The 31-Year Mortgage: Is It The Right Choice For First-Time Homebuyers?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The 31-Year Mortgage: Is It the Right Choice for First-Time Homebuyers?

Buying your first home is a monumental step, filled with excitement and, let's be honest, a fair amount of stress. One of the biggest decisions you'll face is choosing the right mortgage. While 15-year mortgages offer faster payoff and lower interest, the 31-year mortgage, also known as a 30-year fixed-rate mortgage, presents a different appeal, particularly for first-time homebuyers. But is it the right choice for you? Let's explore the pros and cons.

Understanding the 31-Year Mortgage (30-Year Fixed-Rate Mortgage)

A 31-year mortgage, essentially a 30-year fixed-rate mortgage, offers a longer repayment period than shorter-term options. This means lower monthly payments, making homeownership more accessible to those with tighter budgets. The fixed interest rate provides predictability, offering financial stability and peace of mind. You know exactly how much you'll be paying each month for the entire loan term, avoiding unexpected interest rate hikes.

Pros of a 31-Year Mortgage for First-Time Homebuyers:

- Lower Monthly Payments: The extended repayment period significantly reduces your monthly mortgage payment. This frees up more cash flow for other essential expenses like groceries, transportation, and saving for emergencies. For first-time buyers often juggling student loans or other debts, this can be a game-changer.

- Affordability: Lower monthly payments make homeownership more attainable. This is crucial in today's competitive housing market, where even modest homes can command significant prices. A lower down payment requirement may also be available, depending on the lender and specific program. Explore options like FHA loans designed to assist first-time homebuyers.

- Financial Stability: The fixed interest rate eliminates the risk of fluctuating monthly payments associated with adjustable-rate mortgages (ARMs). This stability is invaluable, particularly during economic uncertainty.

- Building Equity Gradually: While the payoff takes longer, you still build equity in your home over the 31 years, gradually increasing your ownership stake.

Cons of a 31-Year Mortgage for First-Time Homebuyers:

- Higher Total Interest Paid: The longer repayment period means you'll pay significantly more in interest over the life of the loan compared to a 15-year mortgage. This is a considerable cost to consider.

- Longer Commitment: You're locked into a 31-year commitment, limiting your financial flexibility. Life changes, such as job relocation or unexpected expenses, can become more challenging to navigate.

- Potential for Missed Opportunities: The extra money paid in interest could have been used for other investments, potentially generating greater returns over time.

Is a 31-Year Mortgage Right for YOU?

The best mortgage for you depends on your individual circumstances and financial goals. Consider these questions:

- What is your current financial situation? Can you comfortably afford the monthly payments, while still maintaining a healthy savings and emergency fund?

- What are your long-term financial goals? Do you prioritize paying off your mortgage quickly or having more financial flexibility now?

- What is your risk tolerance? Are you comfortable with the higher total interest paid over the life of a 31-year loan?

Alternatives to Consider:

Before making a decision, explore other options, such as:

- 15-Year Mortgages: Offer faster payoff and lower total interest, but require higher monthly payments.

- FHA Loans: Designed to assist first-time homebuyers with lower down payments and more lenient credit requirements.

- VA Loans: Offered to eligible veterans and active-duty military personnel, often with no down payment required.

Ultimately, choosing the right mortgage is a personal decision. Consult with a financial advisor and mortgage lender to thoroughly assess your options and determine the best path towards achieving your homeownership dreams. Don't hesitate to ask questions and compare different loan offers before signing any documents. This is a significant financial commitment, so make an informed choice that aligns with your long-term goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The 31-Year Mortgage: Is It The Right Choice For First-Time Homebuyers?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Raw Footage Of Ross Monaghan Shooting Appears On Spanish Broadcast

