Taxman Targets HS2 Contractors: Issues With Subcontractor Compliance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Taxman Targets HS2 Contractors: Issues with Subcontractor Compliance

The UK's tax authority, HMRC, is intensifying its scrutiny of contractors working on the High Speed 2 (HS2) rail project, focusing on compliance issues related to subcontractors. This crackdown highlights growing concerns about potential tax evasion and avoidance within the complex supply chain of one of Britain's largest infrastructure projects. The move signals a significant shift in HMRC's approach, emphasizing proactive investigation and prevention rather than simply reacting to reported irregularities.

HMRC's Increased Scrutiny: A Proactive Approach

HMRC's investigation isn't merely a response to isolated incidents; it represents a broader strategy to ensure tax compliance across large-scale infrastructure projects. The sheer scale and complexity of HS2, with its numerous contractors and subcontractors, presents a unique challenge for tax enforcement. This proactive approach involves:

- Data analysis: HMRC is leveraging sophisticated data analytics to identify potential discrepancies and high-risk areas within the HS2 supply chain. This includes examining payment records, invoices, and other financial documentation.

- Targeted audits: Instead of broad-brush audits, HMRC is focusing its resources on specific contractors and subcontractors identified as potentially non-compliant through data analysis.

- Increased collaboration: HMRC is working more closely with HS2 Ltd and other relevant authorities to share information and coordinate enforcement efforts. This collaborative approach aims to streamline investigations and improve efficiency.

The Challenges of Subcontractor Compliance

The complexities inherent in managing a vast network of subcontractors present significant challenges for main contractors. Ensuring that every subcontractor is meeting its tax obligations can be a monumental task, often involving:

- Lack of visibility: Main contractors may lack complete visibility into the financial practices of their subcontractors, making it difficult to identify potential tax compliance issues.

- Inadequate due diligence: Insufficient due diligence during the subcontractor selection process can lead to inadvertently engaging with companies with a history of tax non-compliance.

- Complex payment structures: Intricate payment structures and multiple layers of sub-contracting can obscure tax liabilities and make it harder to track payments.

The Implications for HS2 and the Wider Construction Industry

The HMRC crackdown on HS2 contractors sends a clear message to the entire construction industry: tax compliance will be rigorously enforced. Failure to comply can result in significant penalties, reputational damage, and even contract termination. This increased scrutiny is likely to:

- Drive improved compliance: Contractors will be incentivized to implement robust systems to ensure their subcontractors are meeting their tax obligations.

- Increase costs: The added administrative burden of stricter compliance measures may lead to increased costs for contractors.

- Promote transparency: Greater transparency and accountability within the construction industry’s supply chains are expected as a result.

Looking Ahead: A Call for Industry-Wide Reform?

The HS2 situation highlights the need for more effective mechanisms to ensure tax compliance throughout large-scale infrastructure projects. Industry bodies and government agencies should collaborate to develop strategies that improve transparency and simplify the process of verifying subcontractor compliance. This might include developing standardized reporting requirements and providing greater support to smaller subcontractors in navigating tax regulations. The future of large-scale infrastructure projects depends on a robust and transparent tax compliance framework. This proactive approach by HMRC sets a precedent for other major construction projects across the UK.

Keywords: HS2, HMRC, Tax evasion, Subcontractor compliance, Construction industry, Tax investigation, Infrastructure projects, Tax avoidance, UK tax, Data analytics, Due diligence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Taxman Targets HS2 Contractors: Issues With Subcontractor Compliance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fear And Uncertainty The Impact Of Israeli Strikes On Iranian Daily Life

Jun 17, 2025

Fear And Uncertainty The Impact Of Israeli Strikes On Iranian Daily Life

Jun 17, 2025 -

Second Act In France An American Womans Transformative Move At 80

Jun 17, 2025

Second Act In France An American Womans Transformative Move At 80

Jun 17, 2025 -

Solidarity With Greenland French Presidents Visit Amidst Growing Tensions

Jun 17, 2025

Solidarity With Greenland French Presidents Visit Amidst Growing Tensions

Jun 17, 2025 -

Dungeons And Dragons Alumni Join Critical Roles Growing Team

Jun 17, 2025

Dungeons And Dragons Alumni Join Critical Roles Growing Team

Jun 17, 2025 -

Key Witness In Ukraine War Crimes Trial Russian Soldier Describes Execution

Jun 17, 2025

Key Witness In Ukraine War Crimes Trial Russian Soldier Describes Execution

Jun 17, 2025

Latest Posts

-

Critics Weigh In Early Reviews For The F1 Movie Ahead Of Its New York Debut

Jun 17, 2025

Critics Weigh In Early Reviews For The F1 Movie Ahead Of Its New York Debut

Jun 17, 2025 -

Major Shift In D And D Top Designers Transition From Wizards To Critical Role

Jun 17, 2025

Major Shift In D And D Top Designers Transition From Wizards To Critical Role

Jun 17, 2025 -

Philadelphia Phillies Vs Miami Marlins Your Guide To Betting Odds And Predictions

Jun 17, 2025

Philadelphia Phillies Vs Miami Marlins Your Guide To Betting Odds And Predictions

Jun 17, 2025 -

Critical Role Expands Team With Key Dungeons And Dragons Hires

Jun 17, 2025

Critical Role Expands Team With Key Dungeons And Dragons Hires

Jun 17, 2025 -

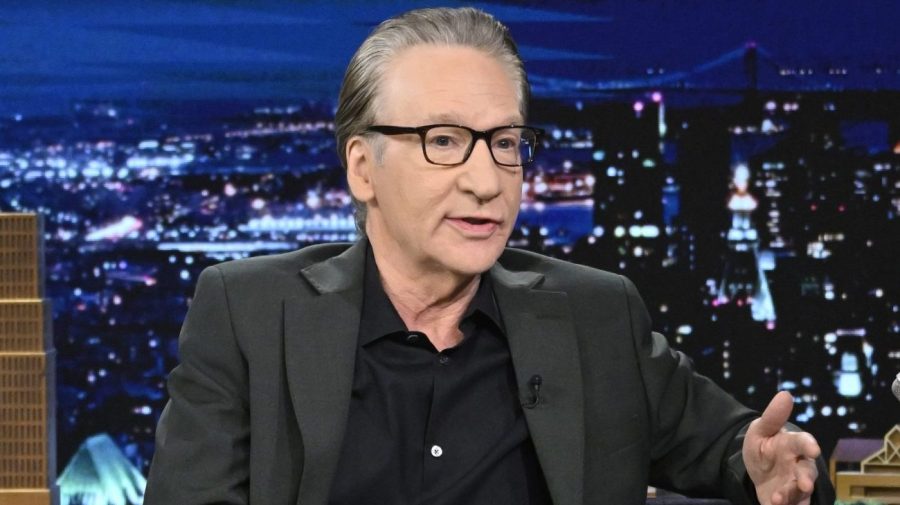

Bill Mahers Controversial Take Applauding The Trump Parade Yet Decrying Tanks In The Streets

Jun 17, 2025

Bill Mahers Controversial Take Applauding The Trump Parade Yet Decrying Tanks In The Streets

Jun 17, 2025