Tax Implications Of Overtime Pay And Tips: What Employees Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Implications of Overtime Pay and Tips: What Employees Need to Know

Navigating the complexities of taxes can be daunting, especially when it comes to additional income like overtime pay and tips. Understanding how these earnings are taxed is crucial for accurately budgeting and avoiding unpleasant surprises come tax season. This comprehensive guide breaks down the key tax implications of overtime pay and tips, empowering you to manage your finances effectively.

Overtime Pay: Understanding the Tax Implications

Overtime pay, generally earned for working beyond your regular hours, is subject to the same federal, state, and local income taxes as your regular wages. This means the taxes withheld will be based on your combined regular and overtime earnings, potentially leading to a higher tax burden than anticipated.

- Federal Income Tax: The IRS considers overtime pay as taxable income, and the amount withheld will depend on your filing status, number of allowances, and your overall income level.

- State and Local Taxes: Many states and localities also levy income taxes on overtime pay. The specific tax rates and regulations will vary depending on your location. It's crucial to check your state's tax regulations for precise details.

- Social Security and Medicare Taxes (FICA): Overtime pay is also subject to Social Security and Medicare taxes (FICA). However, there's a cap on the amount of earnings subject to Social Security tax each year. Medicare taxes are applied to all earnings without an annual limit.

Tips: A Separate Tax Consideration

Tips, unlike overtime pay, often require a bit more attention to tax compliance. Many employers include tips reported to them as part of your regular wages, simplifying the tax process. However, if you receive tips directly from customers, you are responsible for reporting them accurately.

- Reporting Tips: Employees are legally required to report all tips received, regardless of whether they're reported to the employer. This is often done using Form 4070, Employee Tip Report, which is usually provided by your employer. Failure to accurately report tips can result in significant penalties.

- Employer Reporting: Your employer might also report tips to the IRS based on credit card charges or other methods. It's crucial to reconcile your reported tips with your employer's records to prevent discrepancies.

- Tax Withholding on Tips: While some employers may withhold taxes from your reported tips, you may also need to adjust your W-4 form to reflect your total income, including tips, to ensure proper tax withholding throughout the year.

Minimizing Tax Burden: Practical Strategies

While paying taxes is unavoidable, there are strategies you can employ to minimize your tax burden:

- Review Your W-4: Regularly review your W-4 form to ensure the withholdings accurately reflect your income, including overtime and tips. Adjusting your allowances can help optimize your tax withholdings.

- Tax Planning: Consulting with a tax professional can help you understand your specific tax situation and develop a personalized tax plan. They can advise you on deductions and credits you might be eligible for.

- Keep Detailed Records: Meticulously maintain records of your overtime pay and tips received. This will simplify tax preparation and prevent potential issues during an audit.

Key Takeaways:

- Overtime pay is taxed as regular income.

- Tips must be accurately reported to the IRS, even if not reported to your employer.

- Regular review of your W-4 and consulting a tax professional are beneficial strategies.

Understanding the tax implications of overtime pay and tips is vital for responsible financial management. By staying informed and taking proactive steps, you can ensure accurate tax reporting and avoid potential penalties. For personalized advice, consider consulting with a qualified tax advisor. They can provide tailored guidance based on your specific circumstances and help you navigate the complexities of tax law.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Implications Of Overtime Pay And Tips: What Employees Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Vaibhav Suryavanshis Dominance A Comparison To Tendulkar And Kohli

