Stock Market Surge: Six-Day Winning Streak For S&P 500, Positive Close For Dow And Nasdaq

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Surge: Six-Day Winning Streak for S&P 500 Fuels Investor Optimism

The US stock market is experiencing a significant upswing, with the S&P 500 enjoying a remarkable six-day winning streak. This positive momentum has also lifted the Dow Jones Industrial Average and the Nasdaq Composite, leaving investors feeling cautiously optimistic. But what's driving this surge, and how long can it last?

This impressive run marks the S&P 500's best performance in several months, defying recent economic anxieties and fueling speculation about a potential market turnaround. The gains have been broad-based, indicating a shift in investor sentiment rather than a rally driven by a single sector.

Key Drivers Behind the Market Surge

Several factors are contributing to this positive market trend:

-

Easing Inflation Concerns: Recent economic data suggests inflation may be cooling faster than initially anticipated. This reduces pressure on the Federal Reserve to continue aggressively raising interest rates, a key concern for investors. Reports from the Bureau of Labor Statistics will be crucial in gauging the continued trend. You can find the latest data on their website: [insert BLS link here].

-

Strong Corporate Earnings: While some companies have reported weaker-than-expected earnings, many others have exceeded projections. This positive corporate performance is bolstering investor confidence and driving up stock prices. Analysts are closely monitoring earnings season for further indications of economic health.

-

Improved Consumer Sentiment: Despite persistent economic uncertainty, consumer confidence appears to be improving slightly. This suggests increased consumer spending, which is a vital driver of economic growth and positively impacts stock valuations. Further analysis of consumer spending habits can be found via reputable financial news sources like the [insert reputable financial news source link here].

-

Geopolitical Stability (Relative): While geopolitical risks remain, there has been a relative period of calm recently. Reduced uncertainty in global markets can encourage investment. However, it's crucial to remember that the global landscape remains dynamic and subject to change.

Dow and Nasdaq Follow Suit

The Dow Jones Industrial Average and the Nasdaq Composite have also experienced significant gains during this period, mirroring the positive performance of the S&P 500. This broad-based rally suggests a more widespread shift in market sentiment rather than a sector-specific phenomenon.

Cautious Optimism: What Lies Ahead?

While the current market surge is encouraging, investors remain cautious. Several economic headwinds persist, including persistent inflation, rising interest rates, and the ongoing war in Ukraine. These factors could easily reverse the current positive trend.

Experts are divided on the sustainability of this rally. Some believe it signals a genuine market turnaround, while others warn it may be a temporary bounce before further corrections. It's crucial for investors to remain informed and to diversify their portfolios to mitigate risk.

What to Watch:

- Inflation data releases: Keep an eye on upcoming inflation reports for crucial insights into the Fed's future policy decisions.

- Corporate earnings reports: Continue monitoring earnings season for a clearer picture of corporate performance and future growth prospects.

- Geopolitical developments: Global events can significantly impact market sentiment, requiring continuous monitoring.

This six-day winning streak provides a much-needed boost to investor confidence. However, it's crucial to approach this positive momentum with a balanced perspective, recognizing the potential for future volatility. Stay informed, stay diversified, and consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Surge: Six-Day Winning Streak For S&P 500, Positive Close For Dow And Nasdaq. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cuando Fue La Ultima Vez Que America Perdio Una Final El Rol De Mohamed

May 20, 2025

Cuando Fue La Ultima Vez Que America Perdio Una Final El Rol De Mohamed

May 20, 2025 -

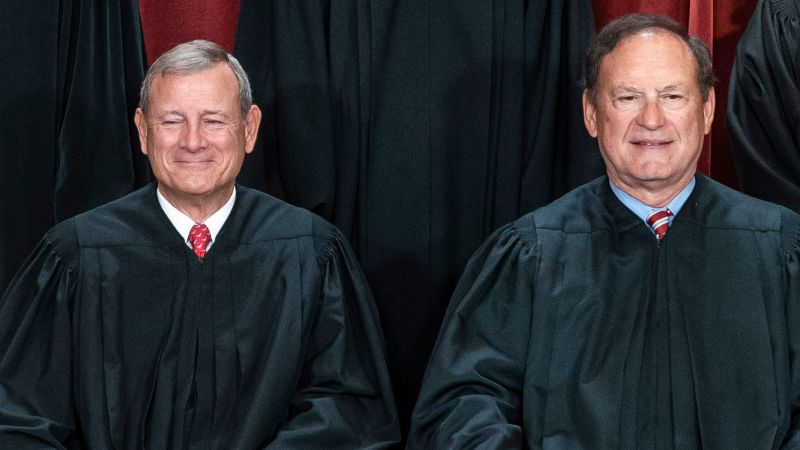

Supreme Court Justices Alito And Roberts A Look Back At Their Near 30 Year Service

May 20, 2025

Supreme Court Justices Alito And Roberts A Look Back At Their Near 30 Year Service

May 20, 2025 -

Prostate Cancer Diagnosis For President Joe Biden Impact On Presidency

May 20, 2025

Prostate Cancer Diagnosis For President Joe Biden Impact On Presidency

May 20, 2025 -

2027 The Projected Uk Launch Date For Driverless Cars Ubers Optimism Contrasts With Reality

May 20, 2025

2027 The Projected Uk Launch Date For Driverless Cars Ubers Optimism Contrasts With Reality

May 20, 2025 -

Mma Fans Erupt Jon Jones Latest Remarks On Tom Aspinall Cause Stir

May 20, 2025

Mma Fans Erupt Jon Jones Latest Remarks On Tom Aspinall Cause Stir

May 20, 2025

Latest Posts

-

Tom Aspinall And Jon Jones Feud Heats Up Analysis Of Jones Strip The Duck Statement

May 21, 2025

Tom Aspinall And Jon Jones Feud Heats Up Analysis Of Jones Strip The Duck Statement

May 21, 2025 -

Down To The Wire Eu And Uk Negotiate Crucial Brexit Deal

May 21, 2025

Down To The Wire Eu And Uk Negotiate Crucial Brexit Deal

May 21, 2025 -

Contradictions In Trumps Trade Policy Revealed By Us Factory

May 21, 2025

Contradictions In Trumps Trade Policy Revealed By Us Factory

May 21, 2025 -

Mma Fans Erupt Jon Jones Latest Remarks On Tom Aspinall Cause A Stir

May 21, 2025

Mma Fans Erupt Jon Jones Latest Remarks On Tom Aspinall Cause A Stir

May 21, 2025 -

The Putin Trump Dynamic A Shift In Power Dynamics

May 21, 2025

The Putin Trump Dynamic A Shift In Power Dynamics

May 21, 2025