Tackling College Tuition: Innovative 529 Plan Uses By Ohio Parents

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tackling College Tuition: Innovative 529 Plan Uses by Ohio Parents

Are you an Ohio parent worried about soaring college tuition costs? You're not alone. The rising price of higher education is a major concern for families across the nation, but Ohio parents have a powerful tool at their disposal: the 529 college savings plan. However, many are unaware of the innovative and often overlooked ways these plans can be used to maximize savings and navigate the complexities of funding a child's education. This article explores some creative strategies Ohio parents are employing to make the most of their 529 plans.

Understanding Ohio's 529 Plan: The Ohio Tuition Trust Authority (OTTA)

Ohio's 529 plan, managed by the Ohio Tuition Trust Authority (OTTA), offers tax-advantaged savings for qualified higher education expenses. This means earnings grow tax-free, and withdrawals used for tuition, fees, books, and other qualified expenses are also tax-free at the federal level. Ohio residents also benefit from state tax deductions on contributions. This makes it a crucial component of any Ohio family's college savings strategy. [Link to OTTA website]

Beyond the Basics: Innovative 529 Plan Uses

While many parents use 529 plans solely for tuition, savvy Ohio families are finding creative ways to leverage their plans:

1. K-12 Tuition: Did you know that some 529 plans can be used for K-12 tuition expenses? While not all expenses are covered, many private schools and certain qualifying educational expenses can be paid using 529 funds. This allows for earlier planning and potentially reduces the overall financial burden.

2. Room and Board: Room and board are significant college costs. Your 529 plan can cover these expenses, easing the financial strain on your family. Remember to keep accurate records of expenses to claim tax benefits.

3. Scholarships and Grants: Even if your child receives financial aid, a 529 plan can supplement the funds received. This allows your child to choose the college that best suits them without being restricted by financial limitations.

4. Changing Educational Paths: Life happens. If your child decides to pursue a different educational path than initially planned (e.g., trade school instead of a four-year university), 529 plan funds can often still be used to cover qualified expenses.

5. Beneficiary Changes: While initially designated for one child, the beneficiary of an Ohio 529 plan can be changed to another family member, providing flexibility for future generations.

Maximizing Your 529 Plan's Potential

To truly maximize the benefits of your Ohio 529 plan:

- Start early: The earlier you start saving, the more time your investments have to grow. Even small, regular contributions can add up significantly over time.

- Consider your risk tolerance: Choose an investment strategy that aligns with your risk tolerance and your child's timeline for college.

- Keep track of your contributions and withdrawals: Maintaining detailed records is crucial for tax purposes.

- Explore potential state tax benefits: Familiarize yourself with any additional state tax advantages offered by Ohio beyond the federal tax benefits.

- Seek professional advice: Consult a financial advisor to create a personalized college savings plan that meets your family's specific needs.

Conclusion:

Ohio's 529 plan is a powerful tool for parents aiming to secure their children's futures. By understanding its various applications and employing smart strategies, Ohio parents can significantly reduce the financial burden of higher education. Don't just save for college; strategically invest in your child's education with the help of your Ohio 529 plan. Start planning today! [Link to a reputable financial planning resource]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tackling College Tuition: Innovative 529 Plan Uses By Ohio Parents. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Raw Video Of Ross Monaghan Shooting Appears On Spanish Tv Public Outrage

Jun 04, 2025

Raw Video Of Ross Monaghan Shooting Appears On Spanish Tv Public Outrage

Jun 04, 2025 -

Olympic Diver Tom Daley Opens Up About Identity And Family

Jun 04, 2025

Olympic Diver Tom Daley Opens Up About Identity And Family

Jun 04, 2025 -

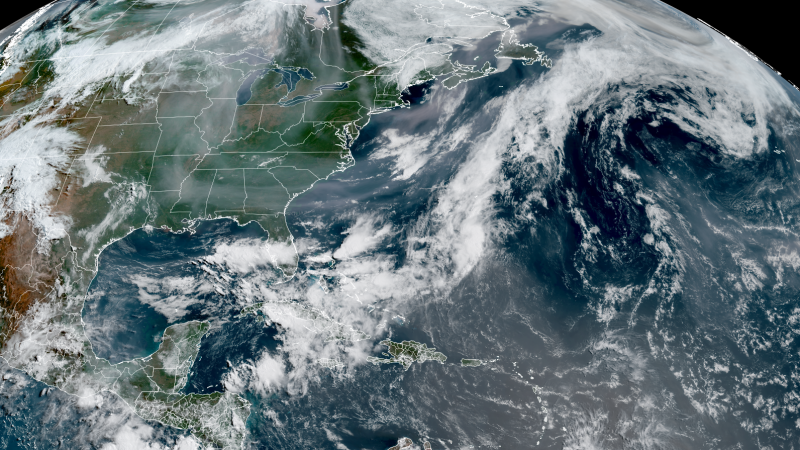

Southern Us Faces Air Pollution Crisis Wildfire Smoke Meets African Dust Plume

Jun 04, 2025

Southern Us Faces Air Pollution Crisis Wildfire Smoke Meets African Dust Plume

Jun 04, 2025 -

Tom Daley On His Ideal Biopic Casting Tom Holland

Jun 04, 2025

Tom Daley On His Ideal Biopic Casting Tom Holland

Jun 04, 2025 -

A1 Newcastle Collision Police Detain Driver Following Car Crash

Jun 04, 2025

A1 Newcastle Collision Police Detain Driver Following Car Crash

Jun 04, 2025

Latest Posts

-

Pathogen Smuggling Investigation University Of Michigan And Two Chinese Researchers

Jun 06, 2025

Pathogen Smuggling Investigation University Of Michigan And Two Chinese Researchers

Jun 06, 2025 -

Us Supreme Court Heterosexual Woman Loses Reverse Discrimination Case

Jun 06, 2025

Us Supreme Court Heterosexual Woman Loses Reverse Discrimination Case

Jun 06, 2025 -

Daniel Anjorin Murder Prosecution Presents Case Against Marcus Monzo

Jun 06, 2025

Daniel Anjorin Murder Prosecution Presents Case Against Marcus Monzo

Jun 06, 2025 -

Winter Fuel Payment Government Reverses Policy For 2024

Jun 06, 2025

Winter Fuel Payment Government Reverses Policy For 2024

Jun 06, 2025 -

Jessie J Opens Up Revealing Her Fight Against Breast Cancer

Jun 06, 2025

Jessie J Opens Up Revealing Her Fight Against Breast Cancer

Jun 06, 2025