Tax Cuts As The Cornerstone: Dissecting The Trump Administration's Strategy For Its Agenda Law

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Cuts as the Cornerstone: Dissecting the Trump Administration's Strategy for its Agenda Law

The Trump administration's 2017 Tax Cuts and Jobs Act (TCJA) remains a highly debated piece of legislation, lauded by supporters as a cornerstone of economic growth and criticized by opponents for exacerbating income inequality. This article delves into the strategy behind the TCJA, examining its core tenets, its intended impact, and its lasting legacy on the American economy.

The Core Tenets of the TCJA:

The TCJA significantly overhauled the US tax code, implementing several key changes:

- Individual Income Tax Rate Reductions: The act lowered individual income tax rates across the board, impacting various income brackets. This was a central element of the administration's "trickle-down" economic philosophy.

- Corporate Tax Rate Cut: A dramatic reduction in the corporate tax rate from 35% to 21% was a major selling point, aiming to boost business investment and create jobs. This was presented as a crucial step to enhance US global competitiveness.

- Standard Deduction Increase: The standard deduction was significantly increased, simplifying tax filing for many Americans, particularly those with lower incomes. However, critics argued this benefit was overshadowed by other provisions.

- Changes to Itemized Deductions: Several itemized deductions were either limited or eliminated, including the limitation on state and local tax (SALT) deductions, a point of significant contention.

The Trump Administration's Strategic Goals:

The administration presented the TCJA as a multi-pronged strategy aimed at stimulating economic growth:

- Boosting Business Investment: The lower corporate tax rate was intended to incentivize businesses to invest more in equipment, technology, and expansion, leading to job creation and increased productivity.

- Attracting Foreign Investment: A more competitive corporate tax rate was seen as a way to attract foreign investment to the US, further boosting the economy.

- Stimulating Consumer Spending: The individual tax cuts were designed to increase disposable income for American families, encouraging them to spend more, thereby driving economic growth.

Evaluating the Impact and Legacy:

The economic impact of the TCJA is a subject of ongoing debate among economists. While supporters point to increased GDP growth and job creation in the years following its enactment, critics highlight concerns about:

- Increased National Debt: The tax cuts significantly reduced government revenue, contributing to a substantial increase in the national debt. [Link to relevant government data on national debt].

- Income Inequality: Opponents argue the tax cuts disproportionately benefited high-income earners and corporations, widening the gap between the rich and the poor. [Link to studies on income inequality].

- Limited Long-Term Impact: Some economists argue the stimulative effects of the tax cuts were temporary and haven't led to sustained long-term economic growth. [Link to academic papers analyzing long-term economic effects].

Conclusion:

The Trump administration's Tax Cuts and Jobs Act was a bold attempt to reshape the American economy through significant tax reform. While its proponents claim it fueled economic growth and job creation, critics raise valid concerns about its impact on income inequality and the national debt. Understanding the complexities of the TCJA and its lasting legacy requires a nuanced analysis considering both its intended goals and its actual consequences. Further research and long-term economic data are essential to fully assess its overall success. The debate surrounding the TCJA continues to shape economic policy discussions today. What are your thoughts on the long-term effects of this legislation? Share your perspective in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Cuts As The Cornerstone: Dissecting The Trump Administration's Strategy For Its Agenda Law. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigating A Construction Scam A Cowboy Builders Unpunished Crimes

Aug 23, 2025

Investigating A Construction Scam A Cowboy Builders Unpunished Crimes

Aug 23, 2025 -

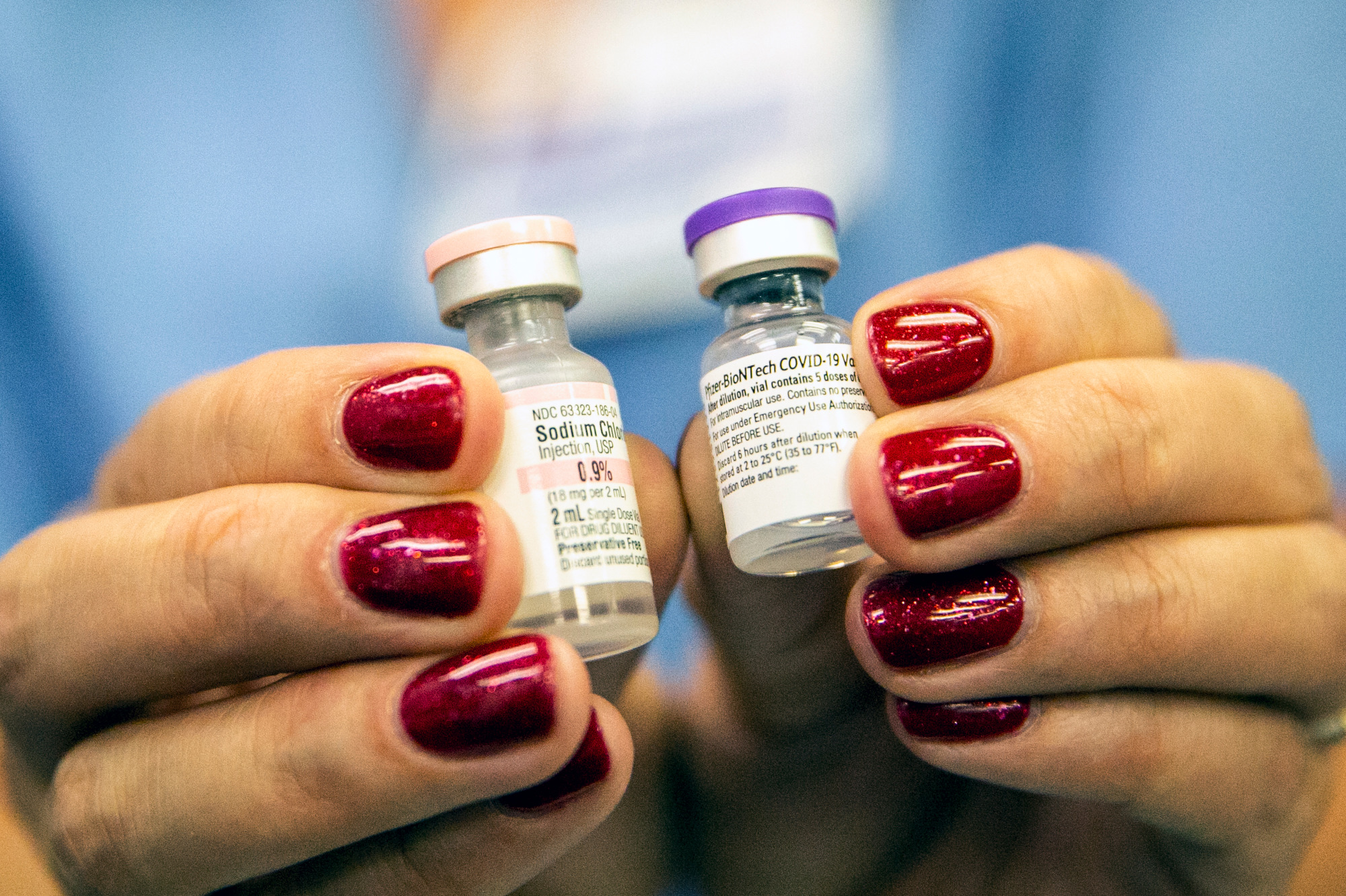

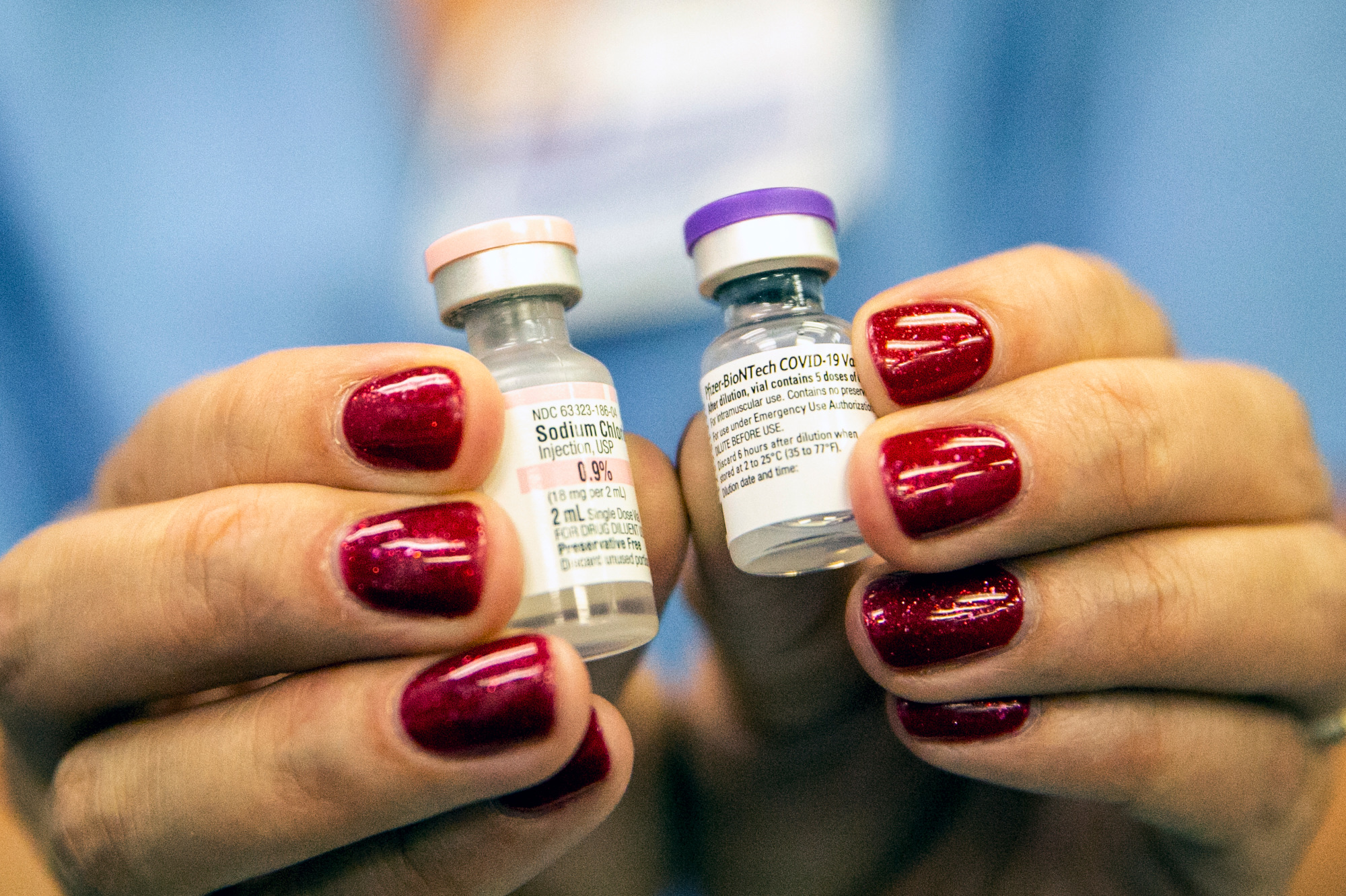

Colorado Doctor Recommends Essential Fall Vaccines For 2024

Aug 23, 2025

Colorado Doctor Recommends Essential Fall Vaccines For 2024

Aug 23, 2025 -

Behind The Scenes Look At Jennifer Aniston And Jim Curtiss Relationship

Aug 23, 2025

Behind The Scenes Look At Jennifer Aniston And Jim Curtiss Relationship

Aug 23, 2025 -

Nebraska Pick 5 Winning Numbers For Thursdays Drawing

Aug 23, 2025

Nebraska Pick 5 Winning Numbers For Thursdays Drawing

Aug 23, 2025 -

Country Star Charley Crockett Beyonces Defender Wallen And Adcocks Critic

Aug 23, 2025

Country Star Charley Crockett Beyonces Defender Wallen And Adcocks Critic

Aug 23, 2025

Latest Posts

-

Hawaii Rainbow Warriors Face Stanford In Season Opener National Tv Broadcast

Aug 23, 2025

Hawaii Rainbow Warriors Face Stanford In Season Opener National Tv Broadcast

Aug 23, 2025 -

Country Star Weighs In Charley Crocketts Public Backing Of Beyonce Amidst Ongoing Debate

Aug 23, 2025

Country Star Weighs In Charley Crocketts Public Backing Of Beyonce Amidst Ongoing Debate

Aug 23, 2025 -

New Couple Alert Jennifer Aniston And Jim Curtiss Adorable Behind The Scenes Video

Aug 23, 2025

New Couple Alert Jennifer Aniston And Jim Curtiss Adorable Behind The Scenes Video

Aug 23, 2025 -

Surge In St Georges And Union Jack Flags Reasons Behind The Increase

Aug 23, 2025

Surge In St Georges And Union Jack Flags Reasons Behind The Increase

Aug 23, 2025 -

Which Fall Vaccines Do I Need A Colorado Doctors Guide

Aug 23, 2025

Which Fall Vaccines Do I Need A Colorado Doctors Guide

Aug 23, 2025