Tax Authorities Scrutinize HS2 Contractors Over Subcontractor Practices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Authorities Scrutinize HS2 Contractors Over Subcontractor Practices

Concerns mount over potential tax avoidance as HMRC investigates the use of subcontractors on the high-speed rail project.

The UK's tax authority, Her Majesty's Revenue and Customs (HMRC), has launched an investigation into the subcontracting practices of contractors working on the High Speed 2 (HS2) rail project. This move follows growing concerns about potential tax avoidance schemes and the exploitation of loopholes within the complex network of companies involved in the massive infrastructure undertaking. The investigation is expected to scrutinize the use of intermediaries and the classification of workers, aiming to ensure all tax liabilities are met.

The multi-billion pound HS2 project, intended to connect London to Birmingham, Manchester, and Leeds, has attracted significant attention, not only for its ambitious scale but also for the complex web of contracting and subcontracting arrangements that underpin its construction. This complexity, while often necessary for managing such a large project, creates opportunities for potential tax evasion and avoidance. HMRC's intervention highlights the increasing pressure on large infrastructure projects to maintain transparency and ethical business practices.

Focus on IR35 and the Gig Economy

A central aspect of HMRC’s investigation is likely to focus on the application of the IR35 legislation. IR35 rules are designed to prevent individuals from disguising employment income as self-employment to avoid paying income tax and National Insurance contributions. The investigation will likely examine whether contractors are correctly classifying their subcontractors under IR35 regulations, particularly those working in roles that resemble traditional employment. The rise of the gig economy and the blurring lines between employment and self-employment have made this area increasingly challenging to navigate.

Furthermore, HMRC is likely to investigate whether contractors are using complex chains of subcontractors to minimize their own tax liabilities and potentially shift the burden onto smaller, less well-resourced companies. This could involve examining intricate corporate structures and the flow of funds to identify potential tax avoidance schemes.

Potential Implications for HS2 and the Construction Industry

The outcome of HMRC's investigation could have significant ramifications for the HS2 project. Any findings of widespread tax avoidance could lead to substantial penalties for involved contractors, potentially delaying the project timeline and increasing its overall cost. Furthermore, the investigation sets a precedent for other large-scale infrastructure projects, sending a clear message about the need for greater transparency and due diligence in subcontracting practices.

The construction industry as a whole will be watching closely. This investigation underscores the growing importance of robust tax compliance within the sector and highlights the need for better internal controls and proactive risk management to prevent future issues.

What's Next?

While the details of the HMRC investigation remain confidential, the move signals a proactive approach to tackling potential tax avoidance within major public projects. The government is under pressure to ensure that taxpayers' money is used efficiently and ethically, and this investigation is a direct response to these concerns. Further updates on the progress and findings of the investigation are expected in due course. We will continue to monitor developments and provide updates as they become available.

Keywords: HS2, HMRC, Tax Avoidance, Subcontractors, IR35, Construction Industry, Tax Investigation, Gig Economy, Infrastructure Projects, Tax Compliance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Authorities Scrutinize HS2 Contractors Over Subcontractor Practices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

College World Series Day 2 Results And Analysis Who Shined Who Faltered

Jun 17, 2025

College World Series Day 2 Results And Analysis Who Shined Who Faltered

Jun 17, 2025 -

Comedian Bill Maher Responds To Anti Trump National Day Of Defiance Protest

Jun 17, 2025

Comedian Bill Maher Responds To Anti Trump National Day Of Defiance Protest

Jun 17, 2025 -

Day 2 Omaha Recap College World Series Standouts And Struggles

Jun 17, 2025

Day 2 Omaha Recap College World Series Standouts And Struggles

Jun 17, 2025 -

Frances President Lands In Greenland A Direct Response To Trumps Eye On The Territory

Jun 17, 2025

Frances President Lands In Greenland A Direct Response To Trumps Eye On The Territory