Jul 22, 2025

Vaibhav Suryavanshis Dominance A Comparison To Tendulkar And Kohli

Jul 22, 2025 -

Birth Rate Decline A Global Threat And The U S Response

Jul 22, 2025

Birth Rate Decline A Global Threat And The U S Response

Jul 22, 2025 -

Los Angeles Emergency Response To Vehicle Collision A Scene Of Chaos

Jul 22, 2025

Los Angeles Emergency Response To Vehicle Collision A Scene Of Chaos

Jul 22, 2025 -

The Fallout Andy Byron Tech Ceo Resigns Over Viral Coldplay Incident

Jul 22, 2025

The Fallout Andy Byron Tech Ceo Resigns Over Viral Coldplay Incident

Jul 22, 2025 -

Heavyweight Boxing Usyks Victory A Second Reign As Undisputed Champion

Jul 22, 2025

Heavyweight Boxing Usyks Victory A Second Reign As Undisputed Champion

Jul 22, 2025

Latest Posts

-

Archaeological Discovery A Secret Tunnel System Beneath Rome

Jul 25, 2025

Archaeological Discovery A Secret Tunnel System Beneath Rome

Jul 25, 2025 -

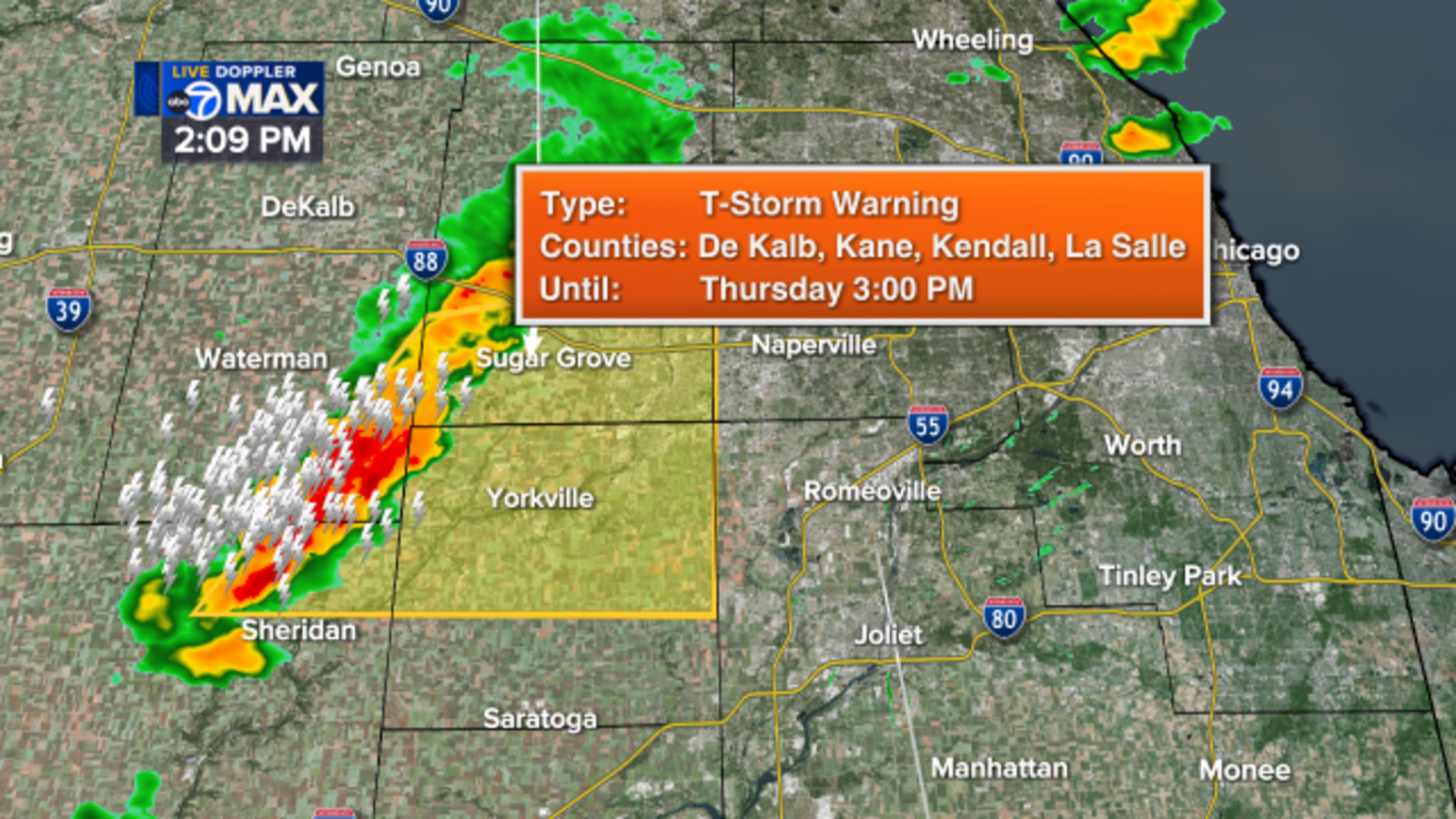

Chicago Heat Advisory 100 Heat Index Expected Thursday

Jul 25, 2025

Chicago Heat Advisory 100 Heat Index Expected Thursday

Jul 25, 2025 -

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025 -

American Dream Fulfilled Normandy Adventure For Two

Jul 25, 2025

American Dream Fulfilled Normandy Adventure For Two

Jul 25, 2025