Strange Trades On Wall Street: Unconventional Investment Strategies Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Strange Trades on Wall Street: Unconventional Investment Strategies Explained

Wall Street, the epicenter of global finance, is known for its high-stakes games and often-unpredictable swings. But beyond the familiar buy-and-hold strategies and index fund investing, lies a world of unconventional investment approaches that can leave even seasoned professionals scratching their heads. These "strange trades," as some might call them, represent a fascinating glimpse into the diverse and sometimes bizarre landscape of modern finance. This article will delve into some of these unusual strategies, explaining their mechanics and potential risks.

Beyond the Usual Suspects: Understanding Unconventional Investment Strategies

While traditional investment strategies focus on predictable returns through established assets like stocks and bonds, unconventional strategies often venture into less-charted territory. These approaches frequently involve higher risk, but the potential rewards can be significantly greater – or devastatingly lower. Let's explore some examples:

1. Meme Stock Investing: The rise of social media has dramatically altered the investment landscape. Meme stocks, driven by online hype and viral trends rather than fundamental analysis, have become a prominent example of unconventional trading. Companies like GameStop and AMC Entertainment experienced wild price swings fueled by online communities, highlighting the power of collective sentiment in the market. While potentially lucrative for early investors, meme stock investing is exceptionally volatile and carries substantial risk. .

2. Volatility Trading: This strategy focuses on profiting from market volatility itself, rather than the underlying asset's price direction. Traders utilize options, futures, and other derivatives to bet on price fluctuations, regardless of whether the market moves up or down. Mastering volatility trading requires advanced knowledge of derivatives and risk management techniques.

3. Arbitrage: Arbitrage involves exploiting price discrepancies between the same asset in different markets. For example, a trader might buy a stock on one exchange at a lower price and simultaneously sell it on another exchange at a higher price, pocketing the difference. While theoretically risk-free, finding and capitalizing on arbitrage opportunities requires speed, efficiency, and access to multiple markets.

4. Short Selling: This controversial strategy involves borrowing an asset (typically a stock) and selling it, hoping to buy it back later at a lower price and return it to the lender, pocketing the difference. Short selling is highly risky, as potential losses are theoretically unlimited if the asset's price rises.

5. Factor Investing: This approach focuses on specific factors believed to drive returns, such as value, momentum, or size. Investors select stocks based on these factors, rather than relying solely on overall market trends. Factor investing requires careful selection of appropriate factors and a thorough understanding of their historical performance.

Navigating the Complexities of Unconventional Trading

These unconventional investment strategies offer both tantalizing possibilities and significant challenges. Before venturing into these complex waters, it's crucial to:

- Conduct thorough research: Understand the risks and potential rewards associated with each strategy.

- Develop a robust risk management plan: Limit your potential losses and protect your capital.

- Seek professional advice: Consult with a qualified financial advisor before making significant investment decisions.

The Bottom Line

The world of finance is constantly evolving, and unconventional investment strategies are a testament to this dynamism. While some may lead to substantial profits, others can result in significant losses. A thorough understanding of these strategies, coupled with a cautious approach and sound risk management, is essential for navigating this complex and exciting landscape. Remember, investing always carries inherent risks, and it's crucial to make informed decisions based on your individual financial situation and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Strange Trades On Wall Street: Unconventional Investment Strategies Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Nba Finals Game 4 What To Watch For In A Pivotal Showdown

Jun 14, 2025

2025 Nba Finals Game 4 What To Watch For In A Pivotal Showdown

Jun 14, 2025 -

Cnn Investigates How Japans 7 Eleven Makes Its Famous Snacks

Jun 14, 2025

Cnn Investigates How Japans 7 Eleven Makes Its Famous Snacks

Jun 14, 2025 -

Wall Streets Unexpected Moves Analyzing Recent Unusual Trades

Jun 14, 2025

Wall Streets Unexpected Moves Analyzing Recent Unusual Trades

Jun 14, 2025 -

Rand Paul Invited To White House Picnic Trumps Confirmation After Controversy

Jun 14, 2025

Rand Paul Invited To White House Picnic Trumps Confirmation After Controversy

Jun 14, 2025 -

Nba Finals 2025 Game 4 Crucial Factors To Determine Series Momentum

Jun 14, 2025

Nba Finals 2025 Game 4 Crucial Factors To Determine Series Momentum

Jun 14, 2025

Latest Posts

-

Air India Crash Survivor A British Mans Harrowing Tale

Jun 15, 2025

Air India Crash Survivor A British Mans Harrowing Tale

Jun 15, 2025 -

Blenheim Palace Gold Toilet Theft Inside The 4 8 Million Robbery And Subsequent Trial

Jun 15, 2025

Blenheim Palace Gold Toilet Theft Inside The 4 8 Million Robbery And Subsequent Trial

Jun 15, 2025 -

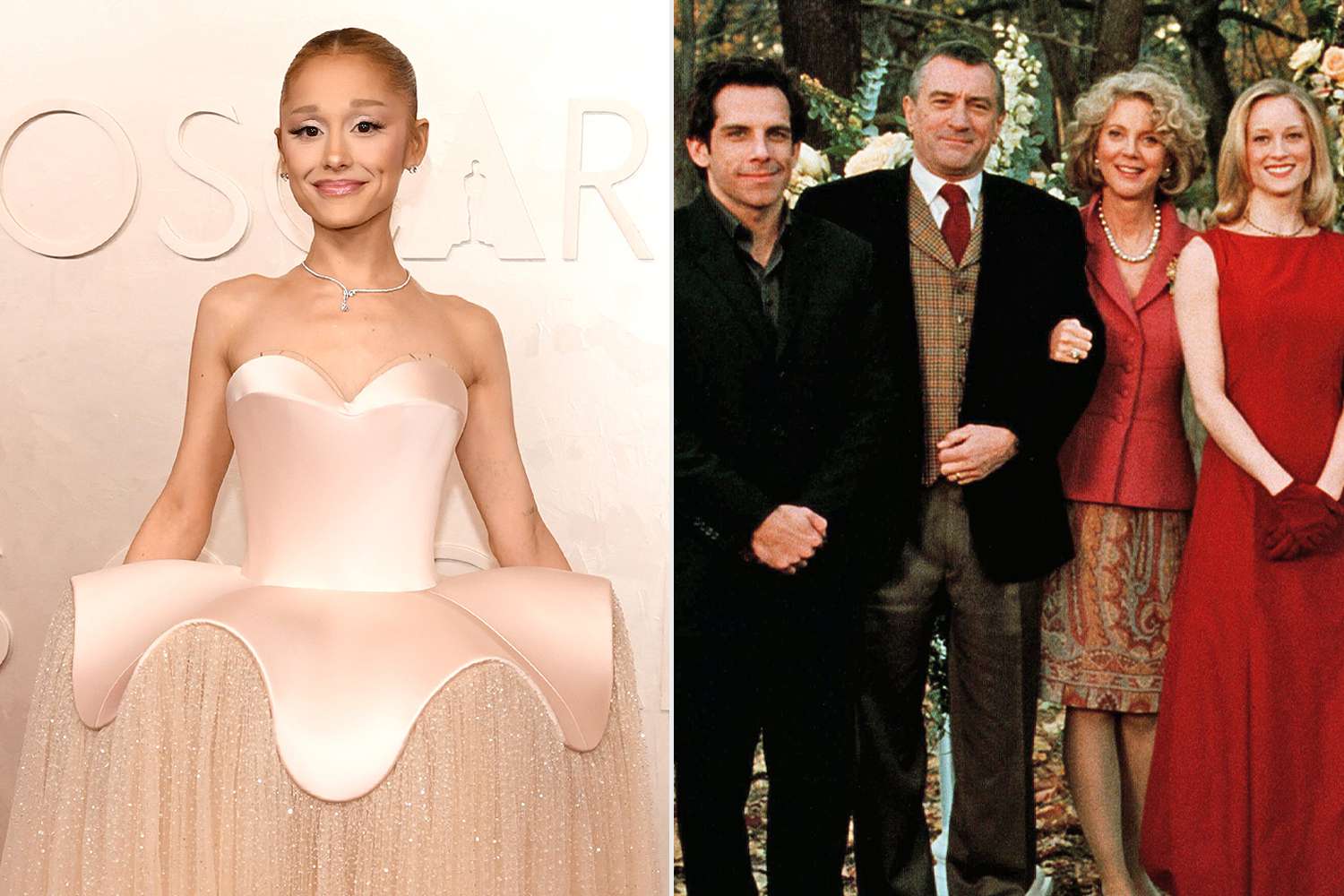

Ben Stiller Ariana Grande To Power Meet The Parents 4 With Hilarious Performance

Jun 15, 2025

Ben Stiller Ariana Grande To Power Meet The Parents 4 With Hilarious Performance

Jun 15, 2025 -

Analyzing The Projected Cut Line For The 2025 Us Open

Jun 15, 2025

Analyzing The Projected Cut Line For The 2025 Us Open

Jun 15, 2025 -

Spencers Stride A Performance Decline

Jun 15, 2025

Spencers Stride A Performance Decline

Jun 15, 2025