Subprime Auto Loan Defaults Rise: Impact On The Economy And Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Subprime Auto Loan Defaults Rise: A Looming Economic Storm?

The rising tide of subprime auto loan defaults is sending ripples through the economy, impacting both lenders and borrowers alike. This alarming trend, fueled by a combination of factors, presents a significant challenge to financial stability and consumer well-being. Understanding the causes and consequences is crucial for navigating this increasingly precarious situation.

The Surge in Defaults: A Deeper Dive

Subprime auto loans, extended to borrowers with lower credit scores and higher risk profiles, have seen a dramatic increase in defaults in recent months. This isn't simply a minor fluctuation; industry experts are expressing serious concerns about the potential for a wider economic impact. Several key factors contribute to this surge:

-

Inflationary Pressures: Soaring inflation has significantly reduced disposable income for many consumers. Facing higher prices for groceries, gas, and housing, many borrowers find it increasingly difficult to meet their monthly loan payments.

-

Rising Interest Rates: The Federal Reserve's efforts to combat inflation through interest rate hikes have made existing loans more expensive, exacerbating the financial strain on borrowers. This makes it harder to stay current on payments, leading to defaults.

-

Used Car Prices Cooling: While used car prices have begun to cool down from their pandemic highs, they still remain elevated compared to pre-pandemic levels. This means borrowers who financed vehicles at inflated prices are now struggling to keep up with payments, even if their incomes remain stable.

-

Supply Chain Issues Lingering: While somewhat abated, lingering supply chain issues continue to impact the availability of new and used vehicles. This limits options for borrowers facing repossession and needing a replacement vehicle.

The Economic Fallout: Beyond the Auto Industry

The consequences of rising subprime auto loan defaults extend far beyond the automotive industry. The impact is felt across various sectors:

-

Financial Institutions: Lenders are facing increasing losses as defaults mount, potentially impacting their profitability and stability. This could trigger a chain reaction impacting the broader financial system. [Link to article on financial market stability].

-

Used Car Market: The increased supply of repossessed vehicles could further depress used car prices, creating a negative feedback loop for borrowers struggling to manage their loans.

-

Consumer Confidence: The rising number of defaults contributes to a general sense of economic uncertainty, impacting consumer confidence and spending.

What Can Consumers Do?

If you're struggling to make your auto loan payments, it's crucial to act proactively:

-

Contact Your Lender Immediately: Don't wait until you're in default. Contact your lender to explore options like loan modification or forbearance.

-

Create a Budget: Assess your income and expenses to identify areas where you can cut back.

-

Seek Credit Counseling: A credit counselor can help you develop a plan to manage your debt and improve your financial situation. [Link to reputable credit counseling organization].

Looking Ahead: A Time for Prudence

The increase in subprime auto loan defaults signals a potential economic challenge. While the full extent of the impact remains to be seen, proactive measures by both lenders and borrowers are crucial to mitigate the risks and prevent a wider economic downturn. Close monitoring of the situation and responsible lending practices are essential in navigating these turbulent times. Further research into the correlation between inflation and consumer debt is needed to fully understand the underlying causes and inform future policy decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Subprime Auto Loan Defaults Rise: Impact On The Economy And Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Terence Crawfords Family Tree His Partner Children And Parents

Sep 14, 2025

Terence Crawfords Family Tree His Partner Children And Parents

Sep 14, 2025 -

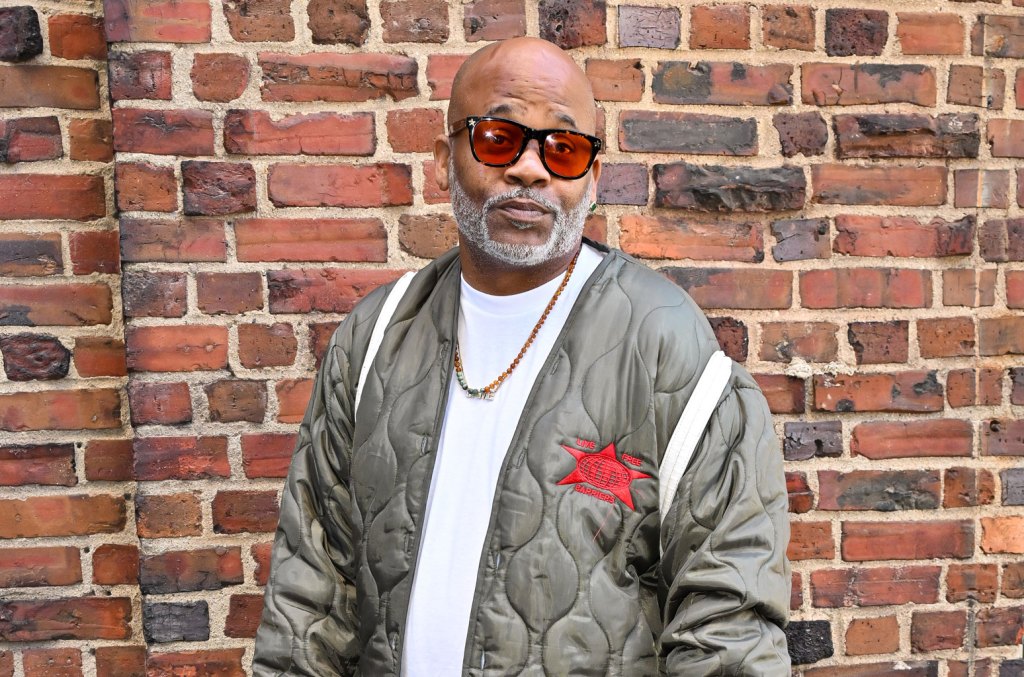

50 Is Now Your New Boss Dame Dash Attacks Cam Rons Paid In Full Deal

Sep 14, 2025

50 Is Now Your New Boss Dame Dash Attacks Cam Rons Paid In Full Deal

Sep 14, 2025 -

Protein Overload Negative Impacts On Your Health

Sep 14, 2025

Protein Overload Negative Impacts On Your Health

Sep 14, 2025 -

Nine Met Police Officers Suspended Following Bbcs Allegations

Sep 14, 2025

Nine Met Police Officers Suspended Following Bbcs Allegations

Sep 14, 2025 -

Jovic Vs Arango Final Del Gdl Open Akron 2025

Sep 14, 2025

Jovic Vs Arango Final Del Gdl Open Akron 2025

Sep 14, 2025

Latest Posts

-

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025 -

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025 -

Social Media Outrage 50 Cent And Styles Ps Response To Charlie Kirks Death

Sep 14, 2025

Social Media Outrage 50 Cent And Styles Ps Response To Charlie Kirks Death

Sep 14, 2025 -

Brazils Bolsonaro Trial A Warning Sign For Trump Supporters

Sep 14, 2025

Brazils Bolsonaro Trial A Warning Sign For Trump Supporters

Sep 14, 2025 -

2025 Emmy Awards Your Complete Guide To Watching Nominees And More

Sep 14, 2025

2025 Emmy Awards Your Complete Guide To Watching Nominees And More

Sep 14, 2025