film Potential Cast And Project Details

May 18, 2025 -

Diddy Trial How Forensic Psychology Could Influence The Verdict

May 18, 2025

Diddy Trial How Forensic Psychology Could Influence The Verdict

May 18, 2025