Stretch Your College Savings: Understanding 529 Account Benefits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stretch Your College Savings: Understanding 529 Account Benefits

Planning for your child's college education can feel overwhelming, but understanding the benefits of a 529 plan can significantly ease the financial burden. These tax-advantaged savings plans offer a powerful tool for families aiming to fund higher education, and this comprehensive guide will help you navigate their advantages.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically to pay for qualified education expenses. These plans are sponsored by states, state agencies, or educational institutions, and offer significant tax benefits to savers. The beauty of a 529 plan lies in its flexibility: contributions grow tax-deferred, and withdrawals used for qualified education expenses are generally tax-free at the federal level. This means more money goes towards your child's education, not to Uncle Sam.

5 Key Benefits of a 529 Plan:

-

Tax Advantages: This is the cornerstone of 529 plan appeal. Earnings grow tax-deferred, meaning you won't pay taxes on investment gains until you withdraw the money for qualified expenses. And, as mentioned, withdrawals for qualified education expenses are generally federal tax-free. Check your state's regulations, as some states offer additional state tax deductions or credits for contributions.

-

Flexibility: You can use 529 plan funds for a wide range of qualified education expenses, including tuition, fees, room and board, books, and even computers. This flexibility extends beyond traditional four-year colleges to include community colleges, vocational schools, and even some apprenticeship programs. .

-

Gifting Opportunities: 529 plans offer unique gifting strategies. You can make larger contributions upfront without exceeding annual gift tax limits by using the five-year gift tax rule. This allows you to contribute up to five times the annual gift tax exclusion amount ($170,000 in 2023) in a single year without incurring gift taxes. Consult a financial advisor to understand the intricacies of this strategy.

-

Investment Options: Most 529 plans offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and time horizon. From age-based portfolios that automatically adjust risk levels over time to individual stock and bond selections, you can find an investment strategy that aligns with your family's financial goals.

-

Potential State Tax Benefits: Many states offer additional tax benefits for contributing to their own state's 529 plan. This could include state income tax deductions or credits on your contributions, further enhancing the savings. It's crucial to research your state's specific offerings.

Choosing the Right 529 Plan:

Choosing the best 529 plan depends on several factors, including your state of residence, investment options, and fee structures. Consider these points:

- State Tax Deductions/Credits: Prioritize plans that offer favorable tax advantages in your state.

- Investment Choices: Select a plan with a diverse range of investment options that suit your risk tolerance.

- Fees: Compare expense ratios to ensure you're not paying excessive fees.

Conclusion:

A 529 plan is a powerful tool for securing your child's future. By understanding the benefits and carefully considering your options, you can make informed decisions that significantly reduce the financial burden of higher education. Remember to consult with a financial advisor for personalized guidance and to explore all available options. Start saving early and watch your college fund grow!

Disclaimer: This article provides general information and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stretch Your College Savings: Understanding 529 Account Benefits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

First Top 10 Win For Musetti Tiafoe Creates New U S Open History

Jun 04, 2025

First Top 10 Win For Musetti Tiafoe Creates New U S Open History

Jun 04, 2025 -

Preferred Bidders Exit Jeopardizes Thames Waters Recovery

Jun 04, 2025

Preferred Bidders Exit Jeopardizes Thames Waters Recovery

Jun 04, 2025 -

22 Years Of Waiting Tiafoe Secures American Roland Garros Win

Jun 04, 2025

22 Years Of Waiting Tiafoe Secures American Roland Garros Win

Jun 04, 2025 -

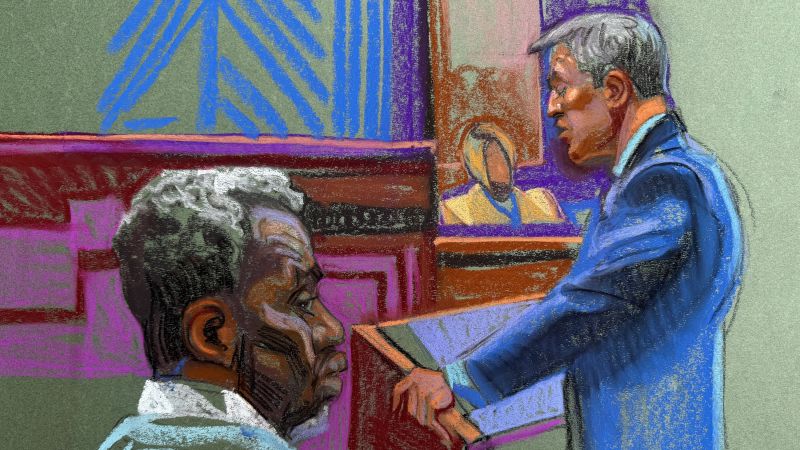

The Sean Diddy Combs Trial Key Moments And Future Implications

Jun 04, 2025

The Sean Diddy Combs Trial Key Moments And Future Implications

Jun 04, 2025 -

Confirmed Glastonbury 2025 Acts Full Stage Schedule And Surprise Performances

Jun 04, 2025

Confirmed Glastonbury 2025 Acts Full Stage Schedule And Surprise Performances

Jun 04, 2025

Latest Posts

-

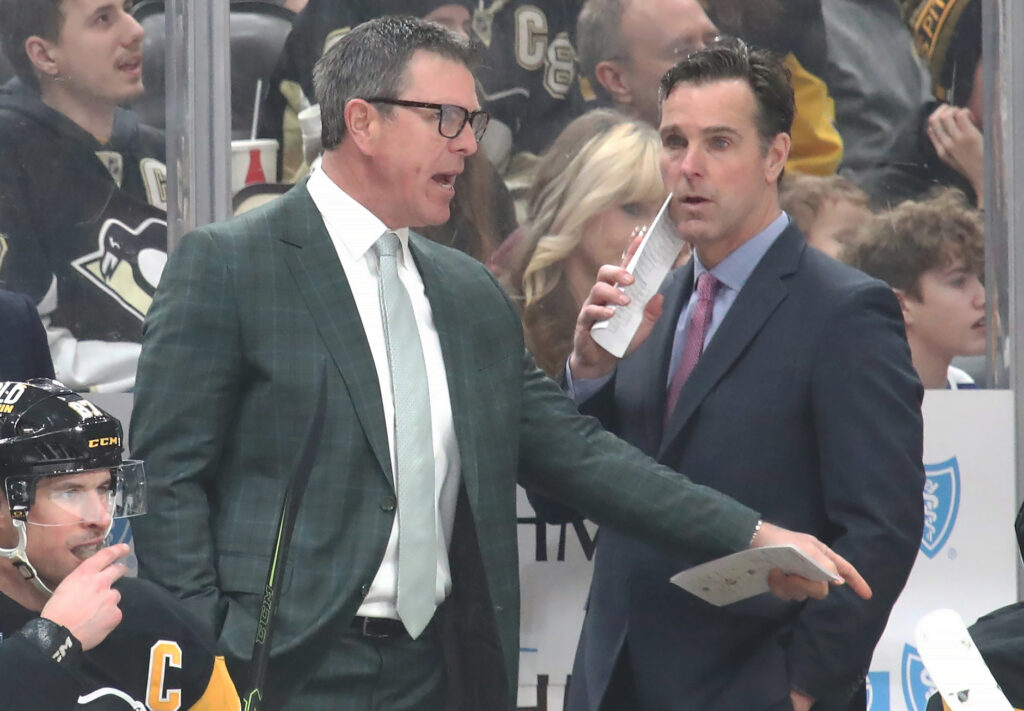

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025