Jun 03, 2025

Raw Footage Of Ross Monaghan Shooting Appears On Spanish Broadcast

Jun 03, 2025 -

Keys On Track To Surmount Second Hurdle

Jun 03, 2025

Keys On Track To Surmount Second Hurdle

Jun 03, 2025 -

Bank Of America Boeing Benefits From Trumps Trade Deal Strategy

Jun 03, 2025

Bank Of America Boeing Benefits From Trumps Trade Deal Strategy

Jun 03, 2025 -

Karen Read Murder Trial Watch The Witness Testimony Live

Jun 03, 2025

Karen Read Murder Trial Watch The Witness Testimony Live

Jun 03, 2025 -

Rise In Injuries Following Liverpool Fc Championship Parade 109 Reported

Jun 03, 2025

Rise In Injuries Following Liverpool Fc Championship Parade 109 Reported

Jun 03, 2025

Latest Posts

-

Analyzing Cyberpunk 2077s Potential On Switch 2 An Xbox Series S Comparison

Aug 03, 2025

Analyzing Cyberpunk 2077s Potential On Switch 2 An Xbox Series S Comparison

Aug 03, 2025 -

Enduring Legacy Remembering Nypd Officer Didarul Islam

Aug 03, 2025

Enduring Legacy Remembering Nypd Officer Didarul Islam

Aug 03, 2025 -

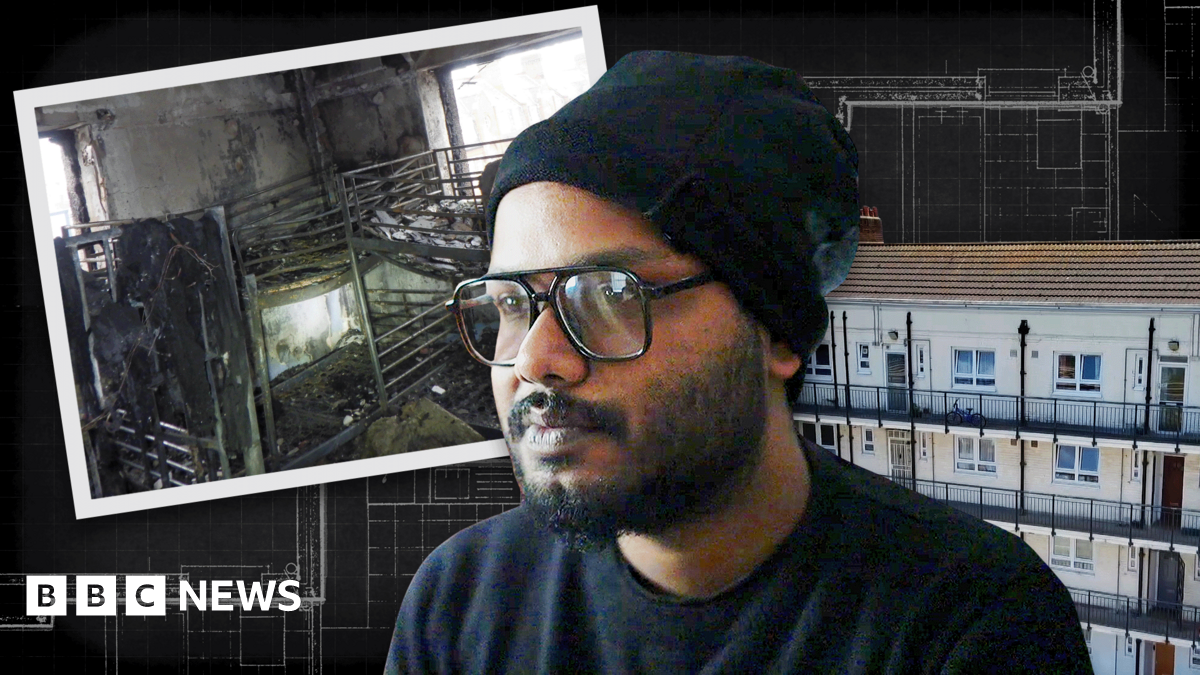

Illegal House Shares A Dangerous Mix Of Rats Mold And Overcrowding

Aug 03, 2025

Illegal House Shares A Dangerous Mix Of Rats Mold And Overcrowding

Aug 03, 2025 -

El Salvador Reeleccion Presidencial Indefinida Y Extension Del Periodo A 6 Anos Analisis Politico

Aug 03, 2025

El Salvador Reeleccion Presidencial Indefinida Y Extension Del Periodo A 6 Anos Analisis Politico

Aug 03, 2025 -

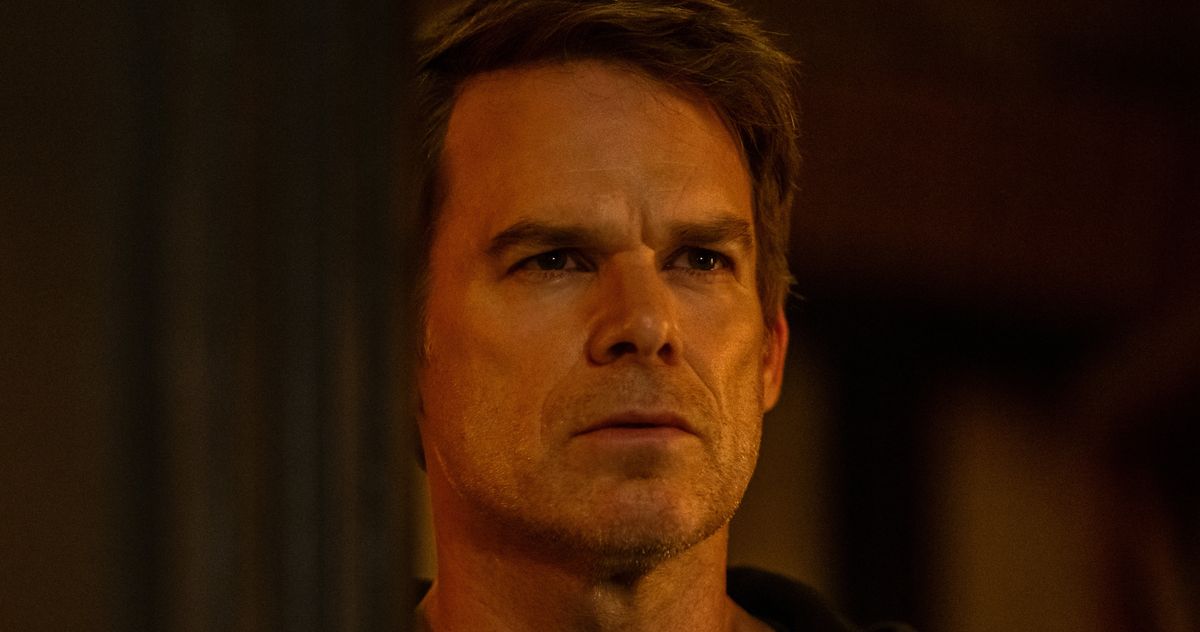

Dexters Return Analyzing The Performance Anxiety In Resurrection

Aug 03, 2025

Dexters Return Analyzing The Performance Anxiety In Resurrection

Aug 03, 2025