Stock Market Surge: Six-Day Win For S&P 500 As Wall Street Ignores Moody's

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Surge: Six-Day Win for S&P 500 as Wall Street Ignores Moody's Downgrade

Wall Street shrugs off Moody's downgrade, propelling the S&P 500 to a six-day winning streak. The stock market defied expectations this week, surging despite a credit rating downgrade from Moody's. This unexpected resilience has analysts scrambling to understand the market's apparent disregard for the negative outlook. What's driving this bullish sentiment, and what does it mean for investors?

The S&P 500's impressive six-day rally is a testament to the market's complex and often unpredictable nature. While Moody's downgrade of 10 US banks, citing concerns about the increasing debt burden and weakening profitability, sent ripples through the financial sector, the broader market remained largely unfazed. This begs the question: why the disconnect?

Moody's Downgrade: A Deeper Dive

Moody's decision to downgrade the credit ratings of several major US banks wasn't entirely unexpected. The agency cited rising interest rates, increased loan losses, and a generally weaker economic outlook as contributing factors. This action was seen by many as a potential catalyst for a market correction. However, the market's response has been surprisingly positive. [Link to Moody's press release]

Factors Fueling the Stock Market Surge

Several factors could be contributing to the S&P 500's resilience:

- Strong Corporate Earnings: Despite economic headwinds, many companies have reported better-than-expected earnings, boosting investor confidence. This positive news has seemingly overshadowed concerns about the banking sector.

- Resilient Consumer Spending: Consumer spending remains relatively robust, suggesting that the economy is not as weak as some analysts predicted. This strength in consumer demand is supporting corporate profits and bolstering market sentiment.

- Anticipation of Fed Rate Pause: The market is increasingly anticipating a pause or even a potential pivot in the Federal Reserve's interest rate hiking cycle. This expectation is fueling speculation that inflation may be peaking, leading to a more favorable environment for stocks.

- Ignoring the Noise: Some analysts suggest that the market is simply "ignoring the noise" surrounding the Moody's downgrade, focusing instead on the positive economic indicators and strong corporate performance. This could reflect a belief that the downgrade is already priced into the market.

What This Means for Investors

The recent stock market surge presents a complex picture for investors. While the six-day winning streak is undeniably positive, it's crucial to remember that market volatility remains a significant risk. The Moody's downgrade highlights underlying vulnerabilities within the financial system, and the market's current resilience may not be sustainable in the long term.

Here are some key considerations for investors:

- Diversification: Maintaining a well-diversified portfolio is crucial to mitigate risk.

- Long-term Perspective: Investors should avoid making impulsive decisions based on short-term market fluctuations and focus on their long-term investment strategy.

- Risk Assessment: Carefully assess your risk tolerance before making any investment decisions.

The S&P 500's six-day win is a fascinating development, challenging traditional market analysis. While the reasons behind this surge are multifaceted, understanding these factors is crucial for navigating the current economic landscape and making informed investment decisions. The future remains uncertain, but staying informed and adapting your strategy as needed is paramount. Consider consulting a financial advisor for personalized guidance.

Keywords: Stock Market, S&P 500, Moody's, Downgrade, Wall Street, Stock Market Surge, Six-Day Win, Credit Rating, Banking Sector, Economic Outlook, Federal Reserve, Interest Rates, Investment Strategy, Market Volatility, Investor Confidence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Surge: Six-Day Win For S&P 500 As Wall Street Ignores Moody's. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Helldivers 2 May 15th Update Master Of Ceremony Warbond Drop Details

May 21, 2025

Helldivers 2 May 15th Update Master Of Ceremony Warbond Drop Details

May 21, 2025 -

Costa Rican Prison Drug Bust Cat Smuggles Narcotics

May 21, 2025

Costa Rican Prison Drug Bust Cat Smuggles Narcotics

May 21, 2025 -

Record Bitcoin Etf Investments Is This A Sustainable Market Trend

May 21, 2025

Record Bitcoin Etf Investments Is This A Sustainable Market Trend

May 21, 2025 -

International Assistance Urgently Needed Ensuring Safety And Responsible Tourism In Bali

May 21, 2025

International Assistance Urgently Needed Ensuring Safety And Responsible Tourism In Bali

May 21, 2025 -

Jon Jones Ufc Departure Imminent Aspinall Negotiation Breakdown Adds Fuel To I M Done Fire

May 21, 2025

Jon Jones Ufc Departure Imminent Aspinall Negotiation Breakdown Adds Fuel To I M Done Fire

