State Farm's Rate Increase Approved: What California Drivers Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's Rate Increase Approved: What California Drivers Need to Know

California drivers are facing another potential blow to their wallets as State Farm, one of the state's largest auto insurers, has received approval for a significant rate increase. This news comes as many Californians are already struggling with rising living costs and inflation. Understanding the implications of this increase and what options are available is crucial for maintaining financial stability.

How Much Will Rates Increase?

The exact percentage increase varies depending on several factors, including location, driving history, and the type of vehicle insured. While State Farm hasn't released a universally applicable percentage, reports suggest increases ranging from 10% to 20% or even higher in some areas. This means many California drivers can expect to see a noticeable jump in their monthly premiums. It's vital to check your individual policy for the specific adjustment.

Why the Rate Increase?

State Farm cites several reasons for the necessary increase, primarily focusing on the increasing costs associated with auto insurance in California. These include:

- Higher repair costs: The cost of vehicle repairs, particularly for newer vehicles with advanced technology, has skyrocketed.

- Increased claims frequency and severity: A rise in accidents and the severity of those accidents leads to larger payouts by insurance companies.

- Inflation and rising operating costs: Like many businesses, State Farm is facing pressures from general inflation affecting everything from administrative costs to employee salaries.

- Legal and regulatory changes: Shifting legal landscapes and regulatory requirements also contribute to increased operational expenses.

What Can California Drivers Do?

Facing a significant rate increase can be unsettling, but several strategies can help mitigate the impact:

- Shop around: Don't assume State Farm offers the best rates. Contact other major insurers like Geico, Progressive, and Allstate to compare quotes and find more competitive options. Consider using online comparison tools to streamline this process.

- Review your coverage: Examine your current policy. Do you need all the coverage you have? Reducing unnecessary coverage, such as collision or comprehensive insurance on older vehicles, can lower your premiums.

- Improve your driving record: Safe driving habits significantly impact insurance rates. Maintaining a clean driving record with no accidents or tickets is crucial for securing lower premiums. Consider taking a defensive driving course; many insurers offer discounts for completion.

- Bundle your insurance: Combining your auto and homeowners or renters insurance with the same company often results in significant discounts.

- Increase your deductible: Raising your deductible means lower premiums, but remember this means you'll pay more out-of-pocket in the event of an accident. Carefully weigh the risks and rewards.

Looking Ahead:

This State Farm rate increase is a clear indicator of broader trends in the California auto insurance market. Drivers should proactively manage their insurance costs by regularly comparing rates, reviewing coverage, and practicing safe driving habits. Staying informed about market changes and utilizing available resources can help you navigate these challenges and maintain affordable auto insurance.

Need help understanding your policy or finding a better rate? Contact your insurance agent or explore online comparison tools to find the best options for your needs. Don't hesitate to seek professional advice if needed. Remember to act promptly to avoid unexpected financial burdens.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm's Rate Increase Approved: What California Drivers Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Changing Tariffs On China Are Affecting Small Businesses

May 17, 2025

How Changing Tariffs On China Are Affecting Small Businesses

May 17, 2025 -

State Farm Insurance Rate Hike Approved In California What It Means For Consumers

May 17, 2025

State Farm Insurance Rate Hike Approved In California What It Means For Consumers

May 17, 2025 -

Mike Lynchs Superyacht Suffers Extensive Damage In High Winds

May 17, 2025

Mike Lynchs Superyacht Suffers Extensive Damage In High Winds

May 17, 2025 -

Evaluating Pelicans Draft Picks Flagg And Harpers Potential

May 17, 2025

Evaluating Pelicans Draft Picks Flagg And Harpers Potential

May 17, 2025 -

Billingham Teenager Bella Culley Charged With Drug Offenses In Georgia

May 17, 2025

Billingham Teenager Bella Culley Charged With Drug Offenses In Georgia

May 17, 2025

Latest Posts

-

Joe Ryans Stellar Pitching Leads Twins To 12th Consecutive Victory

May 18, 2025

Joe Ryans Stellar Pitching Leads Twins To 12th Consecutive Victory

May 18, 2025 -

Political Firestorm Trump And Springsteen Clash Over Treason Allegation

May 18, 2025

Political Firestorm Trump And Springsteen Clash Over Treason Allegation

May 18, 2025 -

Istanbul Da Stres Seviyesi Artiyor Ibb Den Uyari Ve Veriler

May 18, 2025

Istanbul Da Stres Seviyesi Artiyor Ibb Den Uyari Ve Veriler

May 18, 2025 -

Flight Booking Glitch British Airways Disputes Passengers Claim

May 18, 2025

Flight Booking Glitch British Airways Disputes Passengers Claim

May 18, 2025 -

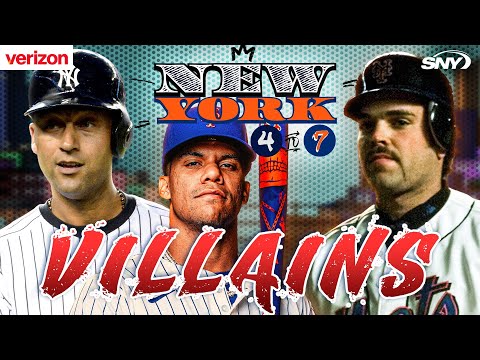

New Yorks Bitter Rivalry Mets And Yankees Most Hated Players

May 18, 2025

New Yorks Bitter Rivalry Mets And Yankees Most Hated Players

May 18, 2025