Subprime Auto Lender Collapse: Will It Trigger A Recession?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Subprime Auto Lender Collapse: Will it Trigger a Recession?

The recent turmoil in the subprime auto lending market has sent shockwaves through the financial industry, prompting concerns about a potential recession. While the situation is complex and doesn't mirror the 2008 subprime mortgage crisis directly, the parallels are unsettling enough to warrant close examination. This article delves into the current state of the subprime auto lending market, analyzing the potential risks and exploring whether a collapse could indeed trigger a broader economic downturn.

The Cracks in the System: Rising Defaults and Delinquencies

The subprime auto loan market, which caters to borrowers with lower credit scores, has seen a significant rise in defaults and delinquencies in recent months. Several factors contribute to this:

- Inflationary Pressures: Soaring inflation has squeezed household budgets, making it harder for borrowers to keep up with loan payments. The rising cost of living, especially for essential items like gasoline and groceries, directly impacts borrowers' ability to repay their auto loans.

- Increased Interest Rates: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have also increased borrowing costs. This makes existing loans more expensive and makes it harder for those struggling to make payments to refinance.

- Weakening Consumer Confidence: A general decline in consumer confidence, fueled by economic uncertainty, can lead to reduced spending and increased financial vulnerability, impacting loan repayment capabilities.

- Lax Lending Standards (Past Practices): Some lenders, in the pursuit of profits, may have relaxed lending standards in the past, leading to a higher proportion of risky loans in the system.

The Ripple Effect: Impacts Beyond the Auto Industry

The consequences of a widespread collapse in the subprime auto lending market could extend far beyond the auto industry itself. A significant increase in defaults could:

- Impact Used Car Prices: A flood of repossessed vehicles onto the used car market could drive down prices, affecting both individuals and dealerships.

- Strain Banks and Financial Institutions: Lenders holding substantial subprime auto loan portfolios could face significant losses, potentially impacting their financial stability and lending capacity. This could lead to a credit crunch, making it harder for businesses and consumers to access credit.

- Affect Consumer Spending: Reduced access to credit could dampen consumer spending, a crucial driver of economic growth. This decreased spending could further exacerbate economic slowdown.

Comparison to the 2008 Mortgage Crisis: Key Differences and Similarities

While the current situation shares some similarities with the 2008 subprime mortgage crisis, there are also crucial differences. The auto loan market is significantly smaller than the mortgage market, and auto loans are typically secured by the vehicle itself, offering some mitigation against losses. However, the interconnectedness of the financial system means that a significant disruption in one sector can still have wider ramifications.

Will it Trigger a Recession? The Verdict is Still Out

Predicting whether a subprime auto lender collapse will trigger a recession is challenging. The severity of the impact will depend on several factors, including the extent of defaults, the resilience of the financial system, and the government's response. While a full-blown recession might not be inevitable, the risks are significant and warrant close monitoring. Experts are divided on the likelihood, with some predicting a mild slowdown while others express more serious concerns.

Staying Informed and Taking Action:

Staying informed about economic developments and understanding your personal financial situation is crucial. Consider reviewing your personal finances, including any outstanding loans, and explore options for managing debt if you're experiencing financial difficulties. Consulting with a financial advisor can provide personalized guidance and help you navigate the current economic climate. The future remains uncertain, but proactive planning can mitigate potential risks.

(Disclaimer: This article provides general information and should not be considered financial advice. Consult with a financial professional for personalized guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Subprime Auto Lender Collapse: Will It Trigger A Recession?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