May 21, 2025

Latest Posts

-

Two Boys Arrested Church Vandalism And Defecation Incident

May 21, 2025

Two Boys Arrested Church Vandalism And Defecation Incident

May 21, 2025 -

Protecting Children Public Debate Erupts Over Paedophiles Parental Rights Following Law Change

May 21, 2025

Protecting Children Public Debate Erupts Over Paedophiles Parental Rights Following Law Change

May 21, 2025 -

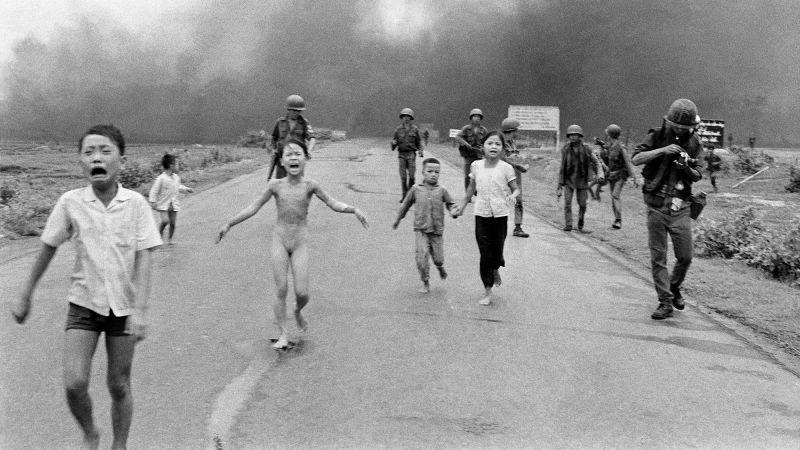

Napalm Girl Photograph A Reckoning Over Attribution And Historical Accuracy

May 21, 2025

Napalm Girl Photograph A Reckoning Over Attribution And Historical Accuracy

May 21, 2025 -

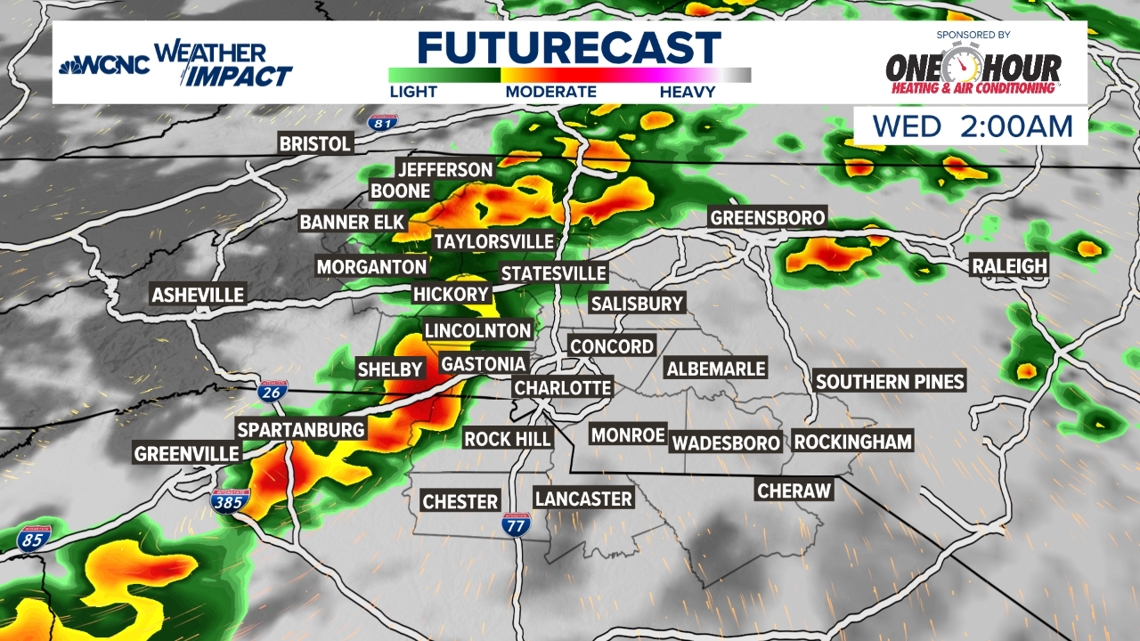

Few Strong Storms Possible Tuesday Night Very Isolated Risk

May 21, 2025

Few Strong Storms Possible Tuesday Night Very Isolated Risk

May 21, 2025 -

Eu Deal Highlights Complex Uk Eu Relationship Chris Masons Analysis

May 21, 2025

Eu Deal Highlights Complex Uk Eu Relationship Chris Masons Analysis

May 21, 2025