The 529 Advantage: Smart Savings For Your Child's Education

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The 529 Advantage: Smart Savings for Your Child's Education

Planning for your child's future education can feel daunting, but with the right tools, securing their academic journey becomes significantly easier. One powerful tool often overlooked is the 529 plan, a tax-advantaged savings plan designed specifically for education expenses. This article explores the significant advantages of 529 plans and how they can help you build a substantial education fund for your child.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan sponsored by a state or educational institution. Contributions grow tax-deferred, meaning you won't pay taxes on the earnings until they are withdrawn for qualified education expenses. This significant tax advantage makes 529 plans a highly attractive option for saving for college and beyond. There are two main types:

- State-sponsored 529 plans: Offered by individual states, these plans often offer state tax deductions or credits for contributions. The investment options and fees vary by state.

- Private 529 plans: Managed by private companies, these plans generally offer a broader range of investment options.

Key Advantages of 529 Plans:

1. Tax-Deferred Growth: This is arguably the biggest advantage. Your investment earnings grow tax-free, allowing your savings to compound faster than in a taxable account. This compounding effect significantly boosts your savings over time.

2. Tax-Free Withdrawals for Qualified Expenses: When you withdraw money for qualified education expenses, such as tuition, fees, room and board, and even certain books and supplies, the withdrawals are completely tax-free. This eliminates a significant tax burden at the time of college enrollment.

3. Flexibility: Most 529 plans offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and time horizon. You can change your investment selections as your child gets closer to college, potentially shifting to more conservative options.

4. Potential State Tax Deductions or Credits: Many states offer state tax deductions or credits for contributions made to their 529 plans, providing an additional financial incentive. Check with your state's tax laws to see if this benefit applies to you. [Link to a reputable source on state tax benefits for 529 plans]

5. Gifting Advantages: You can make larger contributions to a 529 plan by taking advantage of gifting rules. You can contribute up to the annual gift tax exclusion limit ($17,000 per recipient in 2023) without incurring gift tax. [Link to IRS website on gift tax rules]

Beyond College: Expanding the 529 Advantage

While primarily associated with college savings, 529 plans can also be used for:

- K-12 Tuition: Some plans allow for withdrawals to cover K-12 tuition expenses, although this is less common and varies by state and plan.

- Trade Schools and Vocational Programs: The funds can be used for tuition and fees at accredited trade schools and vocational programs.

Choosing the Right 529 Plan:

Selecting the right 529 plan requires careful consideration. Factors to evaluate include:

- Investment options: Look for a plan offering diverse and low-cost investment choices.

- Fees: Compare the expense ratios and fees charged by different plans.

- State tax benefits: Check for any state tax advantages available for residents.

Consulting a financial advisor can be highly beneficial in navigating these choices.

Conclusion: Securing Your Child's Future

The 529 plan offers a powerful tool for securing your child's educational future. By utilizing the tax advantages and flexibility offered, you can significantly increase your savings and reduce the financial burden of higher education. Start planning early and take advantage of this valuable resource to help your child achieve their academic aspirations. Remember to consult with a financial advisor for personalized guidance on choosing and managing a 529 plan.

Disclaimer: This article provides general information about 529 plans and is not financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The 529 Advantage: Smart Savings For Your Child's Education. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tennis Legend Roddick Weighs In Sinner Or Alcaraz The Next Big Thing

Jun 04, 2025

Tennis Legend Roddick Weighs In Sinner Or Alcaraz The Next Big Thing

Jun 04, 2025 -

Why This Former Nfl Penn State Football Stars Jersey Is At The Smithsonian

Jun 04, 2025

Why This Former Nfl Penn State Football Stars Jersey Is At The Smithsonian

Jun 04, 2025 -

Third Odi England Vs West Indies Match Start Delayed By Traffic Problems

Jun 04, 2025

Third Odi England Vs West Indies Match Start Delayed By Traffic Problems

Jun 04, 2025 -

Soundbites Reveal Grace Potters Untold Story Behind Her Forgotten Album

Jun 04, 2025

Soundbites Reveal Grace Potters Untold Story Behind Her Forgotten Album

Jun 04, 2025 -

Buffett Offloads Two Major Us Holdings Implications For American Investors

Jun 04, 2025

Buffett Offloads Two Major Us Holdings Implications For American Investors

Jun 04, 2025

Latest Posts

-

Rainy Night Long Queues Teens Brave Elements For New Ni Product

Jun 06, 2025

Rainy Night Long Queues Teens Brave Elements For New Ni Product

Jun 06, 2025 -

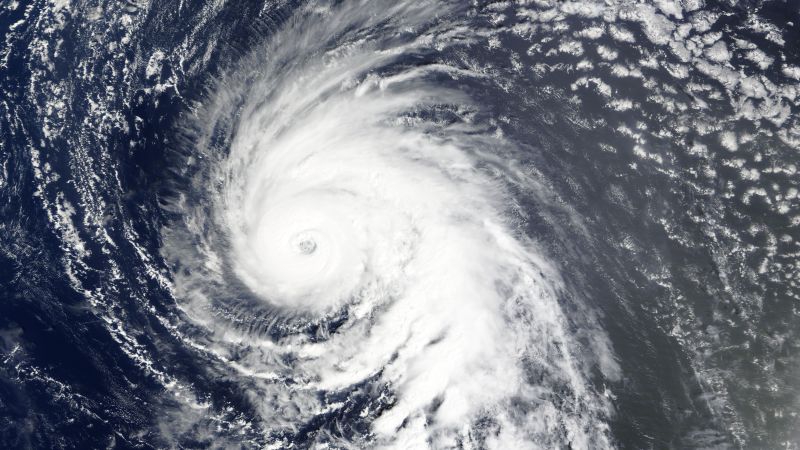

Can Ghost Hurricanes Improve Hurricane Prediction Models

Jun 06, 2025

Can Ghost Hurricanes Improve Hurricane Prediction Models

Jun 06, 2025 -

15 Hour Queue Pouring Rain The Hype Surrounding The New Ni

Jun 06, 2025

15 Hour Queue Pouring Rain The Hype Surrounding The New Ni

Jun 06, 2025 -

Massive Ai Deal Sends Applied Digital Stock Prices Skyrocketing

Jun 06, 2025

Massive Ai Deal Sends Applied Digital Stock Prices Skyrocketing

Jun 06, 2025 -

Find The Nike Air Max 95 Og Bright Mandarin Retailer List

Jun 06, 2025

Find The Nike Air Max 95 Og Bright Mandarin Retailer List

Jun 06, 2025