Stronger Buy Now, Pay Later Rules: Enhanced Shopper Protections

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stronger Buy Now, Pay Later Rules: Enhanced Shopper Protections Offer Peace of Mind

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a convenient way to finance purchases. However, this rapid growth has also raised concerns about consumer debt and potential financial hardship. Recognizing these challenges, regulators are implementing stronger rules to enhance shopper protections and promote responsible lending practices within the BNPL industry. This means significant changes are coming for both consumers and lenders.

What are the new, stronger BNPL rules focusing on?

The new regulations aim to address several key areas to safeguard consumers:

-

Credit Checks and Affordability Assessments: Lenders are now required to conduct more thorough credit checks and affordability assessments before approving BNPL applications. This helps prevent consumers from taking on more debt than they can manage. This shift towards more stringent affordability checks is a crucial step in preventing over-indebtedness.

-

Increased Transparency: Consumers will benefit from clearer and more transparent information about interest rates, fees, and repayment terms. This increased transparency empowers consumers to make informed decisions and avoid unexpected charges. The days of hidden fees and confusing terms are hopefully numbered.

-

Debt Collection Practices: Stricter rules are being implemented around debt collection practices. This includes limitations on aggressive collection tactics and a focus on providing consumers with clear communication and support if they fall behind on payments. This focus on fair debt collection is vital for protecting vulnerable consumers.

-

Early Warning Systems: Some regulatory bodies are exploring the implementation of early warning systems that identify consumers at risk of falling into debt and provide them with support and guidance. This proactive approach can help prevent serious financial problems.

-

Improved Data Sharing: Increased data sharing between lenders and credit bureaus will give a more comprehensive view of a consumer's financial situation, preventing them from accumulating excessive BNPL debt across multiple providers. This collaborative approach will help manage risk more effectively.

How will these changes impact consumers?

These strengthened rules offer several benefits for consumers:

-

Reduced Risk of Over-Indebtedness: By implementing stricter affordability checks and promoting responsible lending, the new regulations aim to reduce the risk of consumers accumulating unmanageable levels of debt.

-

Greater Financial Control: Increased transparency and clear communication will empower consumers to manage their finances more effectively.

-

Improved Debt Collection Processes: Fairer and less aggressive debt collection practices will help to protect consumers from undue stress and hardship.

What should consumers do now?

-

Shop around and compare offers: Don't settle for the first BNPL offer you see. Compare interest rates, fees, and repayment terms from different providers.

-

Only use BNPL for necessary purchases: Avoid using BNPL for impulse buys or non-essential items.

-

Budget carefully: Ensure you can comfortably afford the repayments before using BNPL.

-

Stay organized: Keep track of your BNPL repayments to avoid missed payments and late fees.

The Future of BNPL:

The future of BNPL lies in responsible lending and consumer protection. These strengthened regulations are a significant step towards ensuring that BNPL services are used safely and responsibly. The industry is evolving, and these changes reflect a commitment to protecting consumers while maintaining the convenience and accessibility of BNPL options. Further developments and potential legislative changes are expected as regulators continue to monitor the industry and adapt to its evolving landscape. Staying informed about these updates is crucial for both consumers and businesses utilizing BNPL services.

Keywords: Buy Now Pay Later, BNPL, consumer protection, regulations, responsible lending, credit checks, affordability assessments, debt collection, financial regulation, consumer finance, online lending, financial technology, fintech.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stronger Buy Now, Pay Later Rules: Enhanced Shopper Protections. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Helldivers 2 Warbond Drop Masters Of Ceremony Content On May 15th

