State Farm's Emergency Rate Hike Approved In California: Understanding The Changes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's Emergency Rate Hike Approved in California: Understanding the Changes

California homeowners are facing a significant shift in their insurance landscape. State Farm, one of the state's largest insurers, recently received approval for an emergency rate hike, impacting thousands of policyholders. This move, while controversial, highlights the increasing challenges faced by the insurance industry in California, particularly concerning wildfire risk and escalating claims costs. Understanding the implications of this rate increase is crucial for homeowners across the state.

What Does the Rate Hike Mean for California Homeowners?

The approved emergency rate hike allows State Farm to increase premiums by an average of 6.9% across the state. However, the actual percentage increase will vary depending on factors such as location, property type, and specific coverage levels. Homeowners in high-risk wildfire zones are likely to see even steeper increases. This means many Californians will experience a noticeable jump in their monthly insurance payments.

The California Department of Insurance (CDI) approved this increase citing escalating costs associated with claims, particularly those related to wildfires and other natural disasters. The CDI argued that the rate increase was necessary for State Farm to maintain its financial stability and continue offering coverage in the state.

Why the Emergency Rate Hike? A Look at the Underlying Issues

Several factors contribute to the need for this emergency rate hike:

- Increased Wildfire Risk: California's wildfire season has become increasingly intense and prolonged, resulting in billions of dollars in damage and a surge in insurance claims. The rising frequency and severity of these events put immense pressure on insurers' financial reserves.

- Rising Construction Costs: Repairing and rebuilding homes after wildfires and other disasters is significantly more expensive than in the past. This increased cost of materials and labor directly translates to higher insurance payouts.

- Climate Change: Experts widely attribute the increased frequency and severity of wildfires to climate change, creating a long-term challenge for the insurance industry.

What Can Homeowners Do?

Facing higher premiums can be daunting, but several actions can help mitigate the impact:

- Shop Around: Compare quotes from different insurance providers to find the best rates for your needs. Consider exploring policies offered by smaller, regional insurers alongside larger national companies.

- Review Your Coverage: Evaluate your current coverage levels to ensure you're not overpaying for unnecessary protection. Consider adjusting your deductible to potentially lower your premium.

- Implement Home Safety Measures: Taking proactive steps to reduce your wildfire risk, such as clearing brush around your property and installing fire-resistant materials, can help lower your premiums in the long run. Many insurers offer discounts for homeowners who undertake these measures.

- Contact Your Insurance Agent: Reach out to your State Farm agent to discuss your policy and explore options to manage the impact of the rate increase.

The Bigger Picture: The Future of Home Insurance in California

State Farm's emergency rate hike underscores a broader issue affecting the California insurance market. The increasing costs of natural disasters and climate change pose significant challenges for insurers, potentially leading to further premium increases and reduced availability of coverage in high-risk areas. This situation necessitates a multi-faceted approach involving government regulations, industry innovation, and individual homeowner responsibility. It's a critical issue demanding attention from policymakers, insurers, and California residents alike.

Further Resources:

This situation is constantly evolving, so it's important to stay informed and take proactive steps to protect yourself and your property. Regularly review your insurance coverage and stay updated on any changes in the California insurance market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm's Emergency Rate Hike Approved In California: Understanding The Changes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Vulnerable Benefit Claimants Need Better Protection Mps Demand System Overhaul

May 17, 2025

Vulnerable Benefit Claimants Need Better Protection Mps Demand System Overhaul

May 17, 2025 -

Rediscovering Cannes A Look At Pre Digital Photographys Fun Side

May 17, 2025

Rediscovering Cannes A Look At Pre Digital Photographys Fun Side

May 17, 2025 -

Ohtanis Two Homer Game Highlights Dodgers Victory Over Athletics

May 17, 2025

Ohtanis Two Homer Game Highlights Dodgers Victory Over Athletics

May 17, 2025 -

Angels Season In Freefall Jansens Struggles And Injuries Sink Halos To Al West Cellar

May 17, 2025

Angels Season In Freefall Jansens Struggles And Injuries Sink Halos To Al West Cellar

May 17, 2025 -

Uk Parliament To Debate Assisted Dying Analysis Of The Amended Bill

May 17, 2025

Uk Parliament To Debate Assisted Dying Analysis Of The Amended Bill

May 17, 2025

Latest Posts

-

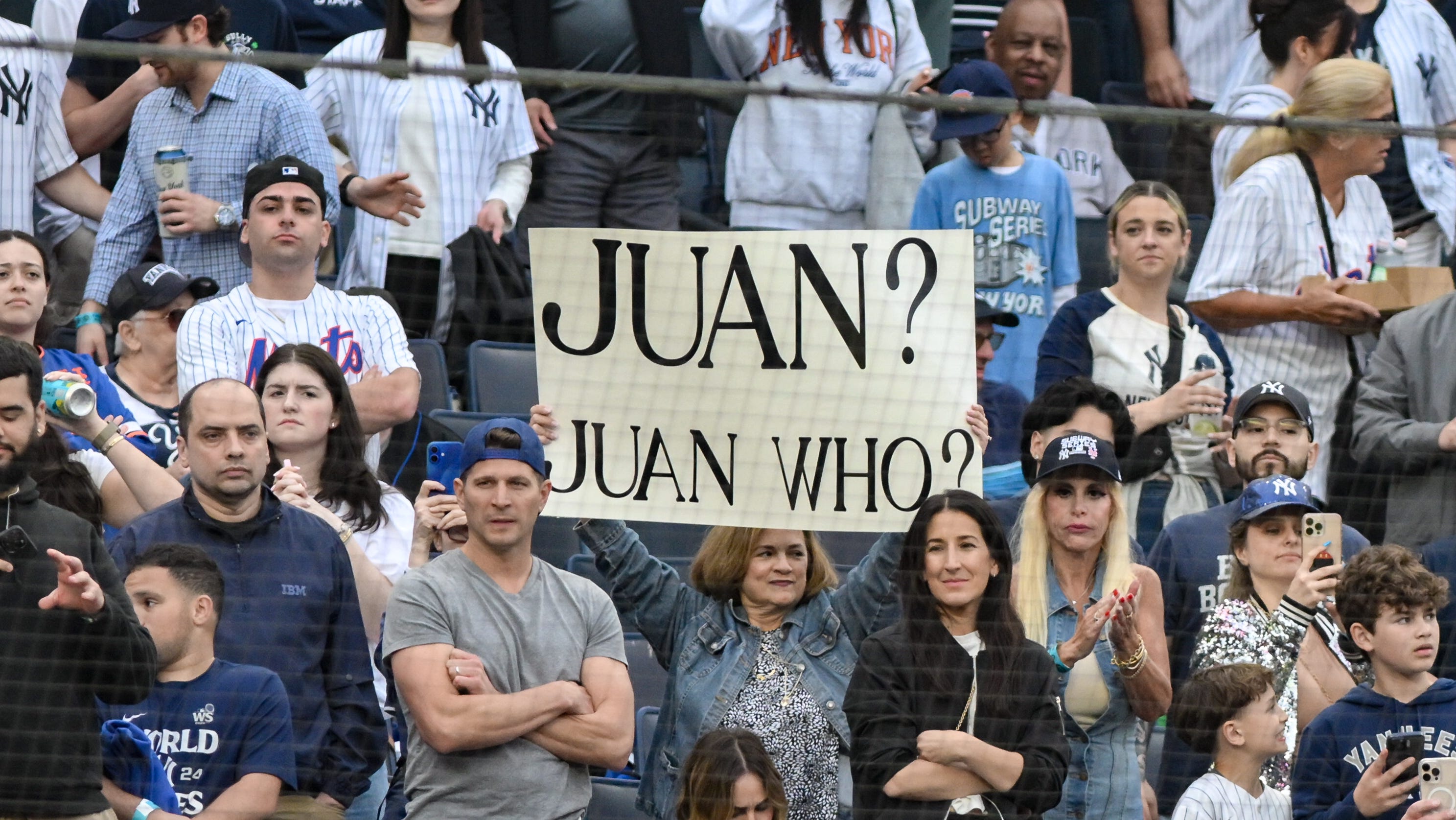

2025 Subway Series Photo Gallery Yankees And Mets Face Off

May 18, 2025

2025 Subway Series Photo Gallery Yankees And Mets Face Off

May 18, 2025 -

Texts Surface Diddys Communication With Cassie Post Assault In L A

May 18, 2025

Texts Surface Diddys Communication With Cassie Post Assault In L A

May 18, 2025 -

San Francisco Police Officer Arrested Following Dui Crash Multiple Injuries Reported

May 18, 2025

San Francisco Police Officer Arrested Following Dui Crash Multiple Injuries Reported

May 18, 2025 -

Cannes Before Smartphones Hilarious And Unbelievable Images

May 18, 2025

Cannes Before Smartphones Hilarious And Unbelievable Images

May 18, 2025 -

Kerri Pegg And The Encro Chat Scandal Details Of A Forbidden Relationship

May 18, 2025

Kerri Pegg And The Encro Chat Scandal Details Of A Forbidden Relationship

May 18, 2025