Stronger Consumer Protections: New Buy Now, Pay Later Regulations Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stronger Consumer Protections: New Buy Now, Pay Later Regulations Explained

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering a seemingly effortless way to purchase goods and services. But this convenience has come with concerns about consumer debt and financial vulnerability. Responding to these worries, regulators across the globe are implementing stricter rules to protect consumers. This article breaks down the key changes in BNPL regulations and what they mean for you.

The Rise of BNPL and the Need for Regulation

BNPL platforms, like Klarna, Afterpay (now part of Square), and Affirm, have revolutionized online shopping. Their ease of use and lack of stringent credit checks have made them particularly attractive to younger generations and those with limited access to traditional credit. However, this rapid growth has outpaced regulatory oversight, leading to concerns about:

- Overspending and Debt Accumulation: The ease of accessing credit through BNPL can lead to impulsive purchases and difficulty managing repayments, resulting in spiraling debt.

- Lack of Transparency: Fees, interest rates, and repayment terms can be unclear, leaving consumers vulnerable to unexpected charges.

- Data Privacy Concerns: BNPL providers collect significant personal and financial data, raising questions about data security and responsible use.

New Regulations: A Shift Towards Greater Consumer Protection

Recognizing these risks, governments are introducing regulations aimed at strengthening consumer protections. These changes vary by country but generally focus on several key areas:

1. Enhanced Transparency and Disclosure: New regulations mandate clearer disclosure of fees, interest rates, and repayment terms. Consumers will have a better understanding of the true cost of using BNPL services before committing to a purchase. This includes upfront disclosure of potential late payment fees and the impact on credit scores.

2. Credit Checks and Affordability Assessments: Some jurisdictions are requiring BNPL providers to conduct more robust credit checks and affordability assessments before approving loans. This aims to prevent consumers from taking on debt they cannot afford. This move is designed to prevent situations where individuals accrue multiple BNPL loans, potentially leading to severe financial hardship.

3. Stronger Debt Collection Practices: Regulations are being introduced to curb aggressive debt collection practices employed by some BNPL providers. This includes limits on the frequency and methods of contact with consumers in arrears. Fairer and more humane debt collection procedures are now being enforced.

4. Reporting to Credit Bureaus: A significant change is the increasing requirement for BNPL transactions to be reported to credit bureaus. This allows lenders to have a more complete picture of a consumer's financial situation, potentially affecting their access to other forms of credit. This added layer of accountability aims to encourage responsible borrowing habits.

5. Increased Consumer Education: Many regulatory bodies are emphasizing consumer education initiatives to improve awareness of the risks and responsibilities associated with using BNPL services. This includes providing resources and tools to help consumers manage their BNPL accounts effectively.

What This Means for Consumers

These new regulations are designed to level the playing field, ensuring that BNPL services are used responsibly. Consumers can expect:

- Greater transparency: A clearer understanding of costs and terms.

- Reduced risk of overspending: More stringent affordability checks.

- Fairer debt collection practices: Protection against aggressive tactics.

- Improved credit management: Better visibility of BNPL activity on credit reports.

Moving Forward:

The landscape of BNPL regulations is constantly evolving. Staying informed about the latest changes in your region is crucial. Before using a BNPL service, carefully review the terms and conditions, compare different providers, and ensure you can comfortably manage the repayments. Remember, responsible borrowing is key to avoiding financial difficulties. For more information on financial literacy and responsible spending, visit [link to a relevant government or financial literacy website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stronger Consumer Protections: New Buy Now, Pay Later Regulations Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Russia Ukraine Conflict Trump Intervenes Peace Talks Planned

May 20, 2025

Russia Ukraine Conflict Trump Intervenes Peace Talks Planned

May 20, 2025 -

Beyond The Action The Emotional Core Of The Last Of Us

May 20, 2025

Beyond The Action The Emotional Core Of The Last Of Us

May 20, 2025 -

Woman Rescued After 21 Days Lost In Californias Rugged Terrain Exclusive Interview

May 20, 2025

Woman Rescued After 21 Days Lost In Californias Rugged Terrain Exclusive Interview

May 20, 2025 -

Todays Mlb Predictions Walk Off Bets And Analysis White Sox Cubs Red Sox Braves

May 20, 2025

Todays Mlb Predictions Walk Off Bets And Analysis White Sox Cubs Red Sox Braves

May 20, 2025 -

Days After The St Louis Tornado Assessing The Damage And Community Response

May 20, 2025

Days After The St Louis Tornado Assessing The Damage And Community Response

May 20, 2025

Latest Posts

-

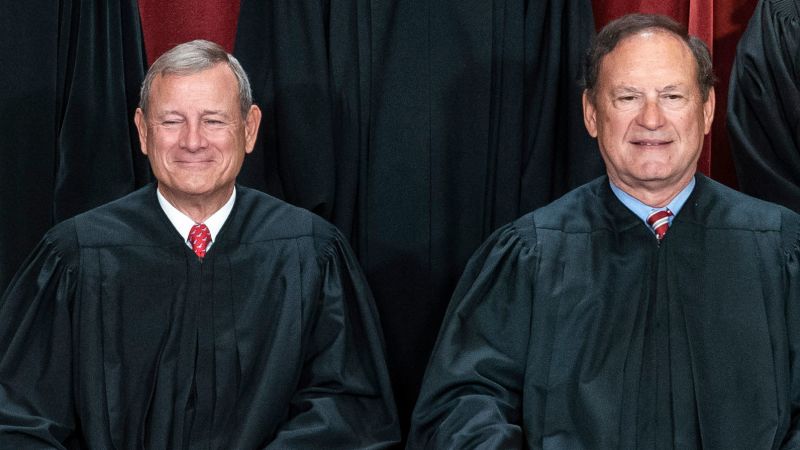

Supreme Court Justices Alito And Roberts Reflecting On Their Tenure

May 20, 2025

Supreme Court Justices Alito And Roberts Reflecting On Their Tenure

May 20, 2025 -

Strip The Duck Fan Fury Over Jon Jones Latest Tom Aspinall Remarks

May 20, 2025

Strip The Duck Fan Fury Over Jon Jones Latest Tom Aspinall Remarks

May 20, 2025 -

Addressing Tourist Misconduct Bali Introduces New Behavioral Guidelines

May 20, 2025

Addressing Tourist Misconduct Bali Introduces New Behavioral Guidelines

May 20, 2025 -

Two Influencers Two Murders Colombian Model And Mexican Influencer Deaths Fuel Femicide Outrage

May 20, 2025

Two Influencers Two Murders Colombian Model And Mexican Influencer Deaths Fuel Femicide Outrage

May 20, 2025 -

Investigating A Prehistoric Puzzle The Pachyrhinosaurus Die Off In Canada

May 20, 2025

Investigating A Prehistoric Puzzle The Pachyrhinosaurus Die Off In Canada

May 20, 2025