The 1000% Rally In SBET Stock: Investment Implications And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The 1000% Rally in SBET Stock: Investment Implications and Analysis

SBET stock has experienced a meteoric rise, soaring over 1000% in a relatively short period. This dramatic surge has captivated investors and sparked intense debate regarding the sustainability of this growth and its implications for future investments. Understanding the factors driving this rally is crucial for anyone considering adding SBET to their portfolio or already holding the stock.

This article delves into the reasons behind SBET's impressive performance, examines the potential risks and rewards, and offers a considered analysis to help investors navigate this volatile situation.

Understanding the 1000% Surge: Key Drivers

Several factors have contributed to SBET's remarkable 1000% rally. It's important to analyze these carefully to determine whether this growth is justified by fundamentals or driven by speculative forces.

-

Positive Earnings Reports: Stronger-than-expected earnings reports, showcasing significant revenue growth and improved profitability, have played a major role. These reports often exceed analyst predictions, fueling investor confidence and driving up the stock price. Reviewing these reports directly is crucial for informed decision-making.

-

Industry Tailwinds: Favorable industry trends and increased market demand within SBET's sector have provided a powerful tailwind. Understanding the broader macroeconomic conditions and the company's position within its industry is key to assessing long-term viability. Researching competitor performance can also offer valuable context.

-

Strategic Acquisitions and Partnerships: Successful mergers, acquisitions, or strategic partnerships can significantly boost a company's value and attract investor interest. Analyzing the impact of any recent strategic moves by SBET is vital to understanding the rally.

-

Increased Investor Sentiment: Positive media coverage, analyst upgrades, and a general increase in investor enthusiasm can create a self-fulfilling prophecy, driving further price increases. However, relying solely on sentiment is risky; a shift in sentiment can lead to equally dramatic declines.

-

Short Squeeze: In some cases, a rapid price increase can be partially attributed to a short squeeze, where investors who bet against the stock are forced to buy it back, further propelling the price upward. Identifying whether this is a factor in SBET's case requires careful market analysis.

Investment Implications and Risks:

While the 1000% rally is impressive, investors need to approach SBET stock with caution. The significant gains raise questions about valuation and the potential for a correction.

-

Valuation Concerns: A dramatic price increase often leads to overvaluation. Investors should carefully assess SBET's price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and other valuation metrics to determine if the current price is justified by the company's fundamentals.

-

Volatility Risk: Highly volatile stocks like SBET are susceptible to sharp price swings. Investors with a low risk tolerance should proceed with extreme caution, considering the potential for significant losses.

-

Market Sentiment Shift: As mentioned earlier, a change in market sentiment can quickly reverse the gains, leading to a substantial price drop.

-

Competition: Analyzing the competitive landscape and identifying potential threats from competitors is vital for long-term investment success.

Conclusion: Navigating the SBET Rally

The 1000% rally in SBET stock presents both opportunities and significant risks. Thorough due diligence, including a comprehensive review of financial statements, industry analysis, and an understanding of the broader market conditions, is crucial before making any investment decisions. While the past performance is impressive, it's not indicative of future results. Investors should focus on the company's fundamentals and their own risk tolerance before considering any investment in SBET. Always consult with a qualified financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The 1000% Rally In SBET Stock: Investment Implications And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Convicted Republicans Receive Pardons Trumps Expanding List

May 31, 2025

Convicted Republicans Receive Pardons Trumps Expanding List

May 31, 2025 -

Challenging Stereotypes Women Farmers Featured On Clarksons Show

May 31, 2025

Challenging Stereotypes Women Farmers Featured On Clarksons Show

May 31, 2025 -

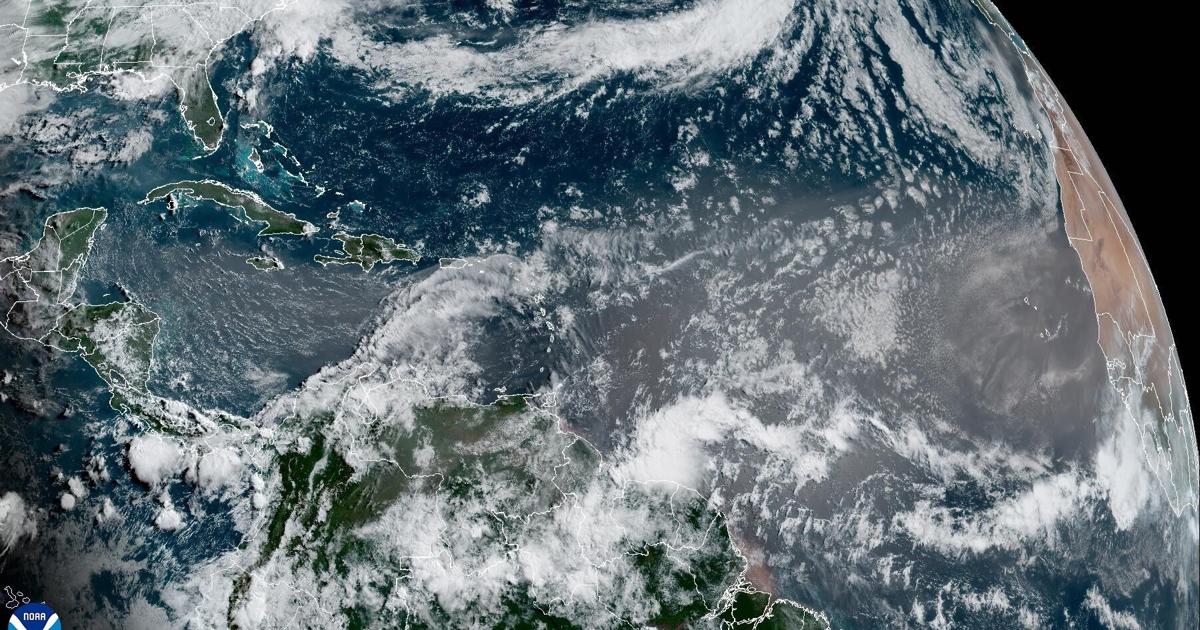

Intense Louisiana Sunsets Expected Saharan Dust Arrival And Forecast

May 31, 2025

Intense Louisiana Sunsets Expected Saharan Dust Arrival And Forecast

May 31, 2025 -

Spanish Grand Prix Piastri Tops Final Practice For Mc Laren

May 31, 2025

Spanish Grand Prix Piastri Tops Final Practice For Mc Laren

May 31, 2025 -

Court Case Update Paul Doyle And The Liverpool Parade Incident

May 31, 2025

Court Case Update Paul Doyle And The Liverpool Parade Incident

May 31, 2025

Latest Posts

-

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025 -

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025 -

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025 -

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025 -

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025