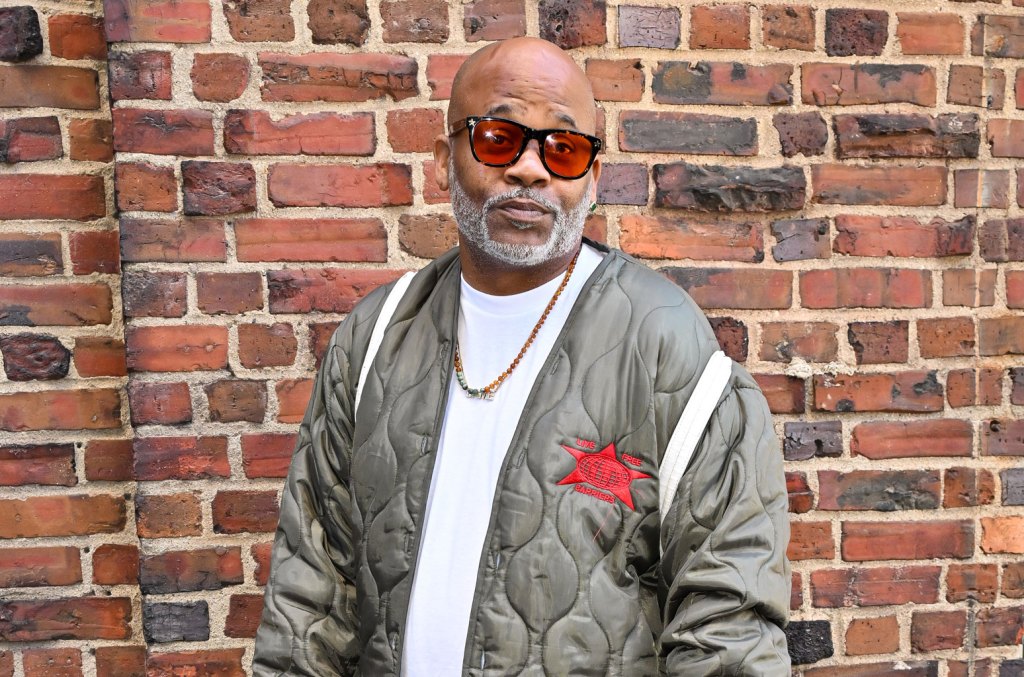

Dame Dash Slams Cam Rons Collaboration With 50 Cent On Paid In Full Series

Sep 14, 2025

Dame Dash Slams Cam Rons Collaboration With 50 Cent On Paid In Full Series

Sep 14, 2025 -

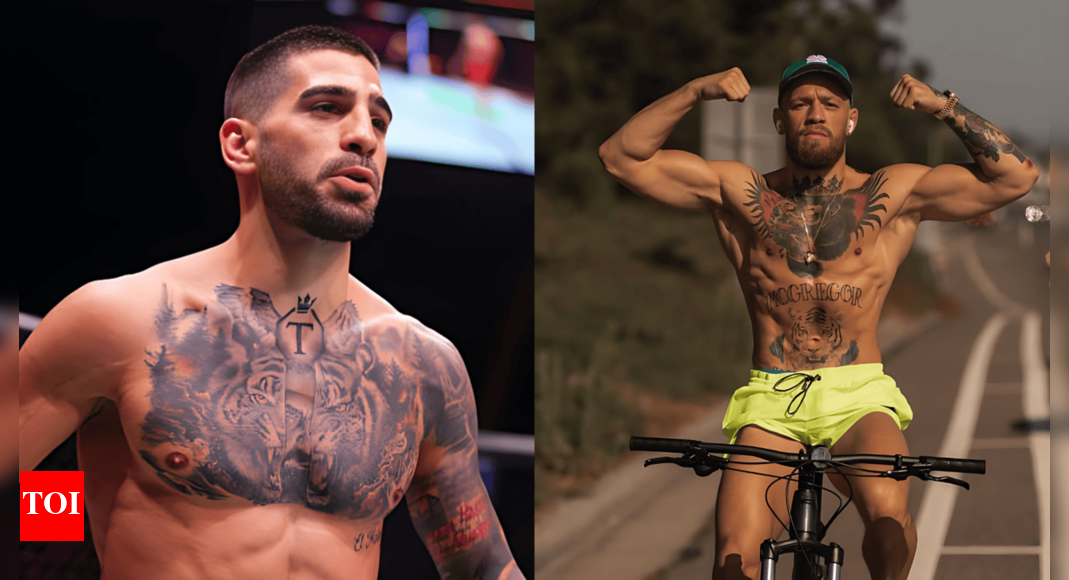

Ilia Topurias Presidential Ambitions A Mc Gregor Esque Campaign

Sep 14, 2025

Ilia Topurias Presidential Ambitions A Mc Gregor Esque Campaign

Sep 14, 2025 -

Water Restrictions Force Ban On Tanker Deliveries To Billionaires Estate

Sep 14, 2025

Water Restrictions Force Ban On Tanker Deliveries To Billionaires Estate

Sep 14, 2025 -

Canelo Alvarezs Reaction Surprised By Terence Crawfords Family Size

Sep 14, 2025

Canelo Alvarezs Reaction Surprised By Terence Crawfords Family Size

