Tax Deductions For Overtime And Tips: What You Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Deductions for Overtime and Tips: What You Need to Know

Are you working overtime and racking up tips, but unsure how it affects your taxes? Navigating the complexities of overtime pay and tip income can be tricky, but understanding the potential tax deductions can significantly impact your bottom line. This guide breaks down everything you need to know about claiming deductions related to your overtime and tips.

Understanding Overtime Pay and Tax Implications

Overtime pay, typically earned for exceeding standard working hours, is considered taxable income. However, while you can't deduct the overtime itself, you can deduct expenses directly related to earning that overtime. This is crucial. Simply working extra hours doesn't qualify for a deduction. The expense must be directly attributable to the overtime work.

What Expenses Are Deductible?

This is where things get specific. Generally, you can't deduct the cost of commuting to your regular job. However, if you incur additional travel expenses solely for overtime work – such as a separate trip to a different work location – these might be deductible as business expenses. This could include:

- Travel: Gas, tolls, parking, and airfare specifically for overtime work at a different location. Keep meticulous records!

- Uniforms/Specialized Clothing: If your overtime work requires specialized clothing not suitable for everyday wear and not reimbursable by your employer, the cost may be deductible. This doesn't usually apply to standard business attire.

- Education/Training: If the overtime involves specialized skills requiring further training or education, some expenses may be deductible. Consult a tax professional for specific guidance on this.

Important Note: Always keep detailed records of all expenses, including receipts, dates, locations, and the direct connection to your overtime work. The IRS requires substantial documentation to support any deduction claims. Failure to provide adequate documentation can result in the denial of your deductions.

Tax Deductions for Tips:

Tips, unlike salary, are often reported differently. Many employers include tips in your overall paycheck, making them subject to the usual income tax. However, if you're required to report tips separately (e.g., through a tip reporting system), understanding the related deductions is crucial.

Unfortunately, there aren't many direct deductions specifically for tips themselves. However, any expenses directly related to earning those tips – such as the purchase of cleaning supplies if you're a server – might be considered deductible business expenses. Again, meticulous record-keeping is essential.

Claiming Your Deductions:

You'll typically claim these deductions on Schedule C (Form 1040), "Profit or Loss from Business," if you're self-employed or an independent contractor, or as a miscellaneous itemized deduction (subject to the 2% AGI threshold) if you're an employee. This can be complex, and seeking professional advice is often beneficial.

When to Seek Professional Help:

Tax laws are constantly evolving. If you have complex income situations, substantial overtime, or significant tip income, consulting a qualified tax professional or accountant is highly recommended. They can help you navigate the intricacies of tax deductions, ensuring you maximize your deductions legally and efficiently. Don't hesitate to ask for clarification on any aspect that seems unclear.

Call to Action: Are you ready to navigate your taxes with confidence? Contact a tax professional today for personalized guidance! [Link to a reputable tax professional resource or a general tax information website - avoid overly promotional links]. Remember, accurate record-keeping is your best defense.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Deductions For Overtime And Tips: What You Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

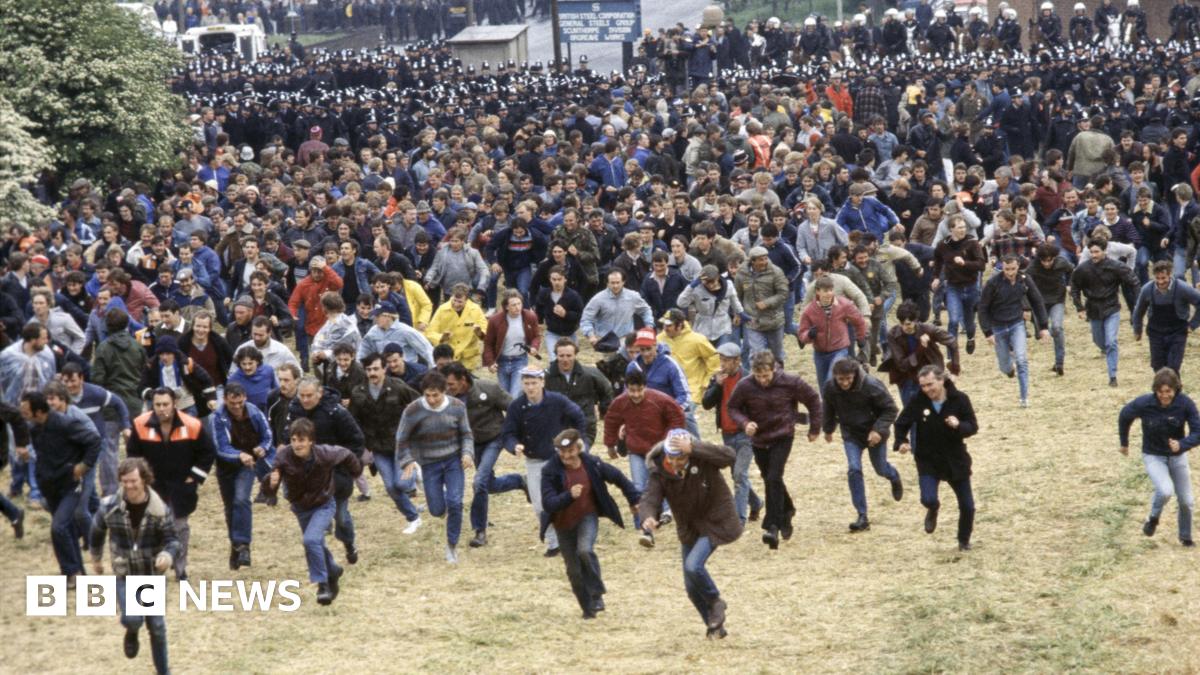

Justice For Orgreave National Inquiry Confirmed By Shadow Home Secretary

Jul 23, 2025

Justice For Orgreave National Inquiry Confirmed By Shadow Home Secretary

Jul 23, 2025 -

Wwe Summer Slam 2024 Two Night Event Coming To Theaters Nationwide

Jul 23, 2025

Wwe Summer Slam 2024 Two Night Event Coming To Theaters Nationwide

Jul 23, 2025 -

Yellowstone Supervolcano Eruption Imminent Examining The Evidence And Fears

Jul 23, 2025

Yellowstone Supervolcano Eruption Imminent Examining The Evidence And Fears

Jul 23, 2025 -

Analyzing The Hype Was Gta Vis Second Trailer Worth The Wait

Jul 23, 2025

Analyzing The Hype Was Gta Vis Second Trailer Worth The Wait

Jul 23, 2025 -

Yellowstone National Park Separating Fact From Fiction Regarding Recent Eruption Fears

Jul 23, 2025

Yellowstone National Park Separating Fact From Fiction Regarding Recent Eruption Fears

Jul 23, 2025

American Dream Fulfilled Normandy Adventure For Two

American Dream Fulfilled Normandy Adventure For Two