Jun 17, 2025 -

Child Abuse Case Nursery Worker Roksana Lecka Receives Sentence

Jun 17, 2025

Child Abuse Case Nursery Worker Roksana Lecka Receives Sentence

Jun 17, 2025

Latest Posts

-

From Dream To Disaster The Realities Of Shared Ownership

Jun 18, 2025

From Dream To Disaster The Realities Of Shared Ownership

Jun 18, 2025 -

Rebecca Lobo Caitlin Clark Drives Espn Viewership

Jun 18, 2025

Rebecca Lobo Caitlin Clark Drives Espn Viewership

Jun 18, 2025 -

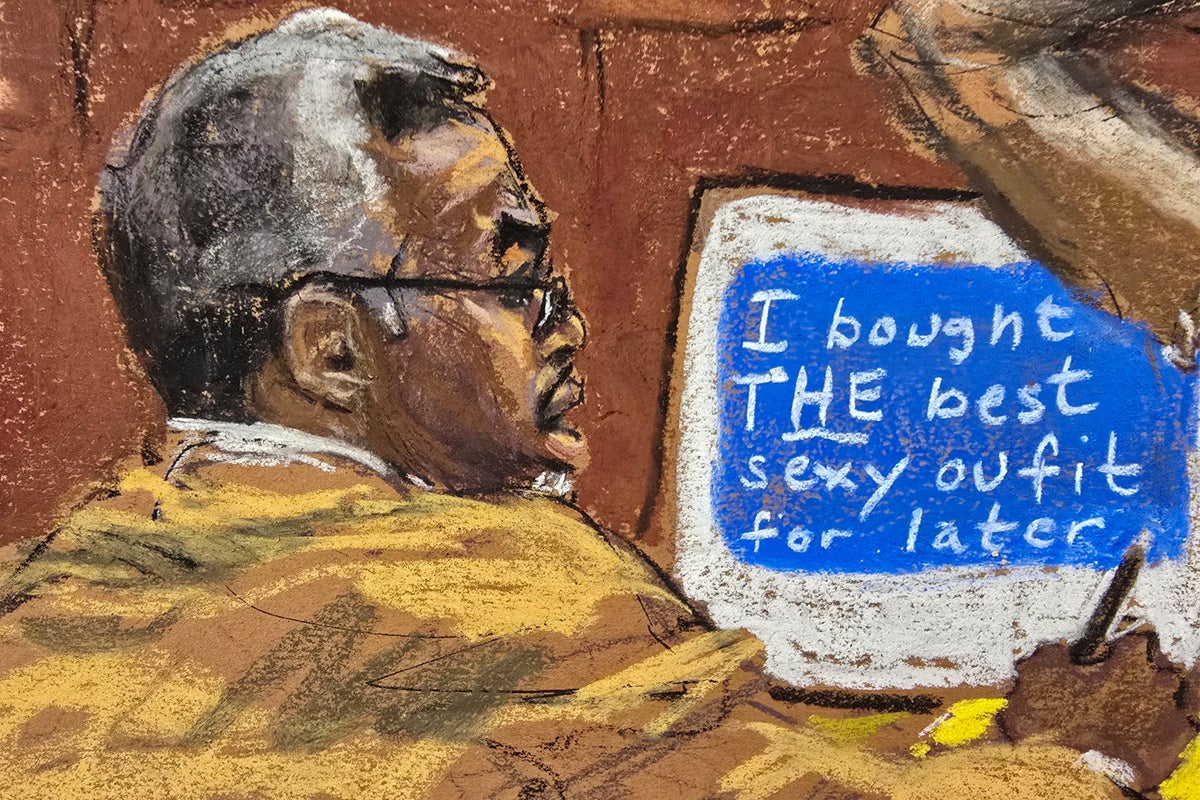

Graphic Footage Dominates Day In Diddys Ongoing Trial

Jun 18, 2025

Graphic Footage Dominates Day In Diddys Ongoing Trial

Jun 18, 2025 -

Mets Face Braves In Pivotal Three Game Series

Jun 18, 2025

Mets Face Braves In Pivotal Three Game Series

Jun 18, 2025 -

40 Year Veteran Judge Rules Nih Grant Cuts Illegal Citing Discrimination

Jun 18, 2025

40 Year Veteran Judge Rules Nih Grant Cuts Illegal Citing Discrimination

Jun 18, 2025