Sep 14, 2025 -

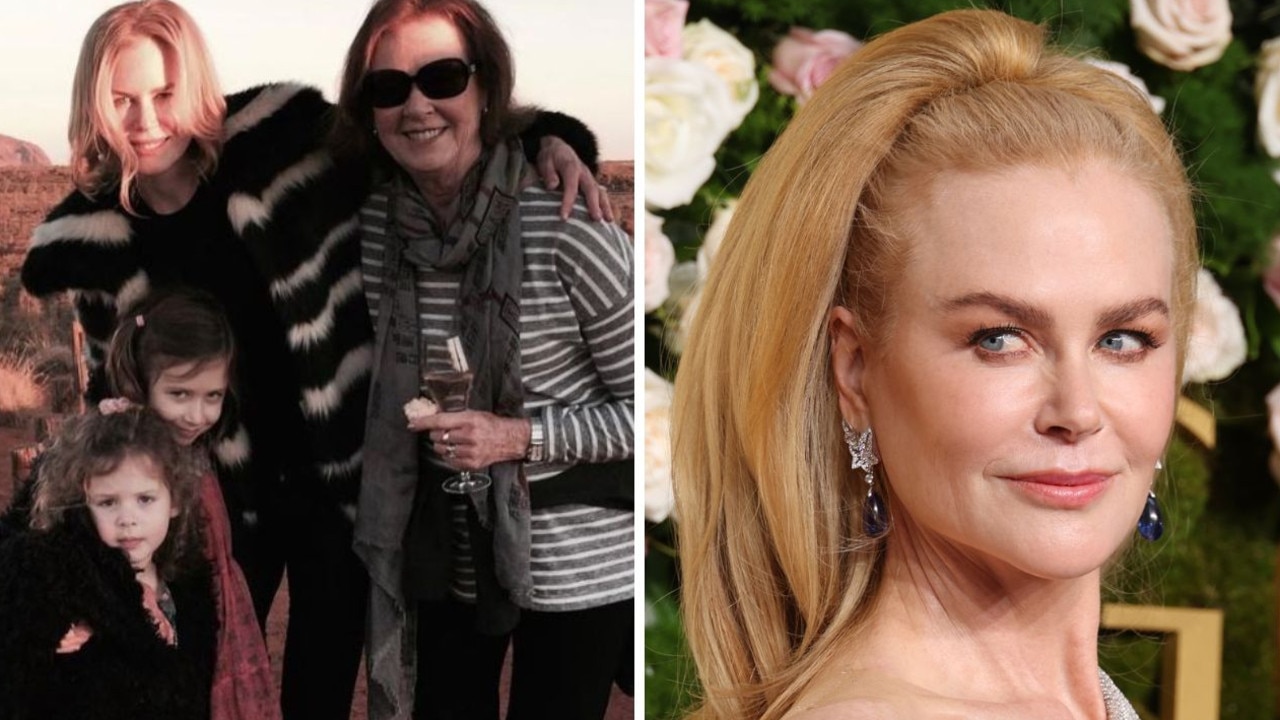

Nicole Kidman And Adoption Addressing The Cold Shoulder Claims

Sep 14, 2025

Nicole Kidman And Adoption Addressing The Cold Shoulder Claims

Sep 14, 2025

Latest Posts

-

Epstein Emails Bbc Report Sheds Light On Starmers Defence Of Mandelson

Sep 14, 2025

Epstein Emails Bbc Report Sheds Light On Starmers Defence Of Mandelson

Sep 14, 2025 -

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025 -

Erika Kirk Honors Charlie Kirks Memory And Work

Sep 14, 2025

Erika Kirk Honors Charlie Kirks Memory And Work

Sep 14, 2025 -

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025 -

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025