May 21, 2025

Helldivers 2 Warbond Drop Masters Of Ceremony Content On May 15th

May 21, 2025 -

Moodys Downgrade Unfazed Stock Market Soars Led By S And P 500

May 21, 2025

Moodys Downgrade Unfazed Stock Market Soars Led By S And P 500

May 21, 2025 -

The Fallout Of Untold Brett Favre A J Perez Speaks Out On Intimidation

May 21, 2025

The Fallout Of Untold Brett Favre A J Perez Speaks Out On Intimidation

May 21, 2025 -

Trumps Trade Policies A Case Study Of The Us Factory Struggling To Compete

May 21, 2025

Trumps Trade Policies A Case Study Of The Us Factory Struggling To Compete

May 21, 2025 -

Femicide In Focus Recent Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025

Femicide In Focus Recent Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025

Latest Posts

-

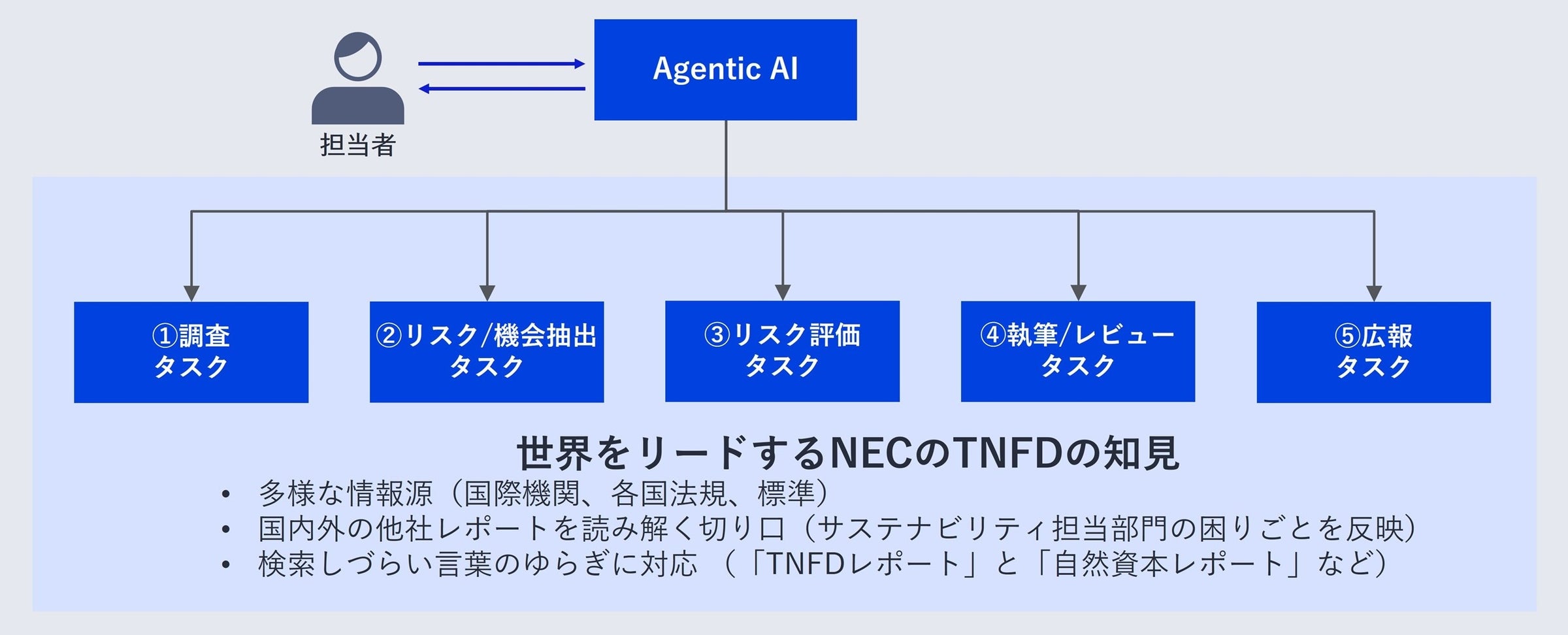

Agentic Ai Nec Tnfd Ai

May 21, 2025

Agentic Ai Nec Tnfd Ai

May 21, 2025 -

Analysis The Impact Of Brexit And The Gaza Conflict On Global Politics

May 21, 2025

Analysis The Impact Of Brexit And The Gaza Conflict On Global Politics

May 21, 2025 -

La Guardia Airport Near Miss Faa And Ntsb Launch Investigations

May 21, 2025

La Guardia Airport Near Miss Faa And Ntsb Launch Investigations

May 21, 2025 -

Letitia James Trump Lawsuits And Doj Probe Clash

May 21, 2025

Letitia James Trump Lawsuits And Doj Probe Clash

May 21, 2025 -

Gaza Offensive Uk France And Canada Urge Israel To Cease Hostilities

May 21, 2025

Gaza Offensive Uk France And Canada Urge Israel To Cease Hostilities

May 21, 2025