Surging Oil Prices: A New Economic War For America?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Surging Oil Prices: A New Economic War for America?

The price of oil is soaring, leaving many Americans wondering if this is simply a market fluctuation or the opening salvo in a new economic war. The recent surge has sent shockwaves through the economy, impacting everything from gasoline prices at the pump to the cost of everyday goods. But is this purely a matter of supply and demand, or is there a more sinister geopolitical game at play?

The Current Crisis: More Than Just Supply and Demand?

The immediate cause of the price hike is multifaceted. The ongoing war in Ukraine has significantly disrupted global oil supplies, with Russia, a major oil producer, facing extensive sanctions. This reduced supply has directly impacted global markets, leading to increased demand and higher prices. Furthermore, OPEC+ production cuts haven't helped alleviate the situation, adding fuel to the fire, literally.

However, some analysts argue that the situation is more complex than a simple supply-demand imbalance. The escalating geopolitical tensions between the US and other global powers, particularly Russia and potentially China, are adding an element of uncertainty and fear to the market. This uncertainty drives up prices as investors seek safer havens for their money.

Impact on the American Economy: A Ripple Effect

The consequences for the American economy are significant and far-reaching. Higher gasoline prices directly impact consumers, reducing their disposable income and potentially slowing down consumer spending, a key driver of the US economy. This "inflationary pressure" affects everything from food prices (transportation costs are a major factor) to manufacturing costs, ultimately impacting the price of goods across the board.

- Increased Transportation Costs: Higher fuel prices increase the cost of transporting goods, impacting businesses of all sizes and potentially leading to job losses.

- Reduced Consumer Spending: With less money in their pockets, consumers are likely to cut back on non-essential spending, affecting businesses reliant on consumer demand.

- Inflationary Spiral: The rising cost of oil contributes to overall inflation, potentially leading to a dangerous inflationary spiral if not properly managed.

Is This an Economic War?

While not a declared war in the traditional sense, the current situation presents many characteristics of economic warfare. The use of oil as a geopolitical weapon, coupled with strategic production cuts and sanctions, suggests a deliberate effort to exert economic influence and pressure. Whether this is a calculated strategy or a consequence of geopolitical instability remains a subject of debate amongst experts.

Looking Ahead: Potential Solutions and Mitigation Strategies

Addressing the current oil crisis requires a multi-pronged approach:

- Diversifying Energy Sources: Investing heavily in renewable energy sources like solar and wind power can reduce reliance on volatile oil markets. This long-term strategy is crucial for energy independence and economic stability.

- Strategic Reserves: Utilizing strategic oil reserves can provide temporary relief during times of crisis, but this is a short-term solution and shouldn't be relied upon long-term.

- International Cooperation: Strengthening international cooperation to ensure stable energy markets is crucial. This requires diplomatic efforts to de-escalate geopolitical tensions and foster cooperation among oil-producing nations.

- Investing in Energy Efficiency: Improving energy efficiency in homes, businesses, and transportation can significantly reduce oil consumption and lessen the impact of price fluctuations.

The surging oil prices pose a serious challenge to the American economy. While the immediate cause is a complex interplay of supply and demand factors, the underlying geopolitical tensions cannot be ignored. Addressing this crisis requires a combination of short-term mitigation strategies and long-term investments in energy independence and diversification. The question of whether this is a new economic war remains open to interpretation, but the economic consequences are undeniable and demand urgent attention. Learn more about energy independence initiatives by exploring [link to a relevant government website or reputable news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Surging Oil Prices: A New Economic War For America?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mariners Offensive Explosion 14 6 Rout Of Cubs

Jun 24, 2025

Mariners Offensive Explosion 14 6 Rout Of Cubs

Jun 24, 2025 -

Reds Cut Ties With Candelario A 45 M Sunk Cost Explained

Jun 24, 2025

Reds Cut Ties With Candelario A 45 M Sunk Cost Explained

Jun 24, 2025 -

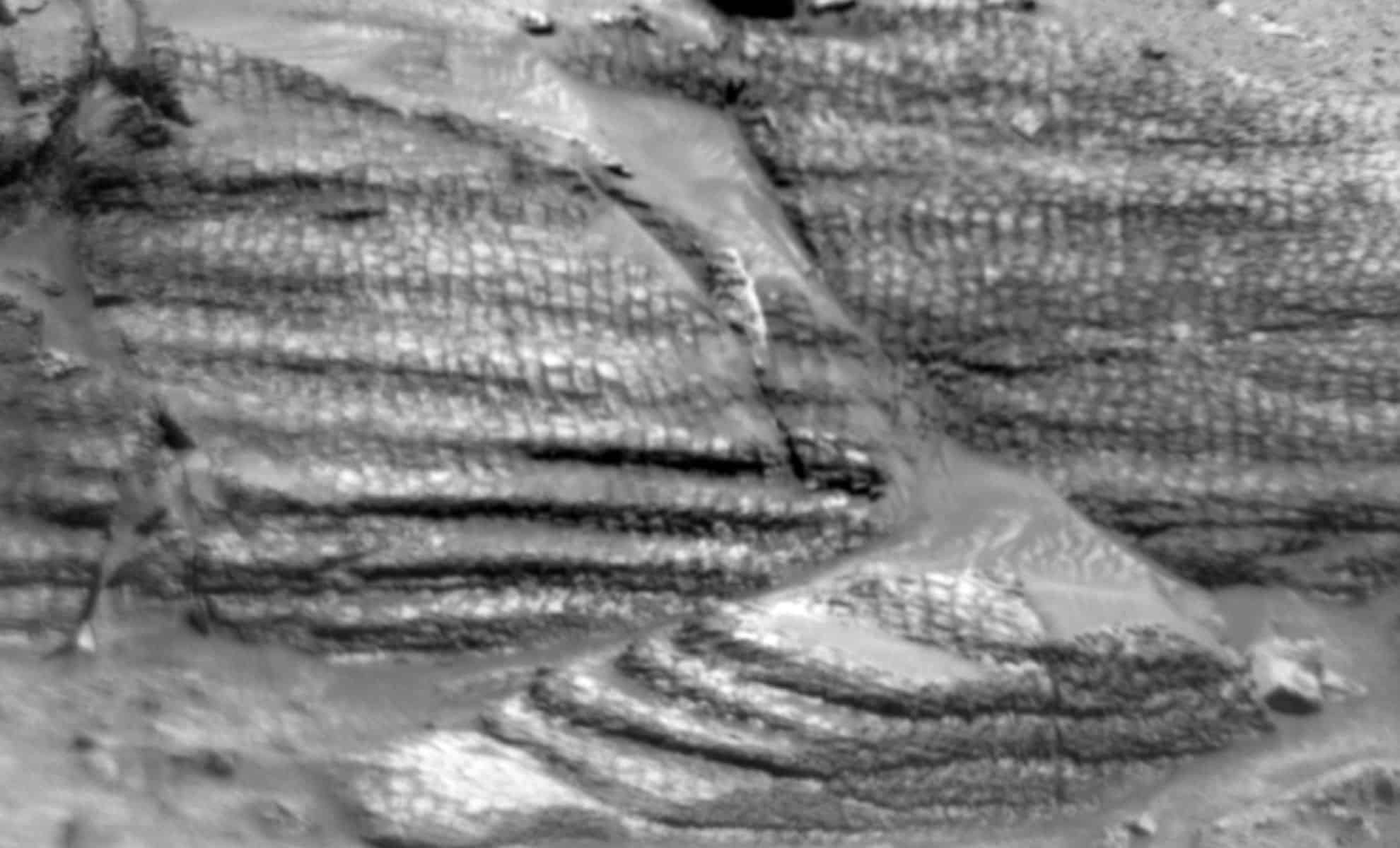

Curiosity Rovers Martian Parking Spot Yields Unprecedented Discovery

Jun 24, 2025

Curiosity Rovers Martian Parking Spot Yields Unprecedented Discovery

Jun 24, 2025 -

Cincinnati Reds Designate Garrett Hampson For Assignment Whats Next

Jun 24, 2025

Cincinnati Reds Designate Garrett Hampson For Assignment Whats Next

Jun 24, 2025 -

Jon Jones Retirement The Goat Hangs Up His Gloves

Jun 24, 2025

Jon Jones Retirement The Goat Hangs Up His Gloves

Jun 24, 2025

Latest Posts

-

Basket Case Titans Des Haslers Future Hangs In The Balance

Jun 25, 2025

Basket Case Titans Des Haslers Future Hangs In The Balance

Jun 25, 2025 -

Love Island Usa Beyond The Villa Release Date And Cast Revealed

Jun 25, 2025

Love Island Usa Beyond The Villa Release Date And Cast Revealed

Jun 25, 2025 -

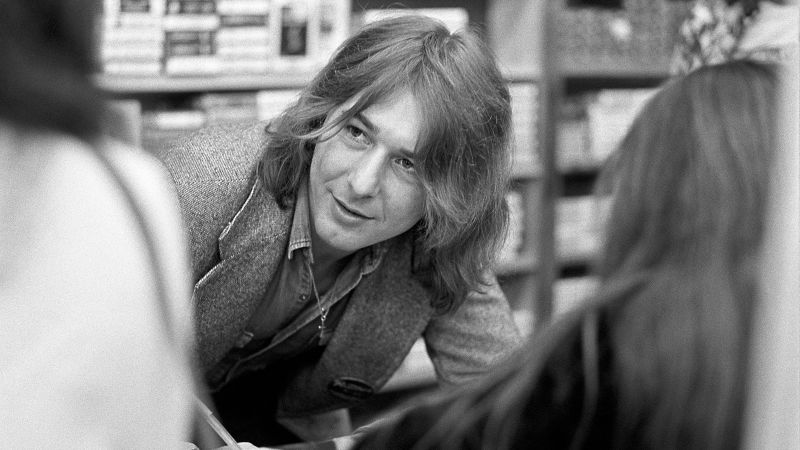

Remembering Mick Ralphs A Legacy In Rock With Bad Company And Mott The Hoople

Jun 25, 2025

Remembering Mick Ralphs A Legacy In Rock With Bad Company And Mott The Hoople

Jun 25, 2025 -

Two Space X Launches Today Axiom Crew And Starlink Deployment In Florida

Jun 25, 2025

Two Space X Launches Today Axiom Crew And Starlink Deployment In Florida

Jun 25, 2025 -

Heatwave Emergency 16 Hospitalized After New Jersey Graduation Ceremonies

Jun 25, 2025

Heatwave Emergency 16 Hospitalized After New Jersey Graduation Ceremonies

Jun 25, 2025