Stronger Consumer Protections: New Buy Now, Pay Later Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stronger Consumer Protections: New Buy Now, Pay Later Regulations Reshape the Lending Landscape

Buy Now, Pay Later (BNPL) services exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, this rapid growth has also highlighted significant consumer protection concerns, leading to a wave of new regulations designed to curb predatory lending practices and safeguard consumers. This article explores the key changes impacting the BNPL industry and what they mean for borrowers.

The Rise and Fall (and Rise Again) of Unregulated BNPL

The ease and accessibility of BNPL services made them incredibly attractive to consumers, particularly younger generations. The lack of stringent regulations initially allowed for rapid expansion, but this also meant a lack of oversight regarding interest rates, late payment fees, and debt accumulation. Stories of consumers drowning in debt due to unchecked BNPL spending became increasingly common, prompting regulatory bodies to intervene.

New Regulations: A Game Changer for Consumer Protection

Recent regulatory changes aim to bring much-needed transparency and accountability to the BNPL sector. These regulations vary by country and region, but several common themes emerge:

- Increased Transparency: Regulations are forcing BNPL providers to clearly disclose all fees, interest rates (even if zero upfront), and repayment terms upfront. This improved transparency empowers consumers to make informed decisions before committing to a purchase.

- Credit Checks and Affordability Assessments: Many jurisdictions are introducing requirements for BNPL providers to conduct credit checks and assess a consumer's ability to repay before approving loans. This helps prevent consumers from taking on more debt than they can manage.

- Debt Collection Practices: Regulations are tightening the rules around debt collection, limiting aggressive tactics and ensuring fairer treatment for consumers struggling to repay. This includes restrictions on repeated calls and threats.

- Reporting to Credit Bureaus: In some areas, BNPL transactions are now being reported to credit bureaus, impacting consumers' credit scores. While this might seem negative, it promotes responsible borrowing and allows lenders to assess the overall creditworthiness of applicants more accurately.

- Stronger Enforcement: Regulatory bodies are increasing their oversight and enforcement capabilities, ensuring BNPL providers comply with the new regulations and face consequences for violations.

What This Means for Consumers

These regulatory changes are significant for consumers, offering several key benefits:

- Reduced Risk of Over-Indebtedness: By promoting responsible lending practices and affordability assessments, these regulations significantly reduce the risk of consumers falling into unmanageable debt.

- Greater Financial Transparency: The increased transparency around fees and interest rates allows for better comparison shopping and informed decision-making.

- Fairer Debt Collection Practices: Consumers are better protected from aggressive and unfair debt collection methods.

Looking Ahead: A More Sustainable BNPL Landscape

The implementation of stronger consumer protections is reshaping the BNPL industry. While some providers may initially resist these changes, the long-term benefits for both consumers and the financial system are undeniable. A more regulated and transparent BNPL market fosters sustainable growth while safeguarding consumers from predatory practices. This move towards responsible lending ensures the continued viability of BNPL as a convenient payment option without the associated risks.

Further Reading: [Link to a relevant government website or financial regulator's page on BNPL regulations]

Disclaimer: This article provides general information and does not constitute financial advice. Always consult with a financial professional before making any financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stronger Consumer Protections: New Buy Now, Pay Later Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Top Mlb Home Run Picks May 17th High Value Player Props For Ketel Marte James Wood

May 20, 2025

Top Mlb Home Run Picks May 17th High Value Player Props For Ketel Marte James Wood

May 20, 2025 -

Sean Combs Faces Serious Charges Cassie Venturas Testimony Holds The Key

May 20, 2025

Sean Combs Faces Serious Charges Cassie Venturas Testimony Holds The Key

May 20, 2025 -

Dominant Mud Hens Performance Earns Victory Against Rail Riders

May 20, 2025

Dominant Mud Hens Performance Earns Victory Against Rail Riders

May 20, 2025 -

Snl Celebrates 50th Season With Record Breaking Finale

May 20, 2025

Snl Celebrates 50th Season With Record Breaking Finale

May 20, 2025 -

Autonomous Vehicles In The Uk Ubers Early Arrival Vs Projected 2027 Launch

May 20, 2025

Autonomous Vehicles In The Uk Ubers Early Arrival Vs Projected 2027 Launch

May 20, 2025

Latest Posts

-

Post Pectra Upgrade Investors Pour 200 Million Into Ethereum

May 20, 2025

Post Pectra Upgrade Investors Pour 200 Million Into Ethereum

May 20, 2025 -

Urgent Legal Aid Data Breach Reveals Sensitive Client Information

May 20, 2025

Urgent Legal Aid Data Breach Reveals Sensitive Client Information

May 20, 2025 -

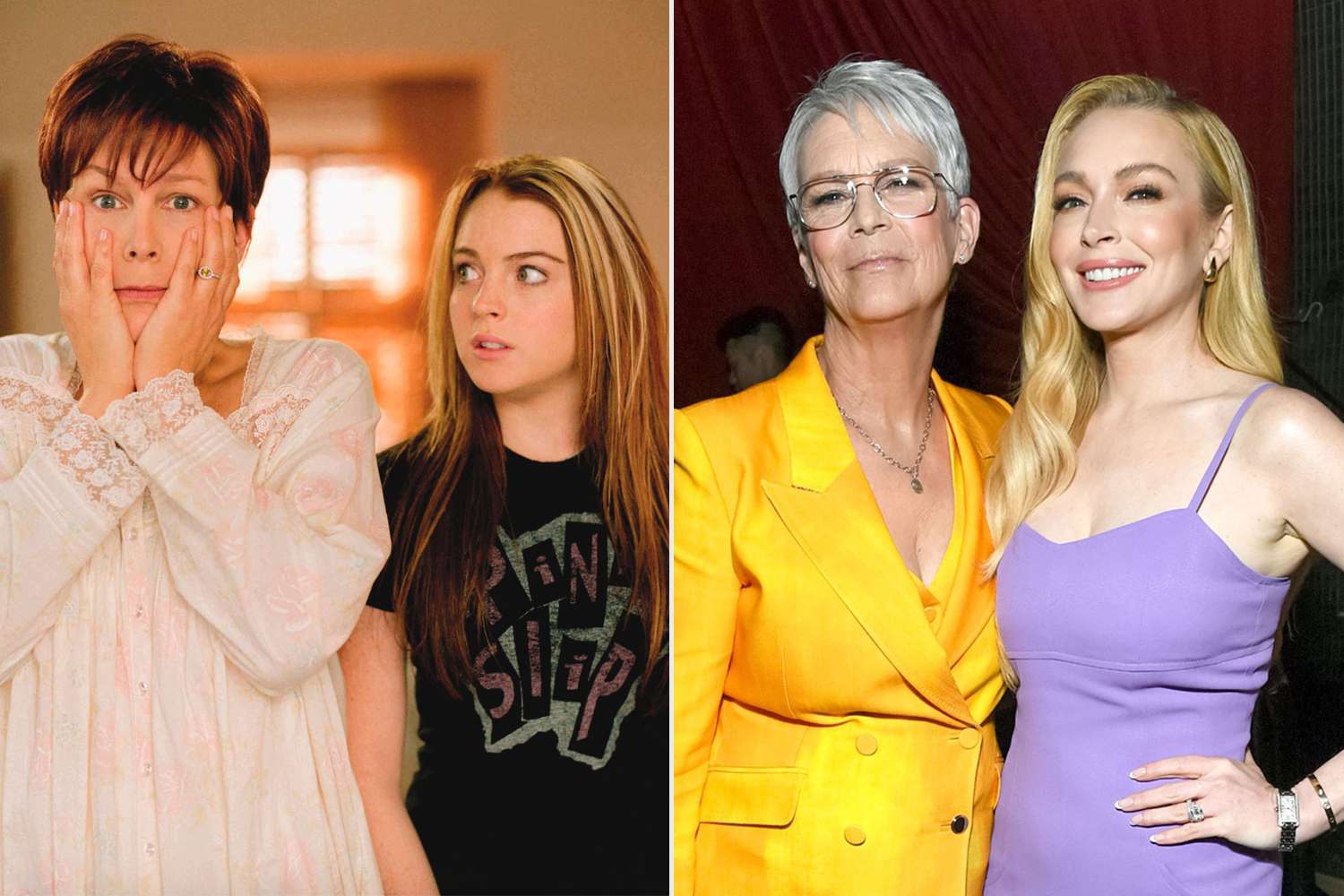

Freaky Friday Reunion Jamie Lee Curtis On Maintaining Contact With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis On Maintaining Contact With Lindsay Lohan

May 20, 2025 -

Match Of The Day Host Gary Linekers Potential Bbc Exit Latest Updates

May 20, 2025

Match Of The Day Host Gary Linekers Potential Bbc Exit Latest Updates

May 20, 2025 -

Days After St Louis Tornado Residents Rebuild Community Rallies

May 20, 2025

Days After St Louis Tornado Residents Rebuild Community Rallies

May 20, 2025