The Curious Case Of Wall Street's Latest Trading Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Curious Case of Wall Street's Latest Trading Strategies: Algorithms, AI, and the Future of Finance

Wall Street, the epicenter of global finance, is constantly evolving. Gone are the days of solely relying on gut instinct and years of experience; today's trading landscape is dominated by sophisticated algorithms, artificial intelligence (AI), and high-frequency trading (HFT). But these new strategies aren't without their quirks and controversies, leading to what some are calling "The Curious Case of Wall Street's Latest Trading Strategies." This article delves into the fascinating world of modern trading, examining both the benefits and the potential pitfalls.

The Rise of Algorithmic Trading:

Algorithmic trading, or algo-trading, utilizes computer programs to execute trades based on pre-defined parameters. These algorithms can analyze vast datasets far quicker than any human, identifying patterns and executing trades with speed and precision. This has led to increased efficiency and liquidity in the market, but also raises concerns about market manipulation and "flash crashes." The complexity of these algorithms, however, makes it difficult to fully understand their decision-making processes, creating a "black box" effect that worries regulators.

The Impact of Artificial Intelligence:

AI is taking algorithmic trading to the next level. Machine learning models are being used to predict market movements, optimize portfolios, and even detect fraudulent activity. AI-powered trading bots can adapt to changing market conditions in real-time, making them incredibly powerful tools. However, the reliance on AI also presents challenges: the potential for bias in algorithms, the need for robust cybersecurity measures, and the ethical implications of automated trading decisions all need careful consideration. [Link to a reputable article about AI bias in finance].

High-Frequency Trading: Speed and Speculation:

High-frequency trading (HFT) firms use incredibly fast computer systems to execute thousands of trades per second, often profiting from minuscule price discrepancies. While HFT contributes to market liquidity, critics argue it can amplify volatility and create an uneven playing field for smaller investors. The sheer speed of these transactions makes it difficult to regulate and monitor, adding to the complexity of the "curious case."

The Regulatory Landscape:

Regulators worldwide are grappling with the challenges posed by these advanced trading strategies. The speed and complexity of algo-trading, AI, and HFT make it difficult to enforce existing regulations effectively. New rules and oversight are needed to ensure market fairness, transparency, and stability. This includes addressing concerns about:

- Market manipulation: Preventing the use of algorithms to artificially inflate or deflate prices.

- Algorithmic bias: Ensuring AI models are free from biases that could discriminate against certain investors.

- Cybersecurity threats: Protecting trading systems from hacking and data breaches.

- Transparency and accountability: Improving the understanding and oversight of complex trading algorithms.

The Future of Trading:

The future of Wall Street's trading strategies remains uncertain. While these advancements offer significant benefits in terms of efficiency and liquidity, they also introduce new risks and challenges. A balance must be struck between fostering innovation and ensuring a fair and stable market. Increased transparency, robust regulation, and ongoing research are crucial to navigating this complex and evolving landscape.

Call to Action: Stay informed about the latest developments in financial technology and regulations. Understanding these trends is crucial for both investors and regulators alike. [Link to a relevant financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Curious Case Of Wall Street's Latest Trading Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

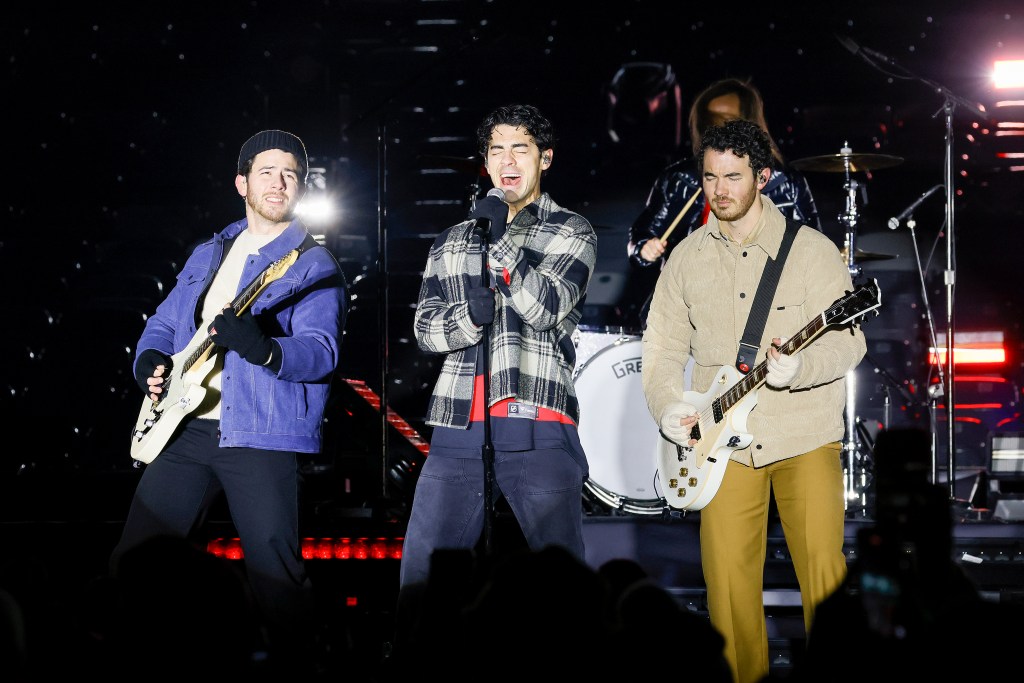

Official Announcement Jonas Brothers Postpone Multiple Concerts

Jun 14, 2025

Official Announcement Jonas Brothers Postpone Multiple Concerts

Jun 14, 2025 -

Boston Logan Airport Jet Blue Aircraft Incident No Injuries Confirmed

Jun 14, 2025

Boston Logan Airport Jet Blue Aircraft Incident No Injuries Confirmed

Jun 14, 2025 -

Indiana Pacers Shock The Thunder Role Players Deliver Crucial Win

Jun 14, 2025

Indiana Pacers Shock The Thunder Role Players Deliver Crucial Win

Jun 14, 2025 -

Toronto Maple Leafs Mitch Marner Contract Renewal And The Fans Perspective

Jun 14, 2025

Toronto Maple Leafs Mitch Marner Contract Renewal And The Fans Perspective

Jun 14, 2025 -

Upset In Oklahoma City Indiana Pacers Role Players Deliver Dominant Performance

Jun 14, 2025

Upset In Oklahoma City Indiana Pacers Role Players Deliver Dominant Performance

Jun 14, 2025

Latest Posts

-

Illini Mens Golf Alumni Making Waves On The Pro Circuit

Jun 14, 2025

Illini Mens Golf Alumni Making Waves On The Pro Circuit

Jun 14, 2025 -

Exclusive Witnessing The Snack Production At Japans Numerous 7 Elevens

Jun 14, 2025

Exclusive Witnessing The Snack Production At Japans Numerous 7 Elevens

Jun 14, 2025 -

No Love Island Usa Tonight June 11th Schedule Explained

Jun 14, 2025

No Love Island Usa Tonight June 11th Schedule Explained

Jun 14, 2025 -

San Antonio Rainfall Disaster Death Toll Rises To Four Two Remain Unaccounted For

Jun 14, 2025

San Antonio Rainfall Disaster Death Toll Rises To Four Two Remain Unaccounted For

Jun 14, 2025 -

Nba Finals Pacers Chances Against The Thunder A Betting Analysis

Jun 14, 2025

Nba Finals Pacers Chances Against The Thunder A Betting Analysis

Jun 14, 2025