State Farm's Double-Digit Insurance Rate Hike Approved In California

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's Double-Digit Insurance Rate Hike Approved in California: What This Means for Policyholders

California homeowners are facing a significant increase in insurance premiums after State Farm, the state's largest insurer, received approval for a double-digit rate hike. This move, impacting hundreds of thousands of Californians, has ignited a firestorm of debate regarding the affordability and accessibility of home insurance in the Golden State. The approval, announced [Date of announcement] by the California Department of Insurance (CDI), allows State Farm to increase rates by an average of [Percentage]% across the state.

This substantial increase isn't isolated; other major insurers have also sought and, in some cases, received approval for significant premium hikes. The rising cost of home insurance in California is attributed to several converging factors, creating a perfect storm for consumers.

Why the Dramatic Increase? A Complex Equation

Several interconnected factors contribute to State Farm's and other insurers' need to increase premiums. These include:

-

Increased Wildfire Risk: California's wildfire season has become increasingly intense and unpredictable in recent years. The cost of rebuilding homes destroyed by wildfires, coupled with the increased risk of future losses, significantly impacts insurance pricing. This is particularly true in high-risk areas like those near forests and brush. Learn more about wildfire mitigation strategies at [link to a reputable source on wildfire prevention].

-

Construction Costs: The cost of building materials and labor has skyrocketed, making it significantly more expensive to repair or rebuild homes after damage. This directly impacts the insurers' payout obligations and, consequently, premiums.

-

Climate Change Impacts: The effects of climate change are undeniable, leading to more frequent and severe weather events. From wildfires to extreme heat and flooding, the increased frequency and severity of these events contribute to higher insurance costs. The [link to a reputable source on climate change and insurance] provides more information on this escalating issue.

-

Increased Litigation: California's legal landscape contributes to higher insurance costs. The frequency and cost of lawsuits related to property damage influence insurers' risk assessment and pricing models.

What Can California Homeowners Do?

Facing a double-digit rate increase is undeniably concerning. However, homeowners can take proactive steps to manage their insurance costs:

-

Shop Around: Don't automatically renew your policy. Compare quotes from multiple insurers to find the best rates. Use online comparison tools to simplify the process.

-

Improve Your Home's Safety: Implementing fire-resistant landscaping, installing fire-resistant roofing materials, and maintaining adequate home maintenance can lower your risk profile and potentially influence your premium.

-

Increase Your Deductible: Increasing your deductible can lower your premium, but be sure you can comfortably afford the higher out-of-pocket expense in case of a claim.

-

Bundle Policies: Bundling your home and auto insurance with the same provider can often result in discounts.

The Bigger Picture: Affordability and Access

State Farm's rate hike highlights a broader issue affecting California residents: the increasing unaffordability and accessibility of home insurance. This issue requires a multifaceted approach involving insurers, lawmakers, and homeowners to find sustainable solutions. The CDI is actively working on addressing these challenges, but significant changes are needed to ensure that home insurance remains accessible for all Californians. We will continue to monitor this situation and provide updates as they become available.

Call to Action: Stay informed about insurance changes by subscribing to our newsletter [link to newsletter signup] and following us on social media [links to social media]. Understanding your options is crucial in navigating these challenging times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm's Double-Digit Insurance Rate Hike Approved In California. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amidst Chaos And Confusion Analysis Of The First Russia Ukraine Direct Talks In 3 Years

May 18, 2025

Amidst Chaos And Confusion Analysis Of The First Russia Ukraine Direct Talks In 3 Years

May 18, 2025 -

Ohtanis Bobblehead Night Success A Rout Fueled By Two Home Runs

May 18, 2025

Ohtanis Bobblehead Night Success A Rout Fueled By Two Home Runs

May 18, 2025 -

Fastest Growth Economic News Overshadowed By Starmers Albania Diplomatic Fallout

May 18, 2025

Fastest Growth Economic News Overshadowed By Starmers Albania Diplomatic Fallout

May 18, 2025 -

Eurovision 2025 Top 5 Favorite Acts Profiled

May 18, 2025

Eurovision 2025 Top 5 Favorite Acts Profiled

May 18, 2025 -

A Delicious Trip Through Italy With Stanley Tucci On Nat Geo

May 18, 2025

A Delicious Trip Through Italy With Stanley Tucci On Nat Geo

May 18, 2025

Latest Posts

-

Cassie Venturas Testimony Ends Dawn Richards Begins In Diddy Trial

May 18, 2025

Cassie Venturas Testimony Ends Dawn Richards Begins In Diddy Trial

May 18, 2025 -

Secret Service Interviews James Comey Over Trump Seashell Post

May 18, 2025

Secret Service Interviews James Comey Over Trump Seashell Post

May 18, 2025 -

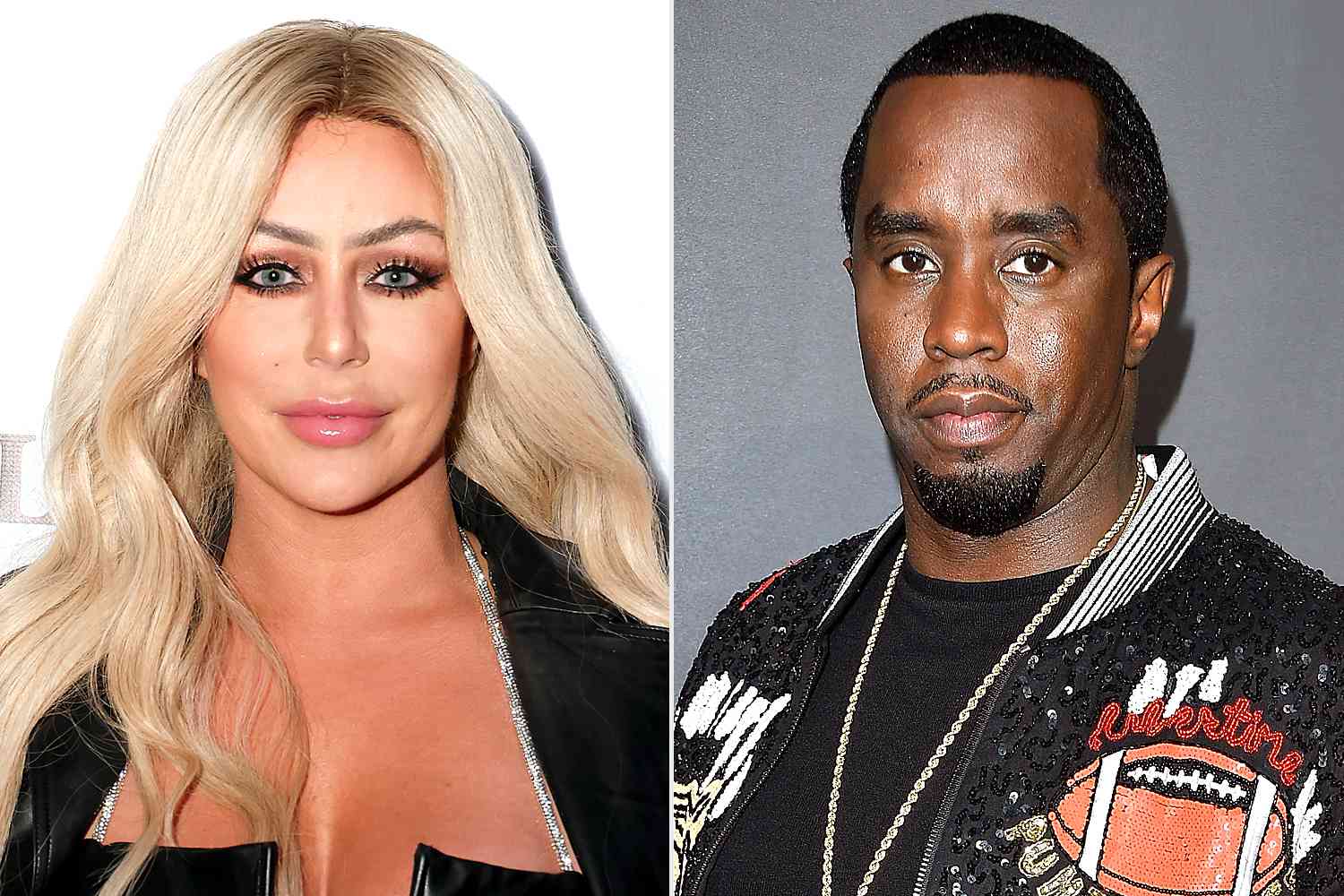

Diddys Legal Battle Why Aubrey O Day Wont Testify

May 18, 2025

Diddys Legal Battle Why Aubrey O Day Wont Testify

May 18, 2025 -

Slowing Ocean Currents Accelerating Us Sea Level Rise

May 18, 2025

Slowing Ocean Currents Accelerating Us Sea Level Rise

May 18, 2025 -

Crucial Ocean Current System Slowdown Implications For Us Coastlines

May 18, 2025

Crucial Ocean Current System Slowdown Implications For Us Coastlines

May 18, 2025