Stricter Penalties For False Child Benefit Claims Made Abroad

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stricter Penalties for False Child Benefit Claims Made Abroad: Government Cracks Down on Fraud

The UK government is cracking down on individuals making fraudulent Child Benefit claims while living abroad, announcing stricter penalties for those caught attempting to deceive the system. This move follows a recent surge in detected fraudulent claims originating from outside the UK, costing taxpayers millions of pounds. The changes aim to deter future fraudulent activity and recover misappropriated funds.

Increased Scrutiny and Enhanced Investigations

The Department for Work and Pensions (DWP) has revealed a significant increase in resources dedicated to investigating suspected fraudulent Child Benefit claims made from overseas. This includes enhanced data analysis techniques, improved collaboration with international partners, and the deployment of specialized investigators. The government is employing sophisticated methods to identify discrepancies in applications, cross-referencing data with other government agencies and international tax authorities. This proactive approach signifies a zero-tolerance policy towards those attempting to exploit the system.

What are the new penalties?

Previously, penalties for false Child Benefit claims, even those made abroad, involved a combination of repayment of the wrongly claimed amount and potentially a fine. However, the new measures introduce significantly harsher punishments. These include:

- Increased Fines: Individuals found guilty of fraudulent claims will face substantially higher fines, potentially reaching tens of thousands of pounds, depending on the scale of the fraud.

- Criminal Prosecution: The government is pursuing criminal prosecution more aggressively, leading to potential jail sentences for those involved in large-scale or particularly egregious cases of fraud.

- Confiscation of Assets: Authorities will be empowered to seize assets acquired through fraudulent means, aiming to recover all misappropriated funds and deter future offenses.

Who is affected?

These stricter penalties target anyone who:

- Falsely claims to be residing in the UK: Individuals living abroad but falsely claiming to meet UK residency requirements to receive Child Benefit.

- Fails to declare changes in circumstances: Those who fail to notify the DWP of changes in their residency status or other relevant information impacting their eligibility.

- Provides false information on their application: Individuals who submit inaccurate or misleading information to support their Child Benefit claim.

What should you do?

If you are receiving Child Benefit and your circumstances change, it's crucial to inform the DWP immediately. Failing to do so can lead to severe penalties under the new regulations. You can find detailed information on reporting changes and eligibility criteria on the .

Looking Ahead:

The government's commitment to tackling fraudulent Child Benefit claims demonstrates a proactive approach to protecting public funds. These stricter penalties serve as a clear warning that such activities will not be tolerated. The increased resources dedicated to investigation underscore the government's determination to recover misappropriated funds and ensure the integrity of the Child Benefit system. The enhanced collaboration with international partners will further strengthen efforts to combat cross-border fraud. This initiative aims to safeguard the system for legitimate claimants and ensure fairness for all taxpayers.

Keywords: Child Benefit Fraud, Child Benefit, Fraud Penalties, UK Government, Overseas Claims, Fraudulent Claims, DWP, Department for Work and Pensions, Government crackdown, Benefits Fraud, Tax Fraud, International Collaboration, Criminal Prosecution, Asset Confiscation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stricter Penalties For False Child Benefit Claims Made Abroad. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dangerous Heat And Storms Expected In Tampa Bay What You Need To Know

Aug 24, 2025

Dangerous Heat And Storms Expected In Tampa Bay What You Need To Know

Aug 24, 2025 -

Mike Pereira On New College Football Rules Addressing Targeting Flag Mechanics And More

Aug 24, 2025

Mike Pereira On New College Football Rules Addressing Targeting Flag Mechanics And More

Aug 24, 2025 -

More Than Just A Monument Discovering Rapid Citys Hidden Gems

Aug 24, 2025

More Than Just A Monument Discovering Rapid Citys Hidden Gems

Aug 24, 2025 -

Sassuolos Impact Nurturing Future Champions

Aug 24, 2025

Sassuolos Impact Nurturing Future Champions

Aug 24, 2025 -

How Walmart Outmaneuvered Target In The Digital Marketplace

Aug 24, 2025

How Walmart Outmaneuvered Target In The Digital Marketplace

Aug 24, 2025

Latest Posts

-

100 Zwolnien A Jednak Powrot Kultowej Polskiej Marki I Ozywienie Produkcji

Aug 24, 2025

100 Zwolnien A Jednak Powrot Kultowej Polskiej Marki I Ozywienie Produkcji

Aug 24, 2025 -

Understanding The New College Football Rules An Interview With Referee Mike Pereira

Aug 24, 2025

Understanding The New College Football Rules An Interview With Referee Mike Pereira

Aug 24, 2025 -

Walmarts E Commerce Victory How Target Lost Ground

Aug 24, 2025

Walmarts E Commerce Victory How Target Lost Ground

Aug 24, 2025 -

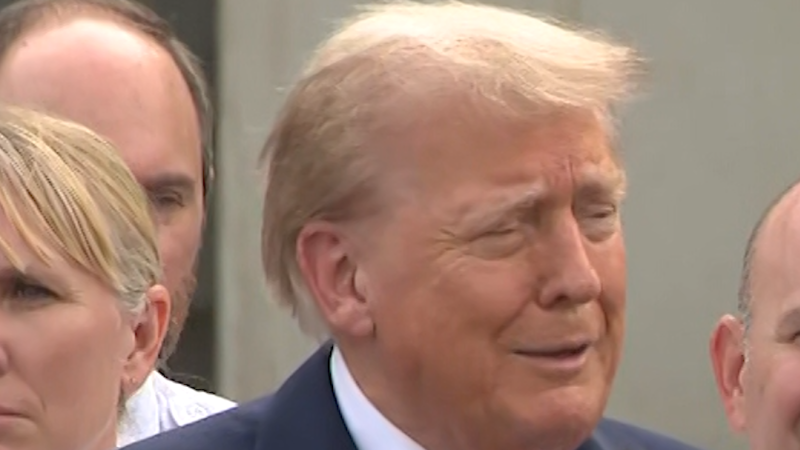

Trump On Grass Expertise A Closer Look At His Recent Remarks

Aug 24, 2025

Trump On Grass Expertise A Closer Look At His Recent Remarks

Aug 24, 2025 -

High Stakes Match In Detroit Harriss Performance Under Pressure

Aug 24, 2025

High Stakes Match In Detroit Harriss Performance Under Pressure

Aug 